Discover is best noted for its personal line of credit notes, but it is and additionally a full-solution financial and you can commission qualities organization.

Ideal Provides

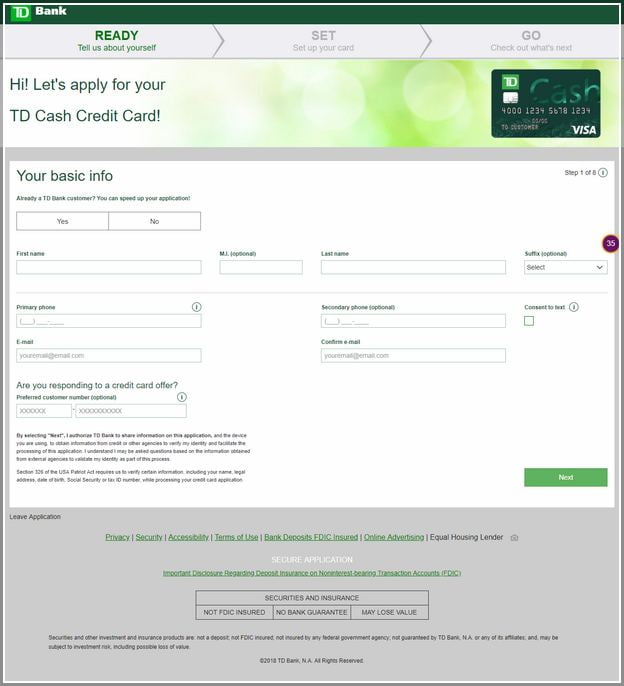

- Easy online application processes

- Zero origination otherwise appraisal costs

- No cash due at the closing

Disadvantages

- Zero get financing or HELOCs

- Family collateral fund start from the $thirty-five,000, which might be too much for most consumers

- Zero twigs to own when you look at the-individual interactions

Assessment

The borrowed funds Account is settled from the a few of the mortgage loan providers i comment. But not, this doesn't connect with the remark processes or the critiques lenders discover. Most of the product reviews are built on their own because of the all of our editorial team. I comment services off spouse loan providers as well as lenders we really do not focus on.

Look for was an electronic digital financial and you will payment qualities organization with you to really recognized brands during the You.S. financial qualities.

When you find yourself considering a mortgage refinance otherwise investigating a home security financing, Discover Lenders office offer a personalized option to see your position.

You will need to examine costs out of a number of some other loan providers, so you're able to rest assured about having the lowest price into your own home loan.

Dive To Area.

- What exactly is Pick?

- Select home loans review getting 2024

- Handling See

Selecting the most appropriate lending company can also be lay the foundation for the economic achievement. Thus needless to say you prefer a family that answr fully your issues and you may assist you as a result of each step of the process. Regardless if you are looking to reduce your financial speed or borrow secured on the security getting a repair project, continue reading having an out in-depth Come across Lenders feedback.

What's Find?

Pick is a financial institution that provides a variety of facts and you may qualities, also handmade cards, personal and you may student education loans, on the internet banking, and you may mortgage brokers.

The organization was created in 1985 just like the a part regarding Sears Roebuck and you can Co., possesses since the feel an independent company.

While you are Discover was well-noted for its playing cards, See Lenders is among the most the brand-new circumstances. So it home loan choice has become attractive to homeowners finding refinancing or borrowing from the bank against their home collateral Oakland federal credit union personal loan.

You to attractive function away from Look for Home loans is the capacity to get capital and no origination fees, no assessment charges, and no bucks due at the closure. Reducing such charges will help consumers save a significant amount of money.

Look for home loans remark to own 2024

Look for Home loans is actually a home loan company which provides mortgage refinances and house collateral money. Unfortunately, they don't already provide pick fund otherwise domestic equity outlines off borrowing (HELOC).

Using this bank so you can refinance your current financial might help all the way down their payment per month and relieve the borrowed funds term. It is possible to option out of a changeable-rate so you're able to a predetermined-speed financial. not, it's important to keep in mind that Select just has the benefit of antique refinancing and cannot support bodies-recognized financing such FHA or Va fund. So you can be eligible for refinancing you want the very least credit rating off 620.

An option advantage of refinancing which have Get a hold of Lenders is the no-closing cost alternative. This will possibly save you several thousand dollars in the initial charges. Rather, Pick talks about settlement costs for the their re-finance (appraisal fee, label insurance coverage, and you may financing origination costs).

Get a hold of lets consumers so you can refinance to 95% of the home's worthy of. Although not, you could simply acquire between $thirty-five,000 and you can $three hundred,000, and you may installment conditions cover anything from 10 to help you thirty years.

Or even need certainly to re-finance, another option is actually making an application for a discover household guarantee financing. You can tap into the home's equity to finance do-it-yourself ideas, combine loans, otherwise defense most other biggest expenditures.