If you are intending to get a house with a card get regarding 603, there are several things that you should envision before you apply for a loan.

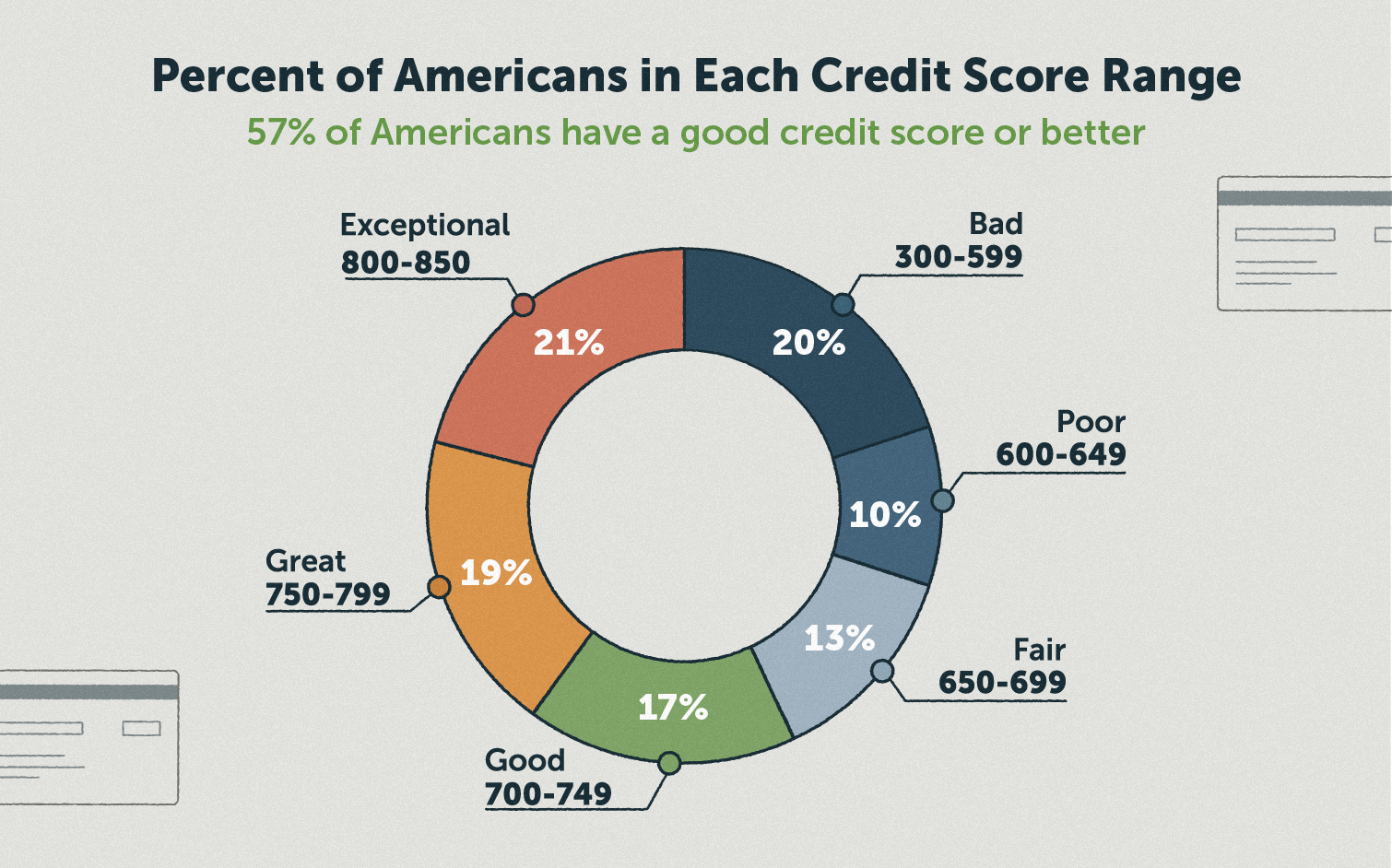

A credit rating out of 640-750 tends to be sensed good by very loan providers and you may loan providers

Which have a home as you are able to phone call your personal are an aspiration we-all often see. To invest in a home, going on brand new fantasy trips, delivering an alternative auto are some of the popular existence requirements. We bundle a great deal to achieve each one of these lifetime needs. Yet not, to shop for big-ticket things such as a vehicle or a house requires an effective ount out-of loans. Even in the event i strive consistently to save cash to your the goals, we end up asking for a few more borrowing from the bank to aid united states visited our objective.

Same is the facts for choosing a house. Whenever you are about to start your own trip of shopping for a beneficial home as well as have simply already been looking for a home loan that have a credit history off 603 you really need to end immediately. Why? Well, while the with a credit score from 603, it could rating a tiny burdensome for that find exactly what you're looking for reasonable interest levels on the home loan.

In case your score drops in this variety, you might be getting money during the an effective interest levels. Because exposure of financing in order to a person with a good large credit rating is lower.

Just which have a steady money and minimal expenses cannot help the fresh financial institutions to judge the danger associated when you look at the credit money for your requirements getting a home loan

Very, when you have a credit history out-of 603 and you're probably purchase a property take effect in your credit history. Change your credit rating after which apply for loans because you gets reduced-interest rate even offers. If you don't, you're paying so much more fundamentally due toward higher-interest of mortgage.

Boosting a credit score demands perseverance. You can see your credit history broadening because of the 2 hundred activities when you look at the thirty days while some some one may experience the brand new get increasing by the 100 items in 45 months. As well as for more individuals, it may take per year right up until they witness the alteration inside their credit score. Thus, enough time it entails for your credit score to improve regarding 603 in order to 640-750 to buy a house would depend completely for the your financial items.

- Constantly pay the money you owe with the timeThis is the basic plus the very extremely important function regarding boosting your credit history. Most of the economic professional usually advise you to pay off all your valuable debts promptly. Failing to pay-off your debt on time as well as in full reveals credit mismanagement. This means you are in some way failing woefully to manage the debt responsibly. When you yourself have missed a due date inadvertently, get hold of your bank card merchant otherwise financial and give an explanation for problem. They might wipe-off new late fee costs from the bill. Yet not, to get making certain that you do not fall behind the fresh new payment schedules, it is best for folks who create car shell out.

- Afford the complete amount perhaps not minimal amountAlways afford the complete matter that's due in your bank card instead of using minimal amount owed. Paying the minimum count owed will not interest people punishment such as for instance late charges. But appeal commission try levied in your entire personal loans Central UT no credit check amount owed also however have paid back a point. This may gather and soon after on may transfer toward an obligations stack. To prevent getting into one to condition, that'll totally damage your credit rating, afford the complete count.