Think Offering Guarantee

Extremely signature loans is actually unsecured. Secured personal loans let you right back the loan which have guarantee, for example a family savings otherwise certificate off deposit (CD). If you're unable to rating an unsecured loan because the you are out of work, there was a go you can qualify for a secured that.

Be aware that you will possibly not obtain the same appeal prices, borrowing from the bank options, otherwise payment terminology just as in an enthusiastic unsecured consumer loan, but if you need the money to possess a crisis or even safeguards very first requires, a secured financing would be a good option.

- Credit rating and credit score

- Earnings

- Debt-to-income (DTI) ratio

Credit rating and you can Records

The higher your credit rating, the more likely you are in order to be eligible for a consumer loan toward matter you want at reduced offered interest. With reasonable or even less than perfect credit does not mean you will not qualify, nevertheless ount you have requested or protecting a great interest.

If you have a history of outstanding obligations or later payments on your own credit report, that could hurt your chances of providing accepted. It is extremely this new unmarried most important factor within the deciding your credit score.

Income

While being employed is one way to prove you have got a great income source, it isn't the only one. You've got other sourced elements of earnings, such as:

- Unemployment experts

- Your lady otherwise lover's income, if applicable

- Alimony

- Child support

- Social Protection advantages (often disability or senior years winnings)

- Resource attention and you can dividends

- Leasing money

Debt-to-Money (DTI) Proportion

Your DTI proportion suggests simply how much of your own earnings visits paying down the money you owe. A premier DTI ratio indicates to help you lenders that it can become hard for you to definitely create repayments toward another type of mortgage. A low DTI implies that whether or not things goes, you might more than likely pay the loan. Different loan providers keeps other DTI criteria.

Where you should Make an application for a personal bank loan While you are Out of work

While unemployed, there are certain supplies well worth examining when you are considering making an application for a personal loan. And additionally old-fashioned banking institutions, you might imagine:

Borrowing from the bank Unions

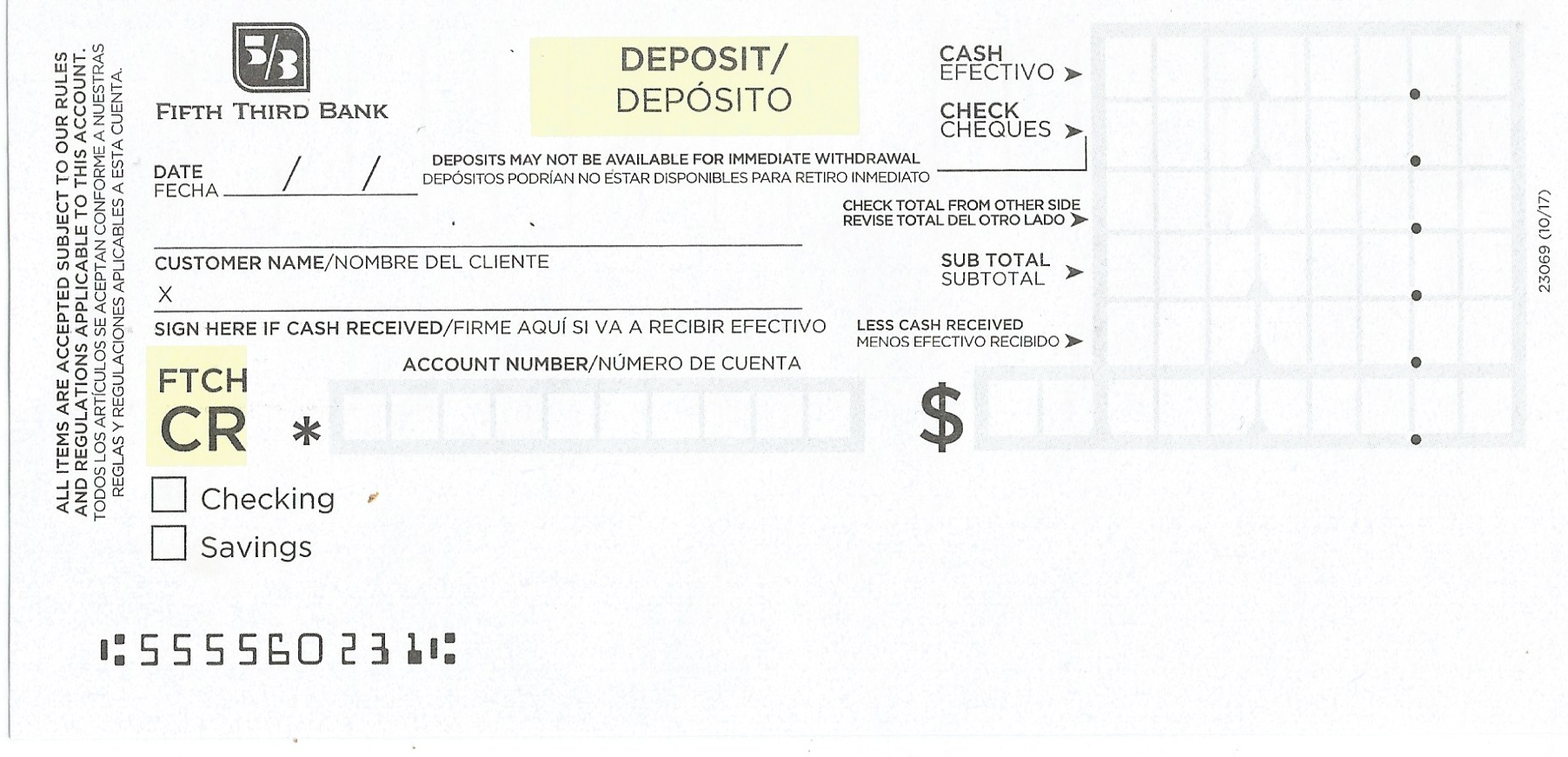

Even if you never belong to a card connection at this time, searching towards credit commitment emergency fund. Use the borrowing relationship locator to locate you to definitely towards you and find out if you're eligible centered on its requirements. PenFed Borrowing Commitment, for example, will see your earnings depending on a state. So you may need certainly to turn over bank comments otherwise tax output as opposed to shell out stubs.

Government borrowing from the bank unions offer pay-day solution money (PALs) having numbers ranging from $200 in order to $1,000, however you will must be a credit relationship affiliate to have during the least 1 month before you can sign up for one of them. Financing terms vary from you to definitely 6 months. The yearly payment costs (APRs) was capped at 28%, whenever you are almost every other fund away from government borrowing from the bank unions is actually capped at the 18%. But even in the twenty-eight%, Buddies is an attractive option as compared to loans from individual pay day lenders, that can bring can cost you and you may charges approaching 400% in a number of claims.

You can get an unsecured loan away from many financial institutions otherwise lenders, particularly You.S. Financial, Dated National Financial, Coaches Federal Borrowing Relationship, NASA Government, and a lot more. You should check with your standard bank, too. So if you have a beneficial NASA Federal account currently, you may find you to definitely NASA Federal has also unsecured loans.

On the web Loan providers

Some lenders do not have income confirmation procedure, making it simpler for title loans West Virginia online you to get that loan mainly based to your almost every other deserves, such as your credit rating or credit rating. That have Up-date, such as, should you get accepted for a financial loan and undertake the newest conditions, you could potentially discovered fund within twenty four hours. Understand that on the web lenders commonly costs a keen origination commission and have now a high restriction Apr compared to the other lending options, such as for example borrowing unions.