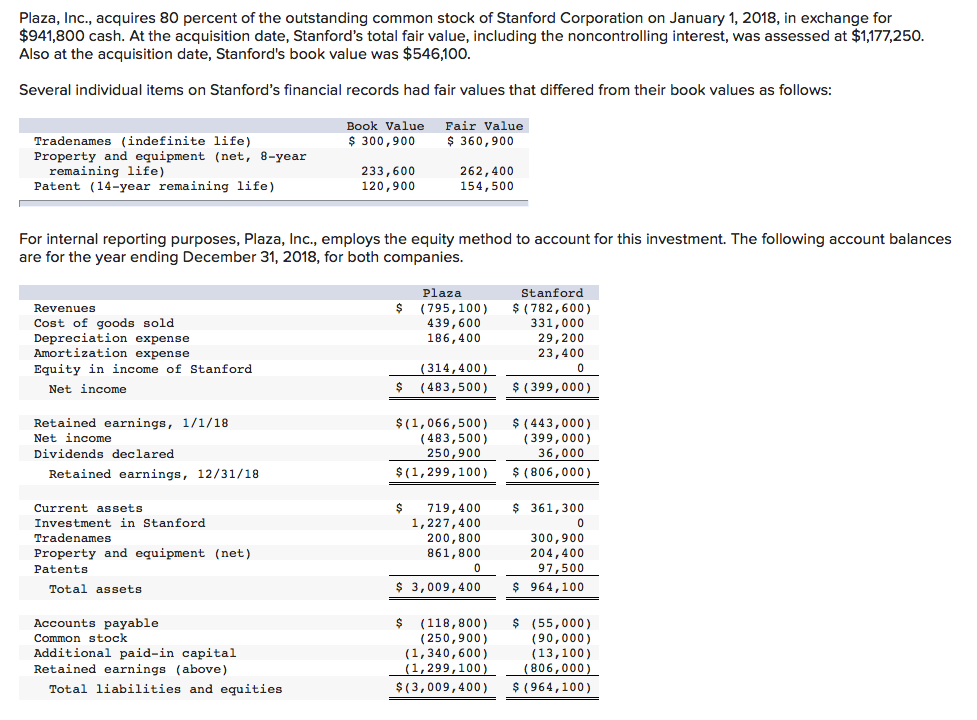

Contained in this blog site, we will security and you may explore Va The fresh new Construction in order to Permanent That-Go out Close Mortgages. Va The latest Build To Long lasting Recommendations from the Gustan Cho Associates motivated by the NEXA Financial, LLC today allows homebuyers to find good Virtual assistant The fresh new Structure household with the Virtual assistant Fund. We are going to money the fresh package, build will set you back, additionally the end financing everything in one loan closure. Homebuyers need certainly to satisfy Virtual assistant Assistance is eligible.

Great things about Virtual assistant Funds

Virtual assistant money are the most effective loan system in the us. The fresh new Service of Pros Affairs have really easy mortgage direction towards Va finance. 100% resource no down payment called for. Really borrowers do not have to value closing costs. Settlement costs shall be included in sometimes a combination of supplier concessions and you will/otherwise lender borrowing from the bank. We're going to coverage our very own Va The newest Framework To Long lasting One to-Time Intimate Loan System about this website.

Why does Virtual assistant The brand new Build To help you Long lasting You to definitely-Date Intimate Performs?

Virtual assistant The brand new Structure To Long lasting You to-Go out Personal Mortgage System is actually an incredibly unique financing system owed towards you to definitely-date closure. Extremely construction loan applications was a-two-step financial process. Towards the Virtual assistant New Design So you can Permanent You to definitely-Day Close, step one (connection mortgage procedure) is very removed. Getting rid of the fresh bridge loan techniques preserves consumers currency, big date, worry, and you can red-tape. The credit of your own package, structure will set you back, and you may avoid mortgage is perhaps all complete at one time ahead of the start of structure.

Sorts of Residential property Entitled to Va The latest Structure In order to Long lasting You to definitely-Go out Close Funding

Only a few qualities be eligible for Virtual assistant New Framework Loans. It ought to be owner-renter number one residences simply. I allow financial support of the advised parcel, framework, and you may avoid of Virtual assistant financing.

Virtual assistant This new Structure Morgage Guidelines

- Stick individualized-mainly based homes

- Are formulated belongings fulfilling Virtual assistant Property Guidelinessitting into a long-term fixed concrete base

- Condominiums do not be considered

- Multi-unit relatives belongings do not meet the requirements

- Non-warrantable and you may condotels dont be considered

Lenders can fund the brand new package. Or homeowners can own the brand new parcel, buy the parcel, otherwise have the parcel skilled of the family relations.

Great things about Va The fresh new Design To Permanent Loans

Into lack of domestic catalog, of a lot pre-acknowledged home buyers get charged from the housing industry. Some homebuyers is actually making to lower-taxed and sensible property claims due to highest home values. Now with the help of our Va This new Construction So you can Long lasting Financing Program, homeowners can also be bespoke build their houses having you to definitely closure process.

Benefits associated with Virtual assistant The fresh new Construction Money

There are dozens of advantages of the fresh new Va This new Structure Financing Program through the today's roaring housing marketplace. Borrowers are not required to make any attract repayments during the home structure techniques. There was only one closure therefore the 1st bridge financing closure try eliminated. Consumers need-not be eligible for a bridge design loan and a second finally loan. The mortgage process was sleek that have you to definitely closure this conserves go out, money, red-tape with only that appraisal called for

Eligibility Requirements And you can Guidelines on Virtual assistant The newest Construction Mortgages

There are certain conditions and terms on the Structure To Permanent Fund. Va does not have the absolute minimum credit rating requirement but it loan program requires a good 620 credit rating. Zero advance payment required that have 100% financial support. The most loan amount was for each Va loan limits. Obligations to help you income rates depends on automatic conclusions. Virtual assistant has no financial obligation to earnings proportion hats.

Instructions Underwriting try Invited towards the Va This new Structure Money

Just like the borrower try certified, the fresh borrower's document knowledge the latest running and you may underwriting procedure. Just after individuals fulfill all Virtual assistant Direction and generally are accepted, the development and you may home building procedure starts. Virtual assistant The fresh new Framework So you're able to Long lasting Finance is closed ahead of the beginning of the design. The mortgage business, name team, consumers, and you may designers all of the accentuate the project. The process is streamlined to avoid people stress into the financial procedure.

Meet the requirements and just have Acknowledged Now to possess Va Brand new Construction so you're able to Long lasting Finance With a-one-Go out Close

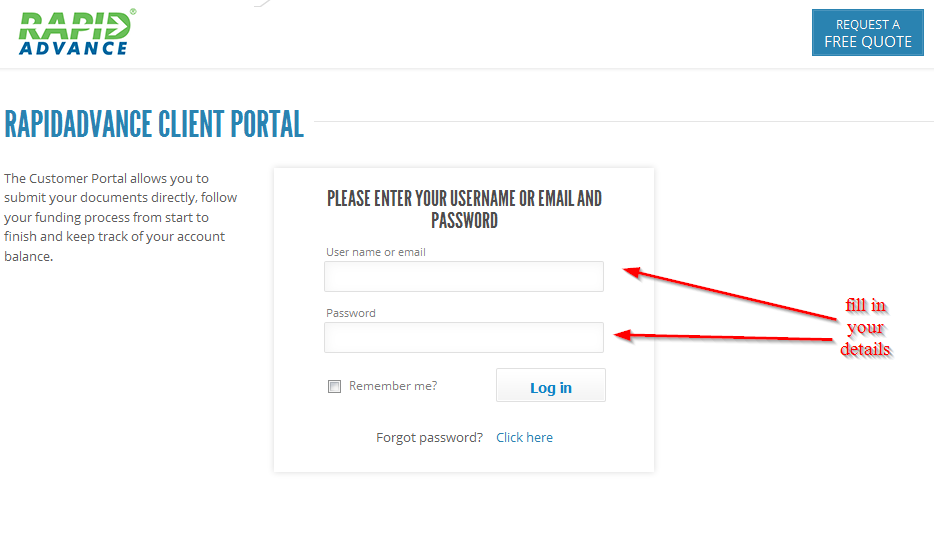

Homebuyers that happen to be looking qualifying to possess Virtual assistant The new Structure In order to Long lasting Fund that have a-one-date intimate, excite e mail us in the Gustan Cho Partners during the 800-900-8569 or text all of us getting a quicker effect. Otherwise current email address all of us in the We are available 7 days per week, on the nights, weekends, and you may holidays. Gustan Cho Associates energized because of the NEXA Financial, LLC is a home loan coach signed up inside the forty eight claims with over 160 general mortgage brokers. The majority of our wholesale Virtual assistant lenders do not have financial overlays into Virtual assistant financing. We simply go-by automatic underwriting program results. Zero overlays. We really do not need people minimal credit score criteria nor keeps a max loans so you can earnings Frisco bad credit loans ratio cover into the the Va financing. The group at the Gustan Cho Lovers also are experts in low-QM loans and you can solution investment.

Michael Gracz NMLS 1160212 try a seasoned mortgage loan officer with Gustan Cho Associates Mike may help individuals with very poor borrowing and higher loans to money percentages. Considering the Team within Gustan Cho Associates being a no overlay bank with the bodies and you may FHA Fund, Mike can be build one very poor consumers data and help them be eligible for a home loan within just an effective short-time.