Merging your financial situation might help describe your finances, reduce your interest levels, and reduce your own monthly obligations. not, should you decide to buy property on the near future, you ought to know out of exactly how debt consolidating could affect your own power to score a mortgage.

One of several points one to lenders thought when determining whether or not to agree your home loan application is your debt-to-money ratio (DTI). This is the portion of your own monthly income that goes to paying your financial situation. Basically, lenders favor borrowers getting a DTI around 30-40% or all the way down. When you have a high DTI, it does code to help you loan providers you will probably have difficulty while making their mortgage payments.

When you combine the money you owe, it does reduce your monthly obligations and also make it more straightforward to control your bills. not, if you choose a debt settlement mortgage which have an extended repayment title, additionally improve your DTI. Particularly, if you have $fifty,000 in debt with a mixed payment per month off $1,500 therefore combine they into a great 10-seasons financing that have an excellent $five-hundred monthly payment, your own DTI might go upwards otherwise can also increase their income.

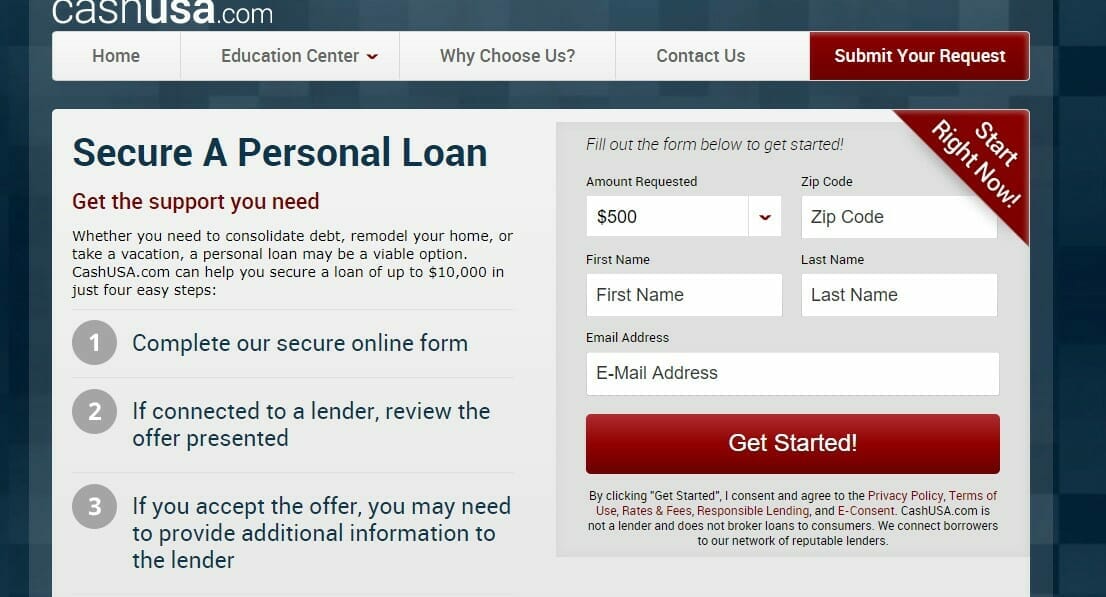

This requires taking right out an individual loan to settle numerous expense, for example playing cards, personal loans, and you will medical costs

Debt consolidation have an immediate and you will harmful influence on your own credit score. For the reason that taking out an alternate mortgage and you will closure several profile into the a short period of your time can seem high-risk in order to credit reporting bureaus. This will enable it to be much harder in order to qualify for a mortgage otherwise rating a great interest rate.

Additionally, if you use a debt consolidation company so you can negotiate together with your financial institutions, additionally, it may effect your credit score. Debt consolidating enterprises typically negotiate that have creditors to minimize personal debt or rates on your behalf.

While this makes it possible to pay your financial situation less, additionally end up in creditors revealing your own account once the "settled" in the place of "paid in complete." These notations can lower your credit score and you may code to loan providers you have got troubles spending your debts in past times.

Through the years, although not, debt consolidating might help improve your credit rating by detatching their total obligations and you may making it simpler and also make money on time. When your funds try paid back entirely, it does increase your credit score, making it easier for you to safe acceptance to your property mortgage.

Debt consolidation reduction is not a silver round to own financial issues. If you are considering a debt consolidation bundle, you will need to determine if the choice to make use of these tools is a simple improve so you're able to bigger trouble, such as for example bad cost management decisions or terrible credit models.

Consolidating the money you owe will help make clear your finances and reduce your own monthly payments, it cannot target the underlying issues that triggered you to accumulate debt first off. If you don't alter your spending designs and address debt problems, your elizabeth disease once again.

A special prospective concern is brand new impact on your credit score

If you are considering debt consolidation reduction while having going to pick a home in the near future, you will need to look out for how it could affect your own capacity to get home financing.

Debt consolidation reduction normally reduce web site here your monthly obligations and you can make clear your bank account, nevertheless can also increase your DTI, lower your credit history, and you will signal so you're able to lenders you have had dilemmas using your own bills prior to now. However, of the improving your loans-to-income ratio, overseeing your credit, and you can protecting to have a down-payment, you can get economically willing to getting acknowledged having a property financing without difficulty.