Your property collateral is the difference between the business property value your house as well as the an excellent harmony on your home loan. To your property really worth $3 hundred,000 having good $200,000 home loan leftover, you'll provides $100,000 from equity.

If you have situated sufficient family security, you might be able to utilize it money to gain access to they for the money, and you can and thus end a foreclosure. Family collateral choice become property equity mortgage, household collateral personal line of credit and you may domestic guarantee arrangement.

Other types of finance which will help residents prevent foreclosure tend to be brand new property foreclosure bailout financing and you can opposite financial. However, in lieu of the home equity situations mentioned above, these fund include higher costs and high-attention costs.

No one imagines once they pick a home that they might 1 day reduce it. That's what might happen whether your family drops to the foreclosures.

Unanticipated economic conditions, scientific emergencies and other activities may cause homeowners to fall trailing to their month-to-month home loan repayments. When you have possessed your residence payday loans Cathedral for enough time to ascertain security, you may be able to avoid property foreclosure by the tapping in to the house's really worth. Being able to access domestic collateral will bring cash according to the worth stored in your property.

Previous foreclosures trends

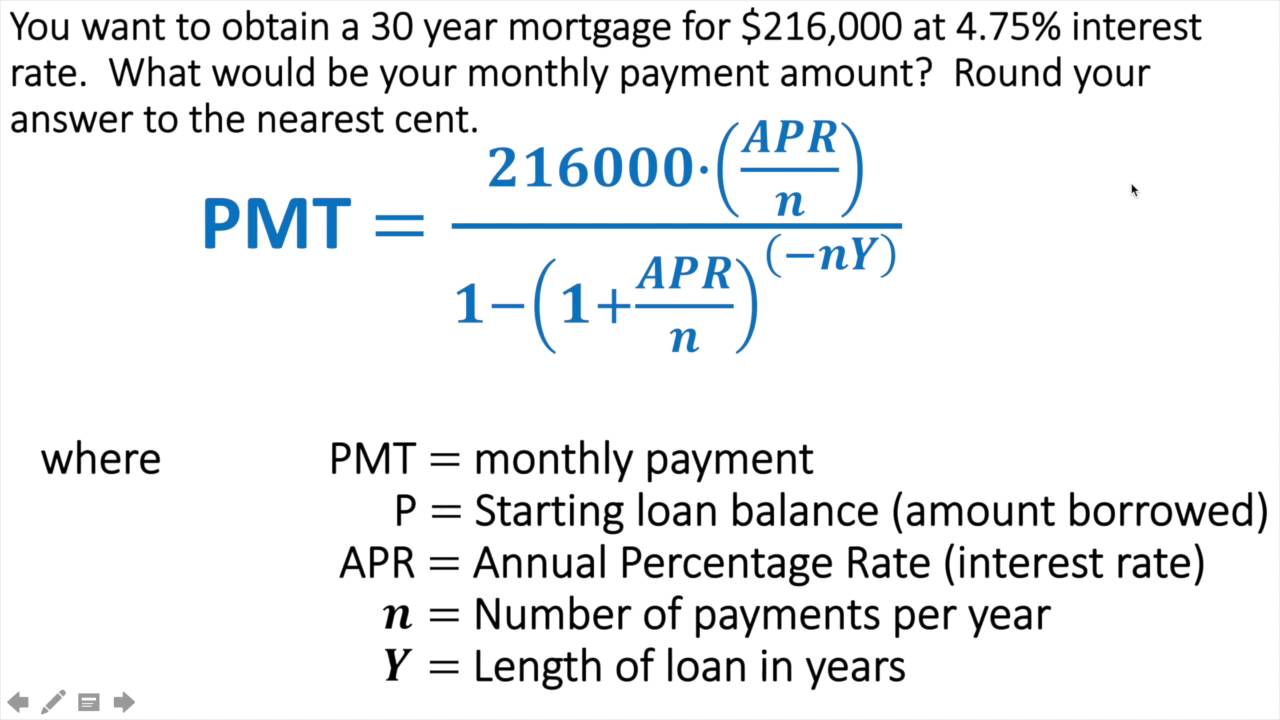

When you take out a mortgage, you usually select the name and you will rate of interest one to is best suited for the money you owe. Nevertheless when your debts alter, what immediately after appeared like a manageable package may become a headache.

One to present analogy affecting of several homeowners has been new COVID-19 pandemic. Not one person have predict one such as a widespread infection do toss the newest savings to your a mess for years at a stretch. The fresh new resulting quarantine and you can unemployment brought about some home owners to reduce the belongings to help you foreclosures.

The latest CARES Work, among federal government's answers into the pandemic, desired some property owners for forbearance on their mortgage payments. The fresh forbearance months invited for approximately 1 . 5 years of paused payments however, so it period's stop may foreshadow a wave of foreclosures.

When you yourself have fallen trailing on your home loan repayments, don't be concerned at this time. To avoid foreclosures are you'll, also of the opening the home's collateral.

Having fun with household collateral to prevent property foreclosure

Some individuals who possess fallen trailing on the mortgage payments looks to help you refinance, in order to get a better interest rate and you may/otherwise lower their money.

However, if you've currently had a belated percentage, refinancing may possibly not be it is possible to. Same as credit cards fee, their home loan company accounts your own fast and you can late mortgage repayments to help you the three major credit rating bureaus. A later part of the commission can harm their borrowing users and you will results, and come up with it harder discover refinancing.

Ahead of embracing home security, another option you are able to envision if you have overlooked a home loan percentage is called reinstatement. This option makes you afford the lender exactly what you missed when you look at the a swelling-contribution amount before a certain go out. Although this count will likely is focus and you will fees, it is the possibility getting property owners exactly who have not fallen notably behind, otherwise provides property or discounts they may be able utilize. If you're currently against foreclosures, even though, you may not get into a monetary status to afford an effective reinstatement.

Another option are a mortgage amendment. That is you are able to once you demonstrate to the lending company that your monetary facts was temporary (elizabeth.g., youre let go but anticipate to end up being reemployed in the future). Home financing modification can also is a good deferral agreement, and therefore needs you to definitely spend a lump sum payment upfront, otherwise a beneficial balloon payment at the end.

How to access home security

The reverse mortgage option is available to residents about 62 yrs . old. Instead of a classic financial or consumer loan, your credit rating isnt a factor. Alternatively, the lender considers your home equity to find the total amount to provide your.