Brand new Liberties of your own Borrower

The SARFAESI operate provides the consumer the ability to notice up against the action regarding repossession pulled because of the financial on Debt Data recovery Tribunal u/s 17 within this 45 days from the day in the event the action are removed. In the event the DRT entry your order against the debtor, next a destination might be submitted through to the Appellate Tribunal within this 30 days out of getting it. If it is stored in the focus that the arms of the brand new investment drawn by secure creditor try unlawful, this new Tribunal or the Appellate Tribunal will get lead its return to the fresh new borrower, as well as compatible payment and value.

Right to Find

For individuals who haven't repaid EMIs to own ninety days, the financial institution need serve you a notification regarding 60 days. While the observe period is over while the expenses was however unsettled, then your bank are permitted to repossess your residence. And till the bank are selling from your property, it has to suffice an alternative notice of 1 month advising you about the same.

Straight to getting Heard

For the one month notice several months, before property is auctioned, a loan defaulter can also be document a representation toward authorities and you will increase arguments with the attempting to sell from the assets. The mortgage officer must after that answer the fresh logo and you can offer valid reasons for bringing down your arguments in this 1 week.

Straight to Reasonable Value

If the lender keeps repossessed your residence because of a loan default, it does not let them have the only directly to choose the latest deals cost of the house. And the one month see telling the customer regarding market of the property, the financial institution must send a reasonable value see that obviously says new marketing cost of the house because the assessed from the financial authorities. Although not, if you think that the financial institution try selling it well within a less than-listed speed, then you may boost arguments and declare a cost which you getting is practical. The financial institution has to consider carefully your plea for reasonable worthy of for the possessions and can need to revaluate the house immediately after once more.

To Equilibrium

As which bank gives personal loan in New Castle Virginia the pricing of property is steeply ascending with each passageway big date, you will find a possibility there would-be a good amount off harmony left adopting the lender possess compensated the loan by the offering off your home. Youre entitled to have that equilibrium count due to the fact bank does not have any claim involved due to the fact mortgage is actually compensated.

Right to feel Handled Politely

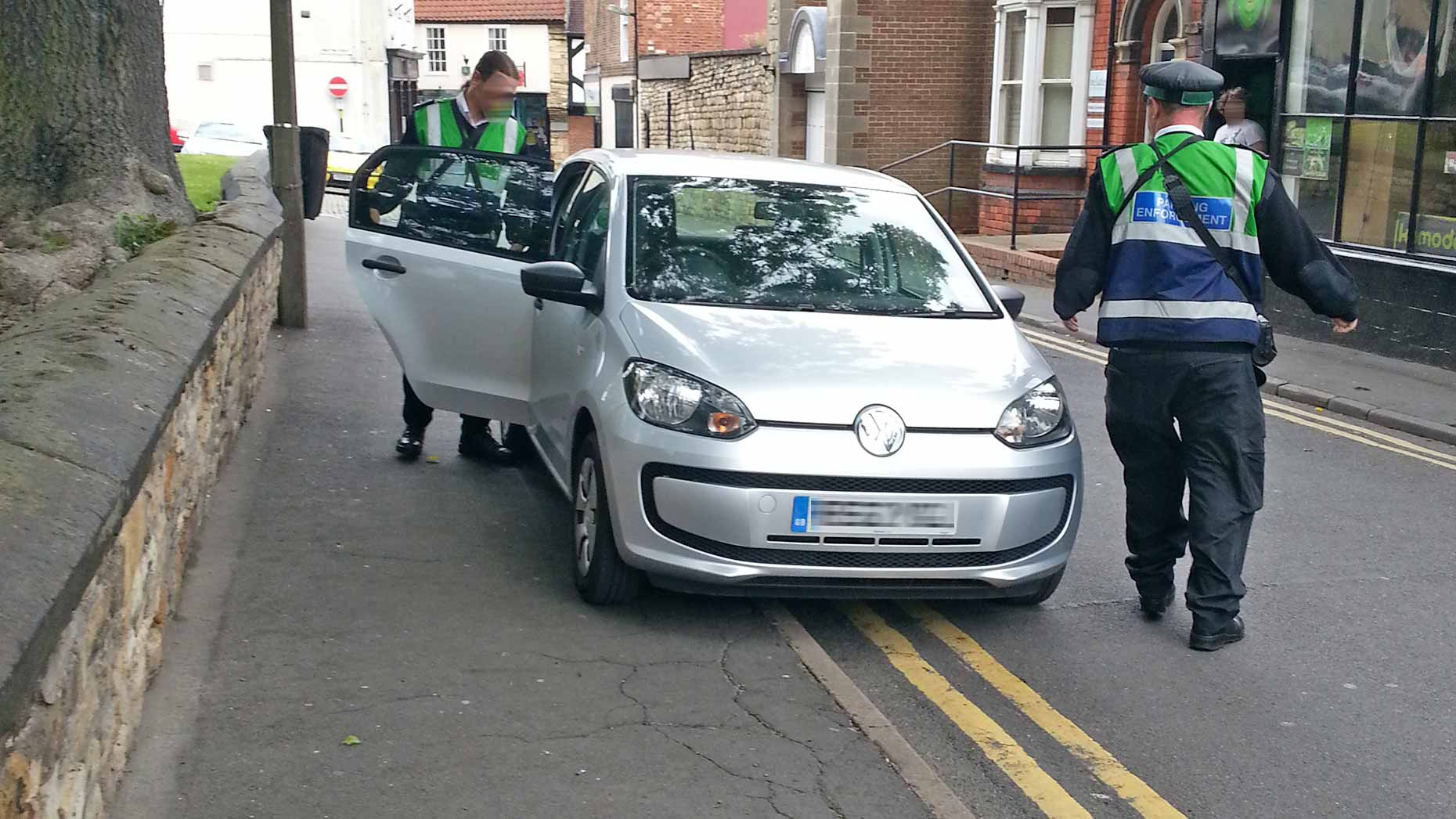

Finance companies was joined organisations and cannot become independent currency lenders with respect to that loan standard. In earlier times there have been profile away from harassment and you will mistreatment from financing defaulters because of the range representatives the good news is financial institutions are determined to follow along with a password off carry out that is respectful and you will sincere. A collection administrator should politely request to generally meet both you and the spot and you will time of the meeting can be as for every your own convenience. Or even address the newest consult, the fresh collection manager will get meet your home or work place. And additionally, the latest representative can meet you merely ranging from seven Am and you can seven PM and can't harass your late at night or even in the latest early period of early morning. This new range representatives are meant to reduce this new defaulters within the a good sincere manner rather than relying on abusive words and you will mistreatment.

The effects

Mortgage standard may have really serious outcomes. Not merely you can expect to it make seizure and you can market regarding your property, however your Credit history as well, will go getting a toss. Also rescheduling obligations tarnishes your credit history to some degree and you can usually mirror on the credit file. Getting financing down the road becomes problems and this is a huge financial setback. Make sure you borrow cash only if you're sure you will be able to create timely costs. A great way to do this is to try to determine yours web well worth when it comes to property you own and the currency you've got available shortly after bringing stock of your own current costs or any other financial commitments.