This informative guide will take care of qualifying getting an FHA loan immediately following financing modification mortgage recommendations. That loan amendment was a substitute for property foreclosure, where homeowner's latest lending company tend to customize their property financing. Loan Modifications are performed and supplied from the lenders as borrower are unable to afford their newest homeloan payment.

Borrowers whom do not want their payments often because they had a good decrease in home income or even the mortgage ran substantially highest due to an adjustable-speed financial.

Mortgage improvement are carried out by the both reducing the interest rate otherwise forgiving a portion of the real estate loan harmony, deciding to make the mortgage payments affordable toward homeowner. Lenders do not want the house and you will as an alternative work at residents than just make assets compliment of foreclosure.

Amendment Process and you may Qualifying For FHA Financing Just after Loan modification

To be eligible for a loan modification, the fresh new citizen must be functioning. Lenders requires the newest financials of one's resident. The current lending company need certainly to remark taxation statements, W2s, and you may income stubs. The borrowed funds financial can come up with a month-to-month mortgage payment your homeowner are able to afford. Residents whom experience a loan modification can be eligible for an FHA financing shortly after amendment one year following the modification time.

Loan mod Replacement Foreclosure

Modify mortgage loan was a substitute for foreclosures to have property owners just who cannot afford its latest loan commission. It can help customize the most recent home loan so that the homeowner are able the fresh freshly altered mortgage.

The outstanding mortgage payments would be put in the back of the borrowed funds harmony otherwise forgiven. A loan amendment are the next options the financial institution gives to help you home owners with sudden money alter or any other extenuating activities.

Loan modification Processes Timeline

Mortgage changes have traditionally received a bad hip hop with lenders. Property owners are offered a try months. Lenders had a credibility to possess giving home owners a shot several months and you may perhaps not approving mortgage changes. Lenders tend to foreclose on a home instead of granting loan mod shortly after a try months. The process for a loan amendment are started in a single of a couple indicates the following.

Loan modification: What exactly is HAMP?

People having Fannie mae or Freddie Mac computer Old-fashioned fund is generally qualified to receive a loan amendment from Home Reasonable Amendment System, known as new HAMP. The new HAMP, needless to say, provides fairly strict inclusion. There are certain conditions, including the mortgage need become started towards the otherwise just before . The latest debtor should be able to confirm past a good doubt its financial hardship (for example the need https://paydayloancolorado.net/el-jebel/ for financing amendment). It is the option for individuals trying to financing modification.

Individual Mortgage Changes

Homeowners with a mortgage should be aware of one personal home loan loan providers are not expected to honor HAMP, nevertheless they certainly have the option to take action. There are many people exactly who . Using qualities along these lines are high-risk, as they can not ensure triumph.

Really merely Fannie mae and you can Freddie Mac money will definitely be eligible for financing amendment. To choose eligibility, head to site, that'll provide home owners great advice on how to handle it.

Naturally, an alternative good choice is to try to contact the loan bank and you can mention they together. Shell out your home loan into the loan mod software and you may demo process.

Expertise Private Financial Changes: A thorough Guide

Personal financial improvement give a good lifeline to have property owners facing financial hardships. In place of government-supported financing changes, speaking of discussed personally involving the debtor as well as their private bank. This guide explores the intricacies regarding private home loan variations, outlining the process, experts, and you will potential problems.

A personal home loan modification is actually a negotiated change to the new terms of a current home mortgage that's not supported by regulators organizations including Fannie mae, Freddie Mac, or the FHA. This type of modifications are tailored to assist borrowers incapable of create monthly mortgage payments on account of monetaray hardship.

- Financial hardship : Loss of money, scientific problems, and other unforeseen charges causes it to be difficult to continue having mortgage payments.

- Avoiding Property foreclosure : Improvement might help residents stay in their houses through money even more in check.

- Interest Adjustments : Consumers having changeable-price mortgage loans (ARMs) you'll seek to secure a reduced repaired rate of interest.

- Name Extensions : Stretching the borrowed funds label decrease monthly installments from the stretching the financing label to help you spread the borrowed funds harmony more a longer timeframe

- Interest Reduction : Decreasing the interest to minimize monthly obligations.

- Financing Term Expansion : Stretching the loan label to minimize the fresh payment matter.

- Prominent Forbearance : Briefly reducing otherwise suspending dominating repayments, on deferred amount set in the borrowed funds balance.

- Dominating Avoidance : Reducing the principal harmony, even when this might be less frequent and often more complicated to help you discuss.

- Assess Your role : Discover your debts and find out if the an amendment is the better. Gather all the associated monetary documents, in addition to money comments, tax returns, and you may an in depth budget.

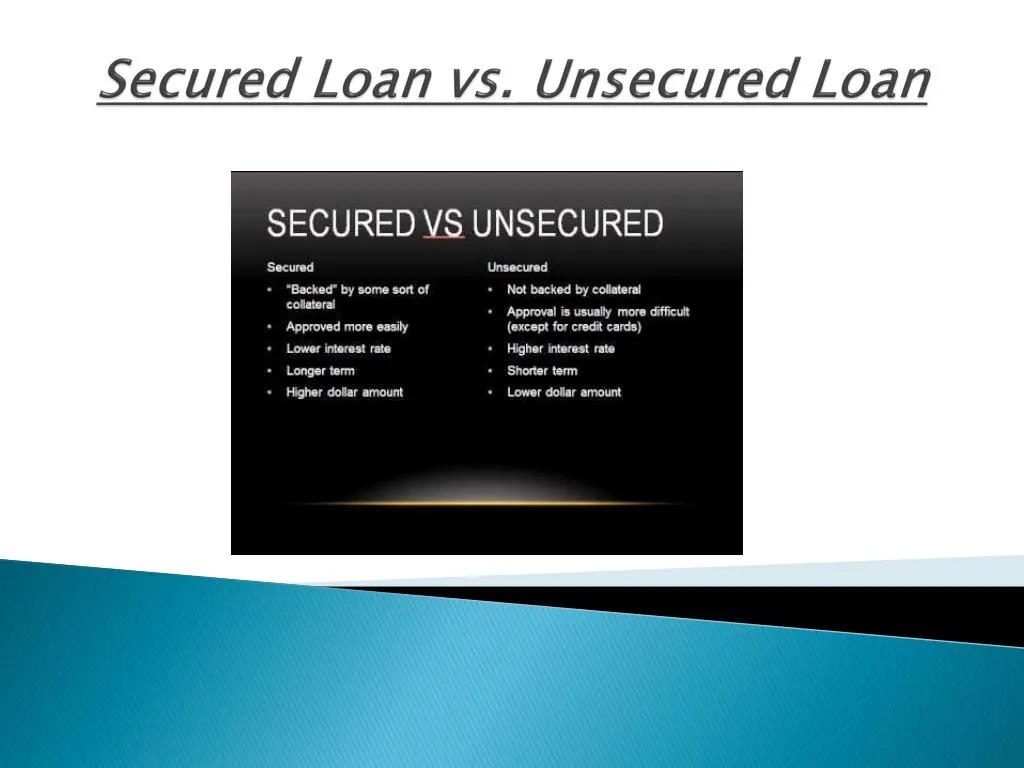

Style of Mortgage loan modification

There are numerous a way to renegotiate the home loan. How you get it done might possibly be some of the pursuing the. A decrease in your monthly obligations. Possibly having a fixed several months. Interest cures. Using a fixed-speed mortgage. There are many different different ways to modify a mortgage loan. Make sure to contact us with any questions about this situation.