Table regarding Articles

- Key Takeaways

- What is a gifted Downpayment?

- How do Skilled Down Money Work?

- How much Do Now i need to possess a downpayment?

- Who can Render a talented Deposit?

- Regulations to own Gifted Off Payments

- Possibilities so you're able to a gifted Deposit

- The bottom line

- Faqs (FAQs)

With the average price of homes all over Canada however uncomfortably higher, its much harder than in the past having very first-date homebuyers to keep enough money for a down-payment. According to the Canadian A property Connection, the fresh new national mediocre domestic speed is actually $649,100 when you look at the . While the absolute minimum advance payment away from 6.15%, you will want $39,910. And when you won't want to pay money for home loan insurance coverage, you may need $129,820 bucks to possess good 20% downpayment.

It's no wonder then, one an increasing number of home buyers is actually counting on the fresh Financial out-of Mom and dad to possess help with the fresh down-payment. Considering a recent questionnaire out of CIBC Financing Locations, more one-third of earliest-go out homebuyers rating help from their loved ones for an all the way down payment. In the Ontario and you will B.C., the most expensive markets for the Canada, one to amount is even large, with 36% off first-time people taking an increase. The average gift is from the $115,000; but not, first-big date buyers in the Ontario get merchandise averaging $128,000, whenever you are people into the B.C. get a massive $204,000. When you find yourself just 12% of mover uppers rely on a gift, the common gift count is $167,000.

While you are able to score assistance from a household user, there are some statutes you will need to realize. Let me reveal everything you need to understand skilled down payments having home financing into the Canada.

A talented advance payment is strictly one to: a financial present provided by a relative for use for a deposit to possess property. Becoming a gift, there needs to be zero expectation that you payday loans Hamilton pay the bucks.

Just how do Skilled Off Payments Really works?

A relative can present you with any amount of money to your an advance payment. An important is the fact that the loans have to be a present instead one expectation of fees. Anyone gifting the income will need to signal home financing provide letter you to info the connection involving the donor and you will recipient, the reason of your own money and this the cash try a provide and not that loan. Donors normally explore deals or even the arises from the brand new product sales off their own domestic because the a way to obtain finance, however, lent finance (off a credit line, for example) are an alternative. Talented off repayments aren't at the mercy of one tax.

After you buy a home, you have to generate a down-payment. The total amount you prefer utilizes the cost of your own domestic. Not as much as newest laws, minimal down-payment is just as comes after:

In the event your downpayment is below 20%, you'll need to get mortgage standard insurance policies which covers the financial in case you can't build your repayments. Mortgage pricing to possess covered mortgages are usually below uninsured mortgages since they're safer on the bank.

Although not, since , this new lowest downpayment cap increases to $1.5 million, definition homeowners usually qualify for a covered home loan as much as you to definitely amount. In addition, it ensures that home buyers will pay 5% toward very first $five-hundred,000 and you may ten% on improvement around $step one.5 billion, a lot less than the present day 20% downpayment importance of homes costing more than $one million.

Generally, simply instant family members can be current you an advance payment, which means parents, grand-parents otherwise sisters. Consult with your lending company to decide in the event that gift ideas from other household members, like aunts or uncles, are allowed.

Rules for Gifted Off Money

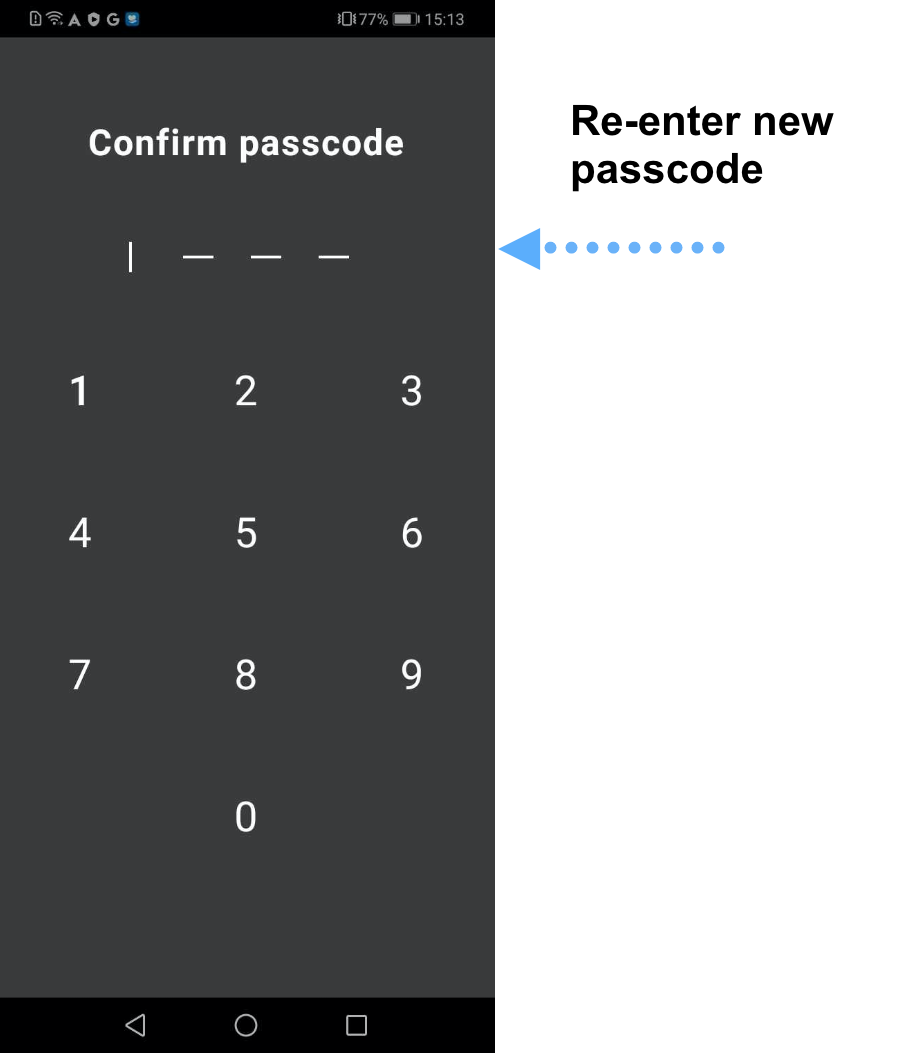

You will need to bring a gifted down payment letter signed because of the the fresh donor therefore the person. Their bank might enjoys their own page theme, although details generally were:

The lending company will most likely also need proof of funds, for example a financial declaration, to verify your currency could have been transferred. The brand new donor elizabeth off, such as for instance discounts or even the income of the home. This is to make certain visibility in the provider of money and to stop currency laundering.

Choices so you can a skilled Down-payment

Family Consumer's Bundle (HBP): Withdraw doing $sixty,000 from your own RRSP to use to the an advance payment getting the first family. You should have 15 years to settle the income.

Earliest Home Checking account (FHSA): Cut back so you're able to $forty,000 ($8,000 annually) with the to shop for property. Benefits try taxation-deductible, and distributions is taxation-totally free. In lieu of new HBP, you do not need to settle money.

The bottom line

When you are a talented down-payment will help young buyers enter into its earliest home, home financing is still a huge responsibility. Even though you rating advice about this new downpayment, you'll need to be eligible for the borrowed funds considering their creditworthiness, income, and you can expenditures, plus demonstrate that you are designed for your mortgage repayments.

| House cost | Lowest advance payment expected |

|---|---|

| $five hundred,000 otherwise less | 5% |

| $five hundred,000 to $999,999 | 5% to the very first $five hundred,000, 10% on the rest |

| $one million or maybe more | 20% |