I know earnings is just one of the main affairs during the getting an unsecured loan. Indeed, it could be by far the most vital area of the app process. The financial institution would like to make sure to can pay right back your existing expense together with the brand new mortgage. You may need to render reveal work history away from latest role. You could potentially confirm your revenue and you can a job from the adopting the implies:

- Paystubs

- Tax returns

- W2 otherwise 1099

- Lender statements

- Manager Contact

Away from a job money, various other version of earnings to adopt also try leasing possessions money, Social Security advantages, retirement, and you may promote care commission. Once more, be sure to render a complete image of your income to help you best your chances of getting recognized.

Financing Terminology

Loan terms and conditions will be terms and conditions involved in credit money. It through the loan's cost several months, interest rates and you can related charges, punishment charge, and just about every other special status that implement.

After you get your financing, specific lenders tend to request you to state how much money your have to obtain, along title you prefer, while the purpose of the borrowed funds. You can make use of tools along these lines unsecured loan calculator to determine a knowledgeable inquire about your financial situation.

While it could be daunting, keep in mind that you could potentially negotiate whenever obtaining good mortgage. For example, you will be in a position to prevent the first loan months given. If you like shorter monthly obligations, you could ask for an extended title. After all, the financial institution commonly earn more to the appeal that have a lengthier term. It's also possible to negotiate the ount. You shouldn't be scared to recommend yourself and you can protect your self financially. Know how to assess how much time you will want to sample spend regarding that loan.

It's not hard to begin panicking. However, contemplate, you might be between 21% out of You.S. consumers who have been declined a card app. With the education you've attained regarding signature loans as well as how loan providers review the job, you are going to provides a so good tip on what went completely wrong. Fool around with you to definitely training so you're able to encourage that continue appearing. Take a breath and focus on what it will end up being instance when you find yourself ultimately out from underneath the challenges off obligations.

Expand Your research

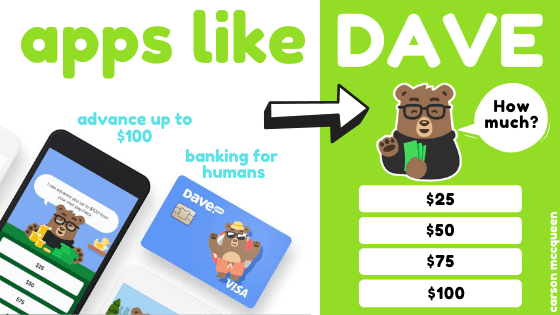

For those who went with a financial for your consumer loan, you can understand why they could has actually denied your. Banks, particularly highest commercial banks, tend to have alot more tight criteria. In terms of-funds installment loans in Miami FL with bad credit institutions, they are going to alway work at your borrowing exposure to make sure they are able to make a profit on package.

There is highlighted some very nice option alternatives for a vintage financial into the the evaluation regarding the most practical method to obtain a loan. Certain more supply to look at include:

- Community financial institutions

- Credit unions

- On the internet loan providers

- Payday Loan providers

You may also pose a question to your manager if they discover of any monetary wellness work with programs that may give you the help you need.

Run Your financial Reputation

If your mortgage isn't really having a crisis, you may want to take the time to change their economic situation. Enhancing your credit score, paying down other expense, and seeking for further sources of earnings you will definitely reputation your since a more tempting debtor. Listed below are some suggestions for for each!

Paying down the money you owe not merely improves your credit rating, but will reduce your debt-to-income proportion. Another way to boost the proportion is to get extra supply of money. For example, could you turn your own passions with the a side hustle? Do you score an associate-time work this isn't as well exhausting on your own plan? If you find a whole lot more imaginative the way to get dollars, you could find you don't need the personal mortgage!