If you are a real estate individual, to invest in foreclosures was another strategy to consist of into the team bundle. Such property is commonly received at under its industry really worth. Foreclosed land try services captured by the banking companies and creditors owed into the homeowner's incapacity to invest its financial. As they would be lower, additionally it is beneficial to learn how to pick foreclosed home having no money.

You might be curious, How can i buy a good foreclosed household versus cash? and you may truly therefore, because the basic build sounds near impossible. But not, for individuals who understand the market, to get a house during the property foreclosure in the place of public of seed investment try a possible goal.

I blogged this short article to deal with exactly how possible its to order a good foreclosed house with no money off, offering the information and methods needed seriously to do it. Utilising the methods and resources laid out right here, you can go into the real estate market because the an alternative starter, building a portfolio without the need to build an enormous very first financial support.

To find an excellent foreclosed household as opposed to making off money is sold with a great multitude of masters, which you could leverage to totally change the fresh new land of the private and you can providers earnings.

Cost-Abilities

Foreclosures essentially bring in less than their actual market price. A no-money-off method form you might be and additionally not receiving towards size degrees of financial obligation, reducing your total capital.

Investment Options

By the saving cash into the very first capital, you can reinvest said cash return towards the property to improve their really worth. Whether your carry out home improvements, repairs, otherwise updates, this strategy can help you inside the wearing a much larger get back for the resource when the time comes to offer or rent the newest possessions.

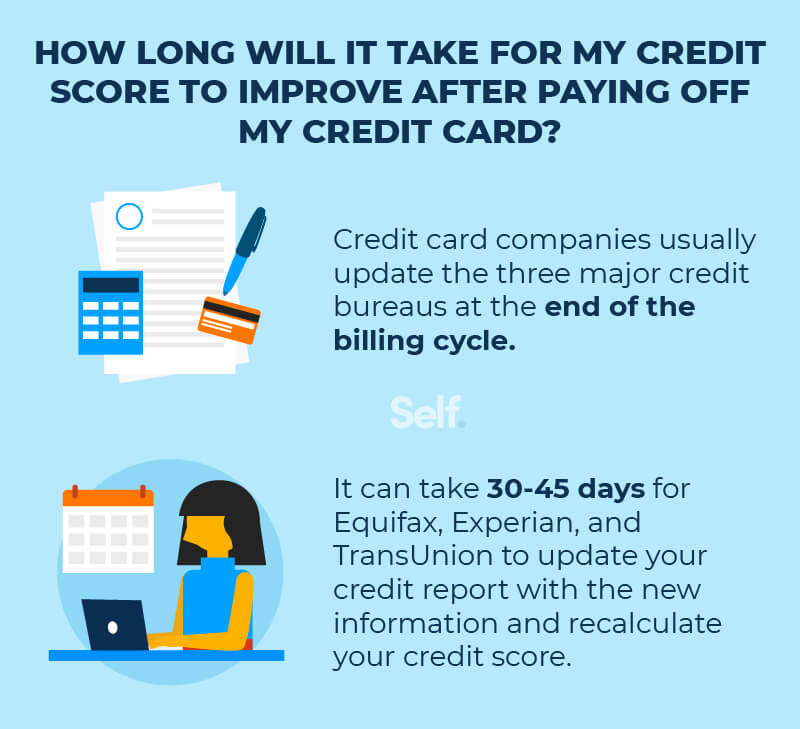

Building Borrowing

Investing in house is usually a good answer to help make your credit score, providing you perform the process securely. Through typical home loan repayments, loan providers note that you may be a reliable borrowing people. Doing so instead of putting anything down very first even offers a very clear timely tune to help you good credit.

Control Choice

Although you are not seeking to getting an entire-go out individual and are also checking to possess a spot to alive, to get rather than placing money off provides you with a clear pathway so you're able to ownership. In the current sector, trying to find a home to name the has become increasingly tough, but if you produces this procedure work, it's a tangible chance.

With all these types of experts, in the event, you should understand that investing a home always happens with huge threats. Be sure to do your research and study all of the small print at each and every phase of your own online game, even consulting a financial advisor if need-be to clear everything upwards. Many resources from organizations including Bank out of America normally next your understanding.

So now in your life the advantages, you ought to can get foreclosed property and no money. Even though it is maybe not a sure issue, we've got discussed ten handy measures that will result in the techniques so much more achievable.

step 1 https://simplycashadvance.net/loans/private-student-loans/. Seller Funding

Labeled as owner financial support, this strategy 's the practice of the vendor becoming a beneficial moneylender, sidestepping the conventional mortgage procedure. It basically form the lending company otherwise financial institution one possesses the assets commonly top the bucks towards the get, taking normal money straight back without the necessity to own an advance payment.

dos. Tough Currency Loan providers

Tough currency loan providers try buyers that will mortgage aside money especially to own short-name a residential property income, making use of their attention becoming primarily to your property's value unlike your very own funds. However, it is essential to note that hard money loan providers you'll assume cost earlier than you could handle, so make sure to obtain the specifics ironed away prior to trembling people hand.

3. Rent to have

A rental-to-very own bargain offers you the chance to pick a house just after renting it getting a specific time. This means you could currently feel located in the house prior to you order it, although some deals will tend to be a fraction of your rent for the the purchase, missing huge down costs.

cuatro. FHA Money

The fresh Federal Houses Management (FHA) even offers loans having low down costs having top house qualities, and additionally particular foreclosure. The goal is to assist people who struggle with individual lenders, making homeowning a great deal more concrete.

5. Personal Currency Loan providers

The fresh stability off individual money lenders due to the fact a strategy for to shop for a foreclosures is highly dependent upon your personal situation. Once you learn a buddy, cherished one, or individual trader that would give you the currency toward deposit or buy, you can purchase been into the repaying versus as often tension.

6. Virtual assistant Fund

This new Institution away from Veterans Affairs (VA) possess loads of foreclosed homes, giving funds to help you army veterans without needing people down payment.

eight. Family Collateral Personal line of credit (HELOC)

If you individual property currently, you could leverage a property equity personal line of credit to invest in the next purchase. Thus you might be making use of the collateral of current property to begin the process of owning another type of.

8. 203K Financing

203K Money, called Rehabilitation Money, are types of FHA fund designed for properties needing repair. The mortgage allows you to buy and you may repair this new foreclosed house and no deposit, performing value for all functions in it.

nine. USDA Outlying Innovation Funds

If you're looking at a great foreclosed property when you look at the a rural city, the usa Agency out of Agriculture also have financing to help you your that have zero deposit.

10. Partner That have Buyers

Inside a residential property, a lot of traders are simply just searching for options inside their freelancing. As much as possible discover somebody that has happy to top the cash to own property in return for a portion of the earnings, you could potentially own a beneficial foreclosed possessions no private down money generated.

Final thoughts

Thus, clearly, understanding how to shop for a great foreclosed home is simply 1 / 2 of the new competition. Though clear, feasible steps can be found, it's not a yes procedure unless of course the fresh things line-up securely for your requirements. However, if you possibly could get there, it is a powerful way to get the capital job or life while the a homeowner on course.