You could have heard of something titled a beneficial contrary mortgage', which will be one way to access the fresh new collateral in your house. But there are many considerations to help you consider and it is important understand every solutions that will be offered to your.

When you are a homeowner aged 60 as well as over, an opposite financial is one way that you could be able so you're able to power the brand new guarantee of your house to view more cash. It is not something all lenders give Westpac doesn't including however, there are more an effective way to availability the brand new guarantee on your own household that may be more suitable to suit your disease.

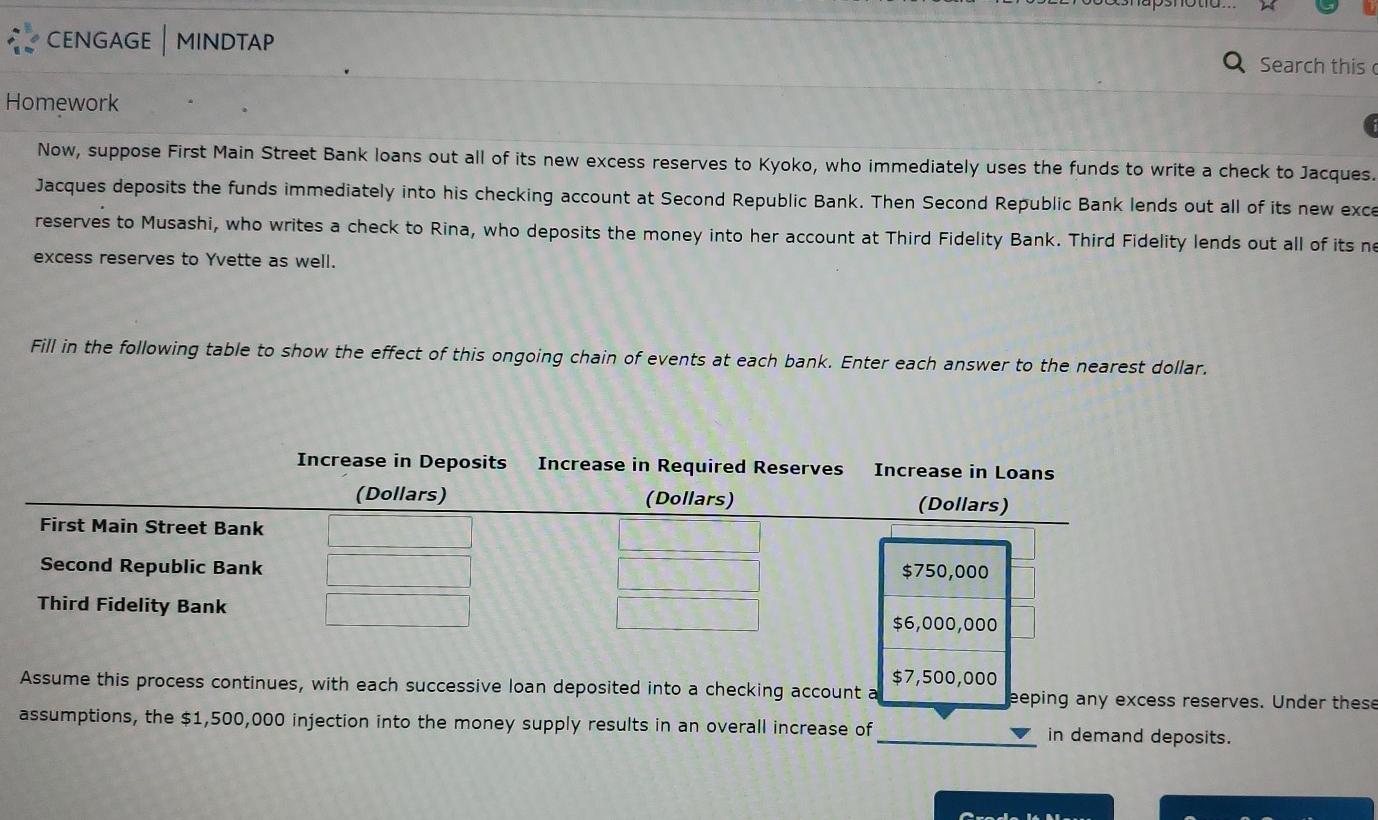

Contrary mortgage loans

You will find several alternatives for opening the amount of money such a consistent income weight, a credit line, lump sum payment, or a mixture of the.

Attributes of an opposing financial

A switch ability away from a face-to-face mortgage is you can stay static in your property and will not have to make money in order to your own bank if you are way of life there. Once you or your home sells the house or property no matter if, the reverse home loan must be reduced into lender in full.

The interest recharged towards mortgage will material through the years. Even though you won't have to pay back the loan as long because the you are in our home, interest continues to be compounding during this time. When the time comes to offer, your otherwise their home would need to pay off so it demand for addition on financing balance you borrowed.

Contrary mortgage loans enables you to obtain way more since you years. Yearly, the new ratio of your own residence's worth as you are able to obtain expands. Due to the fact a broad example, if you're sixty years of age, you could simply be in a position to borrow fifteen20% of your worth cash loan Old Greenwich, CT of your home. This might up coming be improved because of the step one% for each year more than 60.

To give you a much better thought of your own borrowing feature and you will the fresh new effect a loan gets in your collateral throughout the years, you should use ASIC's Moneysmart reverse mortgage calculator.

Considerations away from a reverse financial

Even though you don't need to build costs when still-living into the your house, since possessions accustomed keep the loan is sold, the reverse home loan balance will need to be paid back from inside the full, plus attention and you will people ongoing fees.

It's worthy of noting that contrary mortgages make use of an essential way to obtain money (your home), which means you must very carefully weigh up the benefits and you will downsides and consider carefully your current and you may future circumstances.

If you're for the life's later on degree, it might together with apply to the qualification on Decades Retirement. It can plus assist to consult a suitably licensed monetary or tax agent to understand the results for the personal circumstances.

While doing so, it is really worth thinking about whoever lifestyle with you and just what the reputation might be if you pass away, offered you reside commonly the most significant asset to get kept so you're able to other people.

Bad guarantee security

For folks who took away an opposite home loan immediately following otherwise decide to down the road, you may be protected by brand new zero negative equity verify. This is why you might not finish due the lending company even more than your home is worthy of if for example the property value our home your always hold the financing falls beneath the value of the a fantastic balance.

Always look at the package for folks who got away an opposite home loan until then day. If it cannot are negative security cover, it is preferable to talk to your financial or get independent recommendations.

An opposite mortgage is the one way of accessing the brand new equity of your home. Dependent on your financial and private circumstances, option solutions such as for instance financing increases or house reversion is most useful recommended as they are worth taking into consideration to own residents and consumers at all lifestyle degrees.

Financing expands

A different way to influence your home security is always to borrow funds as a consequence of a mortgage better right up otherwise improve. You'll want to apply along with your bank to increase your current mortgage limitation to view the extra dollars.

A mortgage best up or boost is founded on a beneficial level of situations. First of all, consult your financial when it choice is available for their financing type.

Additionally, you will must be in a position to build more costs, as of the enhancing the number you borrowed on your home loan, your payments will improve.

At exactly the same time, your own bank might require a formal valuation to determine the most recent market price of your home. This is accomplished so you're able to estimate just how much available collateral is in your house. You can buy a sign of the worth of the house or property from the talking-to a local agent or accessing an enthusiastic on the web estimator particularly Westpac's Security Calculator.

If not want to use their equity to boost the latest mortgage harmony, another option is utilizing they to set up a different, supplementary financing account.

This might allow you to favor features out of the individuals into your mortgage. Eg, another repayment regularity, particular rate of interest (instance repaired speed) and you can mortgage identity.

Household reversion

House reversion is when your offer an amount of the future equity of your house at a discount when you're carried on to live indeed there in return for a lump sum payment.

The price to you is the difference in what you get with the display in your home now and exactly what one share will probably be worth subsequently when you decide to market.

This is high-risk as the prices are totally dependent on the condition of the housing marketplace if purchases goes through which try challenging to anticipate. This really is crucial that you rating independent advice on any coming projections and you may comprehend the potential effect on your financial situation in order to weighing up whether or not that one is right for you.

You might not need to pay focus toward lump sum payment because it's just not that loan. not, you'll spend a fee for the order, to really get your household respected, and you may also need to pay extra property transaction can cost you.

Having many different ways to get into the newest guarantee on your house, it is critical to imagine and that option is good for your position and you may what is actually provided with their lender.

Westpac cannot give opposite mortgages otherwise household reversion, however, we could help present consumers play with their security having a mortgage improve. Although not, prior to making the decision, it may be a good idea to seek independent advice on the best way to open equity of your home.

Have significantly more questions? Contact us to the 132 558, for additional information on collateral of your home otherwise check out any branch all over Australian continent to talk to your regional Home Money Movie director.