Since you make your month-to-month home loan repayments, you needless to say obtain collateral of your house. For many who spend in full and on day, your own guarantee will grow by itself as your prominent financing equilibrium decreases, but you can in addition to let speed up the method. Let's have a look at just what domestic equity is, and explore how to gain equity of your house quicker.

What is actually house guarantee?

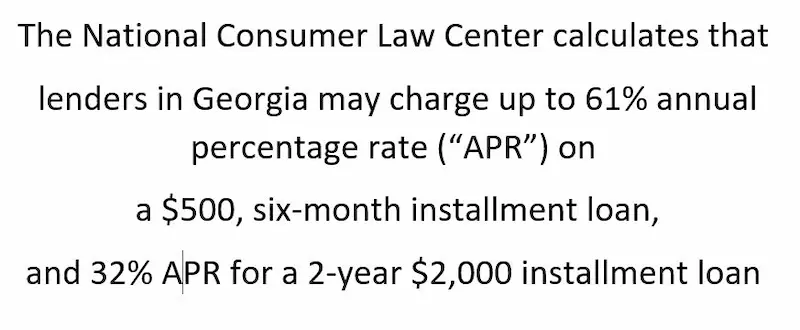

House guarantee is the element of your property which you in fact very own. Per month, you make home financing percentage, slowly paying off much more about of one's mortgage equilibrium toward your residence. Definition if you buy a home that have 20% off, you currently have 20% of one's house's property value collateral at home. Because you pay-off the loan typically, your repayments chip out at your dominating mortgage equilibrium, and you may generate a great deal more collateral https://paydayloansconnecticut.com/poquonock-bridge/. To calculate your house guarantee, do the most recent appraised value of your residence and subtract the newest remaining amount you borrowed.

Why is strengthening guarantee the great thing?

What if your property appraises getting $2 hundred,100, however you still owe $60,100 in your loan. For folks who deduct $sixty,100 away from $two hundred,100000, you have made your property equity: $140,100000. Musical great, proper? Exactly what really does one to count indicate? Strengthening equity is amongst the big incentives of being an excellent property owner. By building guarantee, your property gets a secured item which you can use down the road. Let us take one to $140,000 worth of equity regarding analogy. This is actually the amount of money that you may possibly do something having for people who ended up selling one to household at this time. You could utilize it currency to buy a separate household, or make various other higher pick. Additionally, you might borrow against their guarantee having an additional home mortgage, also known as a house equity mortgage. Many people look at their residence security because the a required offers account. By making typical mortgage payments your build the worth of your own resource, much like and then make deposits into your savings account makes the value of bank account.

5 a method to make your house guarantee quicker

You can create guarantee of the increasing your value of otherwise ount off obligations you own. If you make the loan costs completely as well as on time, you are going to more sluggish make equity of your house. Although not, you can help make your family guarantee quicker.

step 1. Plan to shell out alot more toward your dominating equilibrium

You are able to pay off your own along side pre-determined, repaired time frame (usually 15 otherwise three decades). As you generate payments, the prominent equilibrium decreases, that is what we now have currently read is when you generate guarantee. You could potentially boost how quickly you might be wearing home security by simply making extra mortgage payments, otherwise spending more than you borrowed from each month. If you make you to most commission a-year, you might pay your loan before schedule. You might like to spend $X more than your own expected percentage each month locate ahead. For example, imagine if the monthly mortgage repayment is $step one,200. $step 1,200 split by the a dozen try $100. Should you have $100 into monthly homeloan payment, you will find made that a lot more payment after 1 year, reducing the life of one's mortgage and you will building a whole lot more security. Note: Be careful. Particular funds features prepayment charges, and you also might possibly be punished for people who pay-off a lot of of the financing in advance of plan.

2. Use incentive currency, provide loans, an such like. if you're able to

So it happens hand-in-hands with expenses in advance of agenda. If not should commit to $X a great deal more 30 days otherwise you to definitely additional commission annually, just pay more when you have the funds offered. This really is if you get a vacation added bonus where you work, otherwise if you get the taxation statements. Perhaps you allow it to be your goal to get people overtime pay you will be making into most home loan money. Maybe you happen to be fortunate enough in order to inherit some funds. You might like to lay that towards more repayments. However, once you build even more money, make sure the money is going on the their prominent, maybe not your notice. Talk to your own home loan company to describe.

3plete home improvement venture

Out-of a minor toilet upgrade in order to a major home restoration, property upgrade investment will add tall really worth to your house and that, improve the guarantee you may have of your property. Also a good investment of a few hundred cash you may bring a good grand come back on residence's worthy of.

4. Choose good 15-year financing in lieu of a thirty-year mortgage

A common home loan option is a thirty-12 months real estate loan, which means you pay back the borrowed funds over a 30-12 months several months, but there is however along with an effective 15-seasons financing title option. You can evaluate the latest monthly home loan repayments and you may expenses associated with a 30-seasons in place of a great fifteen-seasons home loan along with your home loan company to find out if an excellent fifteen-season real estate loan is in your allowance.

It is not that simple. For example, in case the amount borrowed try $two hundred,one hundred thousand which have cuatro% focus to own 30 years, their monthly payment just before individual financial insurance policies (PMI) and you may fees and you will any potential HOA charges is regarding the $955. For the same mortgage over 15 years, the monthly payment in advance of PMI and you will taxation and you may HOA fees commonly end up being on $step one,479. Which is a change away from $524, that could see impossible. However, the less financing identity setting you're going to be expenses quicker appeal over the life span of your financing label that have an effective fifteen-12 months loan than simply which have a 30-season financing. Let alone, possible create guarantee of your house smaller with the faster financing title.

5. Generate a large advance payment

You can also be eligible for a loan no or a low downpayment, even though which may be appealing, if you are looking to create guarantee quicker, it might not be the ideal selection. To build equity rapidly, think and then make an enormous downpayment on your family. The greater you devote down, the greater collateral you start with. For folks who put 20% down, you start with 20% of your residence's value of equity in your home. Seem sensible? A plus so you can putting about 20% down is that that have specific funds, this can indicate you might end investing in PMI, which is expensive. Strengthening equity is a significant advantage of homeownership. Through the years by creating their mortgage payment completely or purchasing more than your debt, youre strengthening a secured item that will help during the the long run.