These ten finance companies have to offer a decreased mortgage rates of interest getting salaried some body.

New Set aside Lender away from India (RBI) provides directed most of the arranged commercial financial institutions (except regional outlying banking companies), geographic area banking institutions and you can brief finance banks to hook interest rates of all merchandising finance, also home loans, supplied by him or her, in order to an outward workbench.

Complying using this type of directive, very industrial banking institutions has actually chosen the RBI's repo price since the fresh new external standard that the floating rate loans was connected. Rates attached to the repo rates is known as repo price linked lending speed or RLLR. The fresh new RLLR is made of repo rate along with bank's pass on or margin. Depending on RBI, banking companies are allowed to charge a spread otherwise margin and chance premium past new exterior benchmark price of borrowers.

As the give charged because of the a certain bank remains same getting most of the borrowers, the chance premium will differ from individual to individual. Including, it certainly is viewed one to financial institutions charge a high chance advanced regarding worry about-working individuals as compared to salaried individuals.

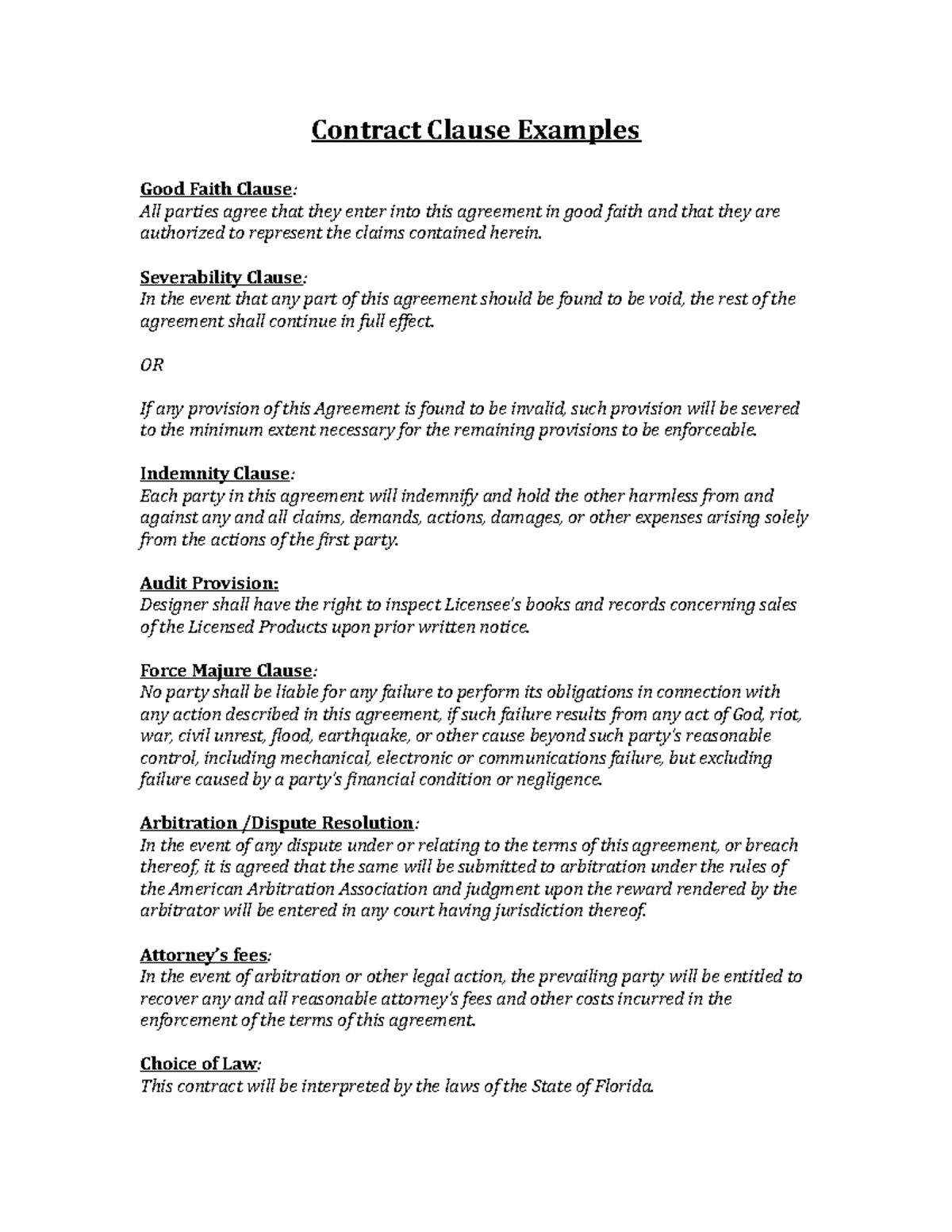

** Arranged on the minimal interest rate charged because of the bank shortly after adding chance advanced*Bank out-of Baroda control charges is actually 0.25% to help you 0.50% out of loan; Min. Rs.8500/- Maximum. Rs.25000/-*Bank out of Asia fees 0.25% out of loan amount while the control costs; Min Rs step 1,500 and you can Max Rs 20,000/-* PNB fees 0.35% (min Rs 2,five-hundred and you can restrict Rs fifteen,000) along with documentation charge Rs 1,350/-*Kotak Mahindra Bank charge a running fee away from max dos% + GST and just about every other legal charges and papers fees as much as Rs.ten,000/-*Commitment Bank regarding Asia charges a control percentage of 0.50% off loan amount, Maximum. Rs 15000*Bank from Maharashtra costs an operating payment out of 0.25% regarding Loan amount Maximum Rs.twenty five,000/-*Punjab & Sindh Financial also offers an entire waiver out of control and you may assessment charges*Canara Financial costs 0.50% since handling charge - lowest Rs 1,500 and you will limitation Rs ten,100.*HDFC Lender charges as much as 0.50% of your own loan paydayloanalabama.com/clayhatchee amount or Rs step three,000 whatever is highest, including taxes*IDFC Basic Financial fees doing Rs ten,one hundred thousand (most premium energized centered on chance reputation) All of the investigation acquired from Economic Minutes Cleverness Category (ETIG)Analysis given that to your

As to the reasons RBI took that it decisionThe central bank grabbed the choice to hook the pace regarding lenders or other shopping money in order to an external benchmark for greater openness and you can faster transmission off the insurance policy price alter.

Previously, beneath the MCLR (marginal cost oriented lending price) routine, assuming RBI cut the repo price, financial institutions did not bequeath the pros so you can consumers fast. At the same time, whenever RBI hiked this new repo price, financial institutions fast increased rates of interest for the fund.

With its game mandating banking institutions to help you link financing to an external benchmark, banking institutions can select from any of the after the benchmarks:

- RBI's repo speed

- Government away from India 3-few days Treasury bill produce authored by Monetary Criteria Asia (FBIL)

- Bodies regarding Asia six-month Treasury expenses produce compiled by FBIL

- Another standard industry rate of interest published FBIL

Whenever is also borrowers' EMI alter?Depending on RBI's circular, banks must reset your house mortgage rates linked on the outside benchmark one or more times in the three months. This would imply that any improvement in the fresh new exterior standard price must be mandatorily died on the buyers inside three months of one's change in the brand new additional benchmark.

Something else entirely that can change the interest on the loan recharged of the lender is the risk level. Certain banks have internal exposure investigations teams just who grade the danger category of the individual. Specific financial institutions including rely on credit score profile from borrowing bureaus. Thus, while bringing a loan it is important that you may have an effective a good credit score score to own a lender so you can charges straight down risk advanced from you.

Also, if you have a general change in this new bequeath we.elizabeth. brand new margin charged by the bank past new outside benchmark rates, this may be perform impact the rate of interest recharged to the loan removed by you.

Home loan pricing: Listed below are top 10 banks' mortgage interest rates in 2022

Remember that when the borrowing-exposure investigations goes through good-sized transform within the period of one's mortgage, your bank is update the chance advanced charged.