During the Expense, we try to generate economic behavior with full confidence. Although of your points assessed come from all of our Suppliers, also people who have hence the audience is associated and people who make up you, our very own feedback should never be determined by them.

Rocket Financial as well as user Skyrocket Loans give cash-away refinancing and private fund, so they provides alternatives for home owners and you can non-homeowners alike.

Really does Skyrocket Home loan Offer Family Security Money otherwise HELOCs?

Skyrocket Financial and its own associated enterprises give several possibilities in order to house security financing and HELOCs that could be useful in some situations. These alternatives are cash-out re-finance loans and private money.

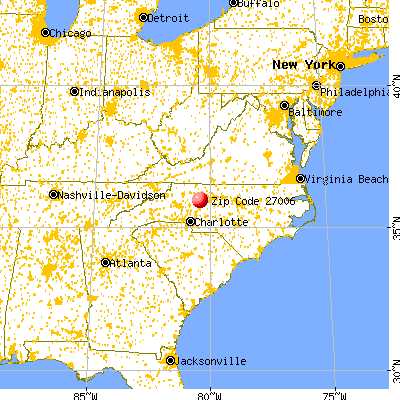

Rocket loans in Columbus Mortgage would depend from inside the Detroit, MI, however, works in every fifty claims. He's section of a family out-of firms that will bring mortgages and private money along with house and you may vehicles purchasing attributes. Skyrocket Mortgage had previously been also known as Quicken Loans.

With regards to the company's site, Rocket Mortgage is the premier home loan company in the usa. Within the 2020, they finalized $320 billion property value mortgages.

Total, the firm features twenty-six,100 staff and you may operates workplaces in the five additional says. The reach is actually nationwide, thru what the organization describes as the first completely on line mortgage sense.

That it on the web focus allows mortgage individuals doing the whole processes without dealing individually which have sales agents or lenders. Although not, its system do promote use of credit positives when wanted.

Cash-out refinancing

Such as a property equity mortgage, a cash-away home mortgage refinance loan try a way of tapping into the newest equity inside a property to locate dollars. Yet not, rather than just credit against guarantee, cash-away refinancing comes to substitution the homeowner's newest home loan with more substantial mortgage. That huge financing lets consumers to displace the present financial and you can utilize the left dollars to many other purposes.

Cash-away refinance fund is a better replacement for family guarantee money in situations where brand new loan's interest rate is much less than that the existing financial therefore the quantity of bucks removed is an enormous portion of the total number lent. How come it matters would be the fact you can find surcharges for the money-aside refinancing, and additionally they work with between .375% and you will 3.125% of your whole amount borrowed just the money away. Good step three% percentage towards the an excellent $300,100000 home loan are $9,100. It doesn't sound right when you are just looking for $20,100 bucks.

Cash-out refinancing is almost certainly not an installment-energetic alternative to a property equity loan when your brand new focus price is not considerably less than the outdated one to. That's because the new fees in taking another financial might get this to an expensive technique for being able to access family equity.

Signature loans

Some other choice supplied by Skyrocket Financial is a personal bank loan. Signature loans can be safeguarded or unsecured. Secured means they are supported by equity, whenever you are unsecured loans count more about the latest borrower's credit history and you can financial situation.

Personal loans are apt to have large interest levels than simply mortgages. Certain personal bank loan organization perform render rates one take on those individuals off domestic security financing, if the borrowers have become licensed. And you will predicated on Government Put aside data, personal loan costs are less expensive than borrowing from the bank towards a charge card. It means unsecured loans could be a fees-productive way to obtain borrowing from the bank to own consumers who don't has actually a hefty level of security within the a property.

Providing a personal loan depends greatly on the borrower's credit score and you may financial predicament. You will find usually fees associated with establishing that loan, and come up with unsecured loans less costs-effective having small amounts.

Skyrocket Home loan House Guarantee Financing

Since Skyrocket Home loan cannot currently give home equity funds, an alternative way out-of tapping into the brand new security in the a house for the money is a profit-out home mortgage refinance loan.