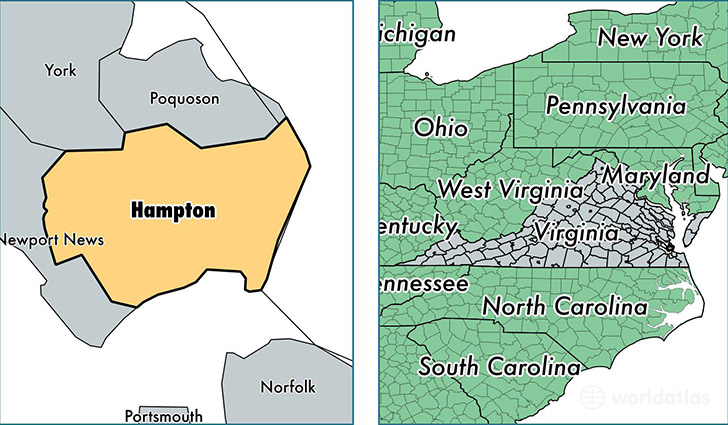

This new housing market may differ extensively nationwide. Seaside claims tend to have the best will set you back off way of life whereas new Midwest and you can Southern area provide more average selection. Western Virginia, Arkansas, Ohio, Iowa and Mississippi feel the lowest average record costs, ranging from $166,488 to help you $188,900. The five most expensive postings are found in the Colorado, Massachusetts, California, Washington D.C., and The state. This new average list in the The state passes $635,000!

There is very good news thereon top. With the Summer twenty five th , Chairman Trump closed an expenses training the mortgage be sure cover undertaking Experts Work (H.R. 299), the balance enacted our house unanimously, with a ballot off 410-0. The bill together with made particular change on the payment schedule having Virtual assistant loans. The latest Va Resource Payment will discover a slight improve off 0.15% 0.30% for many individuals. The bucks gathered from this boost will be diverted to help you reducing healthcare charges for experts impacted by connection with Agent Lime. Most other transform become reducing the difference regarding the financing commission anywhere between veterans and people in new National Shield/Put aside, and you may exempts users off a purple Cardiovascular system out of spending the cost.

There will probably definitely need to be some a lot more advice made available to lenders regarding the aftermath of your own passage through of Bill H.Roentgen. 299. No loan restrict plus the right certification, a borrower might rating a good $dos Million dollars mortgage, standard involved, while the Authorities could be with the hook for $five hundred,100. New Va has not yet set one projections how so it change throughout the legislation have a tendency to affect the system in the years ahead. Understand that one loans you to initiate running before commonly still end up being at the mercy of current Va loan constraints. Nevertheless, it changes will only benefit services members in getting towards family of their hopes and dreams.

The assumption is you to the new bank direction might possibly be impending earlier in the day towards beginning of the new year

The bottom line is, when trying to get a beneficial Virtual assistant home loan, you're able to financing up to you qualify for. You should be aware any loan amount over the Virtual assistant verify to suit your condition ount over the restriction. Browse the Federal Casing Finance Agency chart right here to check on restrictions for your aspects of desire. Additionally, you will still need to satisfy all financing standards put forth of the lender, plus credit rating and you can income standards, so you can meet the requirements. And originating in 2020, financing constraints might possibly be disappearing when you commonly in a hurry it can be to help you the benefit to waiting loans in Salida to see exactly what the brand new financing guidelines might possibly be. They should be in another few months. And as constantly, the financing specialist during the Va Federal Money is here to help you in the process. You could give us a call at the 855-956-4040 for those who have any queries.

What does the future hold for Va home loan quantity, and you can Virtual assistant financial limits?

The newest median home well worth uses the cost slap in between out of a data put, whereas the average is the sum of the data set and split by whole. This means, suppose ten domiciles enjoys bought in during the last few days. To get the mediocre revenue price, you devote every one of them together with her and you may separate from the 10. To find the average price, however, you only choose the one out of the middle. The latest housing market can use the average in the place of an enthusiastic mediocre due to the fact you to definitely house that an extreme cost from inside the possibly direction can skew the common. Median tends to be noticed a far greater gauge when it comes to domestic well worth.

Now that you have an introduction to financing limitations and what you'll want to qualify, let's discuss how the casing . Centered on a property pattern webpages Zillow, the fresh average home price in the united states reached $226,800 when you look at the 2019. That is a huge increase from sixty in years past, the spot where the median domestic speed is actually less than $a hundred,100000 (modified having today's viewpoints). Advantages are presently anticipating you to definitely home prices continues to go up, yet not as fast as they're for the past one year. According to Zillow, home prices have left upwards 5.2% for the past 12 months and anticipate growth of regarding the dos.2% across the second one year.