The majority of people understand that a house should be an effective financial support. Whatever they will most likely not read would be the fact which money will pay of as you however individual the house! And you may we are not talking about renting it out, possibly.

A funds-out refinance is a wonderful treatment for faucet brand new collateral you have built-up of your home. Due to the fact term implies, it offers dollars you can make use of to possess whatever you such if you are leaving the bank account and you will funding car undamaged. The best part (really, two greatest pieces, really) is you can nonetheless watch your property enjoy as you alive on it-however you may be this that have money on hand!

What exactly is a money-Out Refinance?

A cash-out re-finance makes you turn the new guarantee you've collected of your property towards cash. It's so easy. Providing a tad bit more granular, a money-aside re-finance commonly replace your current financial that have a much bigger home loan, while pocket the difference.

How to Sign up for or Tap Security from My personal House?

Individuals need to have at least 20% collateral built up in their residential property to try to get a finances-away refinance. Whether or not for every single financial is different, really makes it possible to eliminate a total of 80% of your own residence's really worth having a cash-out re-finance. The fresh new exclusion is if you have got an excellent Virtual assistant loan. If so, you might be allowed to carry out a finances-aside re-finance doing the full property value your house. That worth could well be calculated compliment of some other appraisal which will be held once you get the fresh re-finance.

What are the Standards to Be eligible for a finances-Out Refinance?

As with the most you might cash-out, lenders along with are very different in terms of the financing rating called for to be eligible for these refinance. Of numerous generally like a credit rating from 620 or a lot more than, however, you will find lots away from options offering specific autonomy. A loans-to-income ratio from below 50% is also best for very loan providers-but once again, you can find flexible solutions.

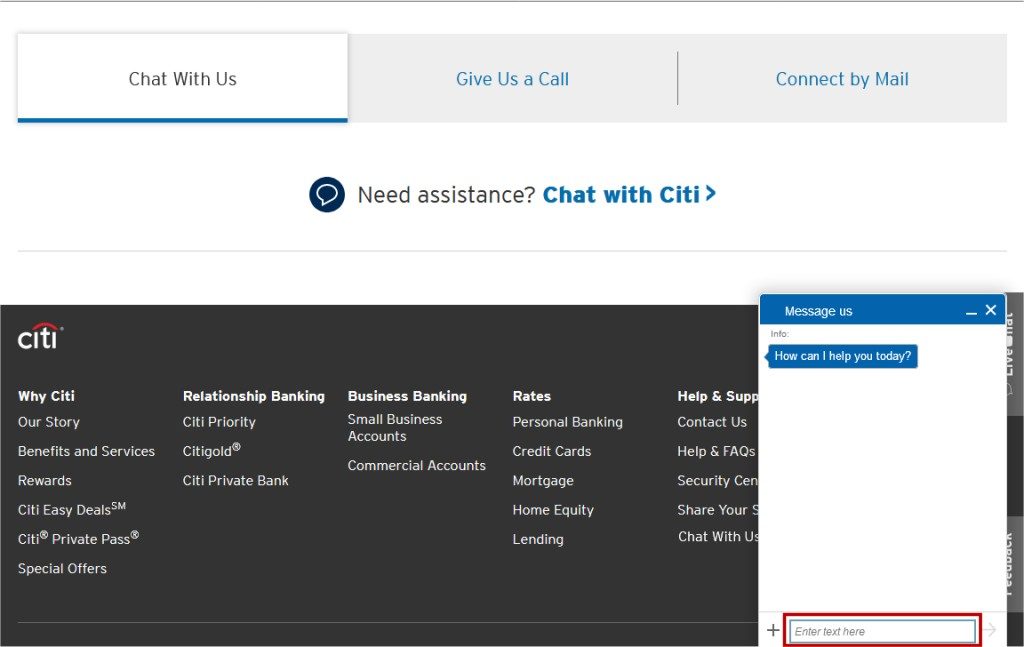

APM is prepared to address any questions you might have from the qualifying for a money-aside refinance. Give us a call anytime.

Should i Refinance In place of Settlement costs?

Just like any financial, you do spend closing costs to own a finances-aside refinance. This can normally mean 2% in order to 5% of one's financial. There are no-closing-rates refinances available owing to of several america cash loans in Brisbane CA loan providers, however, that does not mean this type of charge just fade. Instead, these are generally often rolled towards the prominent or recouped as a result of a higher interest rate.

You ought to determine whether it is good for you or whether you might be better off make payment on fees outside of the proceeds away from the borrowed funds; chat with your APM mortgage manager to own suggestions.

Other Considerations with a cash-Out Re-finance

The biggest thing to consider whenever deciding whether a cash-out re-finance is right for you is what you want to create to the dollars. Even in the event it is your personal accomplish anything you such, it will need to be paid down, so you should weigh the pros and cons of scraping your own equity with the objective you have in mind.

Most people fool around with dollars-aside refinances to fund house renovations, updates, or fixes; pay down highest-focus bills; or perhaps to possess easily accessible in case there is an urgent situation. A profit-out refinance is a famous choice to many of these problems since the speed into the good refinance is generally much better than the speed you could receive with a lot of most other fund or credit cards.

Here is various other benefit to using the bucks regarding a great re-finance so you're able to pay-off other funds otherwise bank card expenses: It does enjoys a big affect your credit score! Shorter the financial obligation, having a lowered complete payment per month, form you have got a better chance to make your payments with the day.

If you are considering home improvements so you can reinvest of your home, interest repaid with the financing spent can tell you a lot more, but bear in mind double-check with your taxation top-notch.

Because your the brand new financial try larger than the old you to definitely, your own month-to-month mortgage repayment will also boost. We would like to be sure to become confident in what you can do to handle the newest fee. Focus on their number with your personal finances to discover precisely what the the fresh new fee turns out on the total economic photo.

As much as interest rates go, according to the rate your covered once you ordered your residence, your rates would be straight down. This may be the truth for some individuals, because current interest rates are nevertheless very low-particularly if you haven't refinanced before 2 yrs. Do not forget to cause of men and women settlement costs, but not, in addition to the highest payment and you may longer fees plan.

Making the decision

Your final material to keep in mind that have an earnings-aside re-finance: It is so fantastic in order to utilize the finance to own surely whatever you for example, but which may be an enticing offer. An effective after-in-a-lifestyle visit to the newest Mediterranean together with your aging parents will get certainly become worthwhile. An impulsive wish to hang out during the Fiji to own a month? Perhaps not a great deal.

So it bucks continue to be your very own so you're able to deploy it however discover match, however, a property try a long-name advantage. When you find yourself debating a cash-aside re-finance to pay off credit card debt otherwise higher requests one to keep racking up, financial counseling and you may a spending plan is most readily useful suited to your. You ought not risk power a long-title house to own an initial-name gain if you don't have a powerful plan set up.

Santa Clarita mortgage loans lender American Family members Funding can help you see your dream regarding home ownership. A very rated Santa Clarita mortgages financial, American Relatives Resource maintains a look closely at neighborhood wedding and an excellent dedication to giving back whenever possible. A casual financial advisor will make the very first time homebuyer feel an easy and fret-100 % free sense - even with poor credit otherwise the lowest advance payment. The new Santa Clarita home loan officials during the American Friends Investment plus are experts in Virtual assistant loans, opposite mortgage loans, refinancing together with Star Mortgage Program.