Obtaining a home collateral mortgage in Maryland can present you with the means to access the bucks move you need to have do-it-yourself ideas, scientific expense, and. These types of money brings borrowers with an adaptable solution one to they may be able used to consolidate higher appeal debt and you may fund larger expenditures.

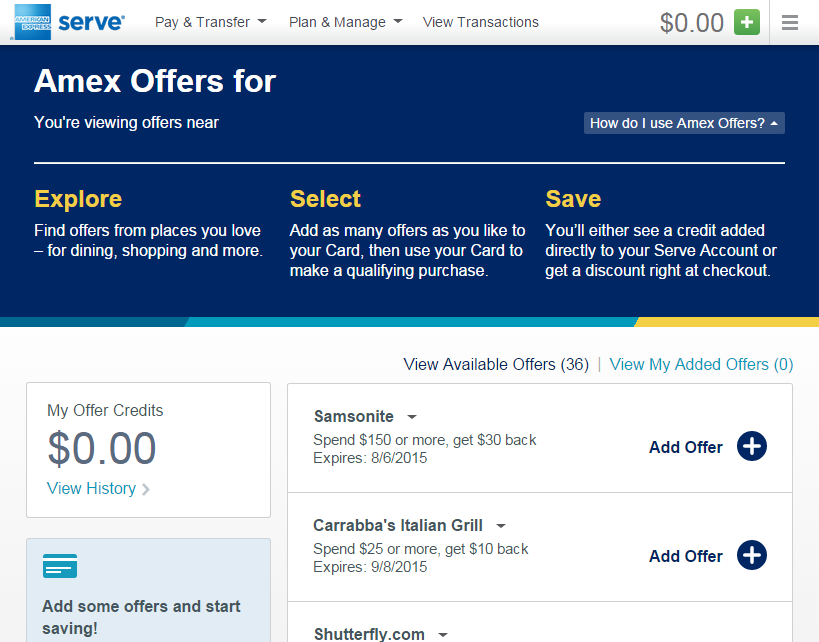

While you are searching for tapping into your residence's equity , Griffin Resource offers Maryland family equity loans with competitive prices. Find out about house equity financing and you can if they're suitable for you.

A property security financing makes you use the collateral within the your property given that collateral when taking away that loan. Together with your home guarantee due to the fact security, you have access to huge loan amounts in the reasonable interest rates. You need money from a house security loan to spend to have such things as household renovations, medical expenditures, educational costs, and much more.

As the household collateral loan rates within the Maryland are typically below playing cards and personal funds, home security money can serve as a good solution in a few instances. Household guarantee fund are specially good for individuals who need certainly to consolidate their large notice loans and you may unite all of their financial obligation below that fee.

While recognized to have property equity loan, you could potentially constantly obtain around 95 % of your guarantee of your house. You are getting your loan from inside the a lump sum payment that have a-flat mortgage title you to typically ranges out of four so you can 40 years. If you opt to sell your residence prior to you have paid down the loan entirely, the loan might be reduced using money from the latest product sales.

Typically, you need to offer W-2s and tax statements to apply for a property collateral loan when you look at the Maryland. However, we provide a zero doctor domestic guarantee mortgage while thinking-operating or has non-traditional sources of income.

Variety of House Security Loans

Section of finding out how a property collateral financing performs is understanding in regards to the different types of financing. You could potentially select from a simple family security mortgage (HELOAN) and you may a house security credit line (HELOC).

Family guarantee finance are just like another loan, but these are typically shielded by the home's equity. When taking away an effective HELOAN, you are getting your money in a single lump sum which have a great repaired rate of interest. Ergo, the monthly payments could be an everyday matter until you have repaid your loan.

A property guarantee credit line try a credit line you can start making use of your family as equity. The lender gives you a spending restrict according to the residence's well worth and how much collateral you have. Each month, you'll need to make a cost based on how far your invested. Once the HELOCs are varying-price money along with your investing can differ, their payment per month will vary each month.

One another variety of home equity financing provides benefits and drawbacks. Think contrasting HELOAN and you can HELOC prices inside the Maryland before you apply to possess financing - and keep planned that house equity personal line of credit prices in Maryland are often changing.

Advantages and disadvantages regarding Maryland House Security Money

Before you apply to own property guarantee financing in the Maryland, you should know what you're getting into. Home security loans is great whenever utilized responsibly, however, there are some benefits and drawbacks you need to know about.

- You can make use of household equity fund to boost earnings

- Griffin Capital offers competitive costs toward family security money to your no. 1, 2nd, and you may resource house

- Domestic collateral financing are apt to have down rates than just credit cards and personal money

- It's not necessary to eliminate lower-speed first-mortgage

- You are able to the income of a house equity financing having everything you need

- HELOCs can lead to overspending or even implement a financial package

- You could reduce your house if you are not capable pay off the loan

- Domestic collateral finance can add toward debt burden

Don't prevent house security finance, however should become aware of the risks before you can commit to some thing. Providing you explore family equity fund sensibly and pay off all of them punctually, they truly are an effective option when it comes to getting even more loans otherwise merging present expenses.

Maryland Household Equity Mortgage Certification Requirements

Making an application for a house collateral loan is relatively easy, but there are requirements you have got to see. This is what loan providers take a look at when reviewing their Maryland family collateral application for the loan:

- Extremely lenders wanted individuals to have a minimum of 15 otherwise 20 percent equity in their home. 20% is much more preferred, you could possibly safer financing that have fifteen % equity. Eventually, you'll need to retain at least five to help you 15 % collateral of your property once having the cash regarding a HELOAN.

Delivering accepted to own property equity loan is not brain surgery, however, that doesn't mean there are no standards. You need the newest Griffin Gold app to monitor the credit get, carry out a spending plan, and optimize your earnings while preparing to try to get capital. The fresh Griffin Gold app including makes you talk about additional investment solutions and have individualized service when you have questions relating to people of mortgage selection.

Make an application for property Equity Mortgage inside Maryland

Maryland house security funds bring several advantages, along with aggressive interest rates and more time for you to pay-off your loan. As long as you use your payday loan in Lester AL loan responsibly and shell out they away from within the loan several months, a house collateral loan tends to be a smart alternative to a unsecured loan otherwise mastercard.

Should you want to influence your home's security and then have availability so you're able to cash flow, Griffin Investment might help. Obtaining a property guarantee financing having Griffin Money can be as straightforward as filling in an online app . Complete our very own on the web software otherwise e mail us today to find out for individuals who qualify for a home collateral mortgage.