Towards the , Chairman Joe Biden's government established that it perform discharge $5

Because the student loan loans mounts-almost $step 1.8 trillion as a whole outstanding personal debt nationwide of the current guess-needs sweeping financing forgiveness and grow.

Government Education loan Debt settlement programs

8 billion when you look at the the student loan financial obligation for more than 560,000 people whom went to and you may, it had been influenced by the us Service out of Knowledge, was basically defrauded from the for-money Corinthian Universities chain. Continua a leggere "Towards the , Chairman Joe Biden’s government established that it perform discharge $5"

Tips boost your odds of providing acknowledged to own a good Virtual assistant loan

Since you check around for the ideal financial, keep track of which lenders features lower or more flexible credit conditions. Before you go, submit an application for preapproval with 3 or 4 loan providers which you believe is happy to assist you. This way you might compare just what for every lender also offers in terms out-of rates, charges, customer service, and additional masters instance quick closing minutes or electronic document publish possibilities.

When you find yourself having trouble wanting a lender you to welcomes a minimal get, you might thought handling a mortgage broker, who will perform the performs regarding doing your research for you. Continua a leggere "Tips boost your odds of providing acknowledged to own a good Virtual assistant loan"

Modular against Are created Land: Selecting the most appropriate choice for you

Today arrives this new exciting region selecting the prime domestic for you! Let's break down elements to assist you pick ranging from modular compared to are designed house.

Funds and cost

Ah, the age-old funds issues. Money doesn't expand into the trees, and you will choosing ranging from modular and you will are formulated house are a financial rollercoaster.

Let us deal with the largest matter: the price of modular and you can are built belongings. Both choices wait an equivalent budget and one you are going to anticipate paying between $180,000 to $360,000 to own a 1,800-square-legs home, towards overall cost also installation anywhere between $100 to help you $two hundred each sqft. But hang on! Earlier clutching the handbag, keep in mind that it bills gives you the fuel regarding modification and you may a house you to definitely depreciates a whole lot more more sluggish. Continua a leggere "Modular against Are created Land: Selecting the most appropriate choice for you"

Paid down in 36 months: Can an $85k tiny family bring larger economic liberty?

Would you transfer to a little home if doing this you'll pluck your outside of the housing crisis? For individuals who replied good resounding yes', you are not by yourself.

About Australians try embracing small property for the a keen effort to get rid of on their own from the grabs of the country's homes drama.

As the clients struggle in the course of listing-reasonable vacancy rates, residents grapple which have a decade-high rates of interest, and you will construction does not outpace request, brand new appeal of an inexpensive albeit brief house is clear. Continua a leggere "Paid down in 36 months: Can an $85k tiny family bring larger economic liberty?"

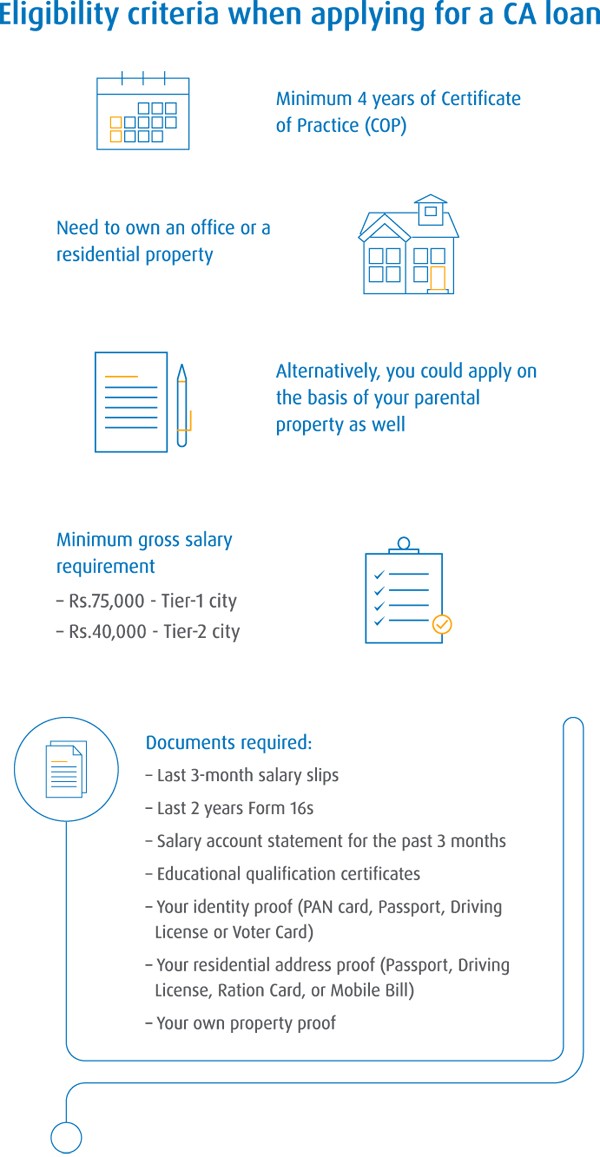

Exactly what do I have to make an application for a reduced Doctor Household Mortgage?

Our very own pro brokers can make suggestions from lower doctor house loan process, and that means you won't need to worry! We shall restrict the best lowest doc home loan costs and loan providers appropriate into app!

- Your own Australian Business Number (ABN)

- Company Hobby Comments (BAS)

- Financial statements

- Money Statement Setting

You'll need their Australian Team Matter plus Organization Hobby Comments. Such standards can be easy for one locate and have current passion. You will also you would like latest lender statements.

You happen to be necessary to done a living Declaration Mode to possess a lender to ensure your earnings. An income Statement Mode are a home-confirmation one to asks one sign that most guidance integrated was correct and you will particular. It also asks that make sure you could potentially meet with the money.

Certain lenders could possibly get consult an explanation page from your Accountant, as well as GST registration info. However, these standards differ according to financial, and it will getting confusing to know what for each and every bank desires!

Either described as alt doc lenders, lower doctor home loans also provide the key to your perfect domestic! Why decrease applying for your property mortgage if there's a beneficial primary choice for at this point you?!

Who'll submit an application for a decreased Doctor Mortgage?

A minimal doc financial try tailored for the care about-employed elite group. Yet not, it is also a great choice getting bargain professionals and personnel who work casually otherwise unconventionally! Continua a leggere "Exactly what do I have to make an application for a reduced Doctor Household Mortgage?"

Should you Use Costco to locate a home loan?

- Nevertheless they carry out provide some special positives getting Costco participants

Costco players enter in its personal statistics, along with assets and financing recommendations, and are generally next offered numerous home loan speed rates of CrossCountry Financial or other affiliates.

In terms of money choices, Costco has nothing regarding what's and actually given. They don't put the minimum down payment or get involved with some other underwriting guidance.

The same goes to own home loan cost Costco will not put all of them or provides almost anything to do using them, but they state they have been competitive.

Costco Mortgage lender Costs Try Capped

- Costco will bring quicker bank fees for its players

- Which includes things like app, underwriting, and you can control

- Although not third-class costs such appraisal and label/escrow charges

- Executive participants only pay financial costs regarding $350 or shorter

- Gold-star professionals spend bank charge out-of $650 or reduced

You to in addition to for the system would be the fact lender charges is capped having Costco professionals, that have Manager Participants expenses $350 or quicker and you will Gold-star People paying $650 or reduced.

Continua a leggere "Should you Use Costco to locate a home loan?"

He's got complete you to financing together and will also be closing on the an additional home loan together with them soon

Far more human than any lender We have dealt with

We come my personal home buying experience we where told through of numerous home loan people we had to wait 3 years. We had been informed three years due to a personal bankruptcy. We receive Danielle French during the blue-water home loan. She informed us the outcome we are able to score a mortgage dos many years away. She was able to respond to our very own issues. She is actually available throughout the day. I performed score an excellent rate of interest. I plus unearthed that people who do work trailing Danielle was in addition to of use. I've already known nearest and dearest in order to Danielle. We have been within our brand new home since the November.

They were wonderful to work alongside. We recommend all of them. Besides was basically it able to get me an educated/reasonable rates effortlessly nevertheless they work very quickly so you're able to emails. They generated the entire processes as worry totally free that one can.

Coping with Blue water Financial Corp was a feel. My wife and i couldn't getting delighted on the process. Continua a leggere "He’s got complete you to financing together and will also be closing on the an additional home loan together with them soon"

Down rates of interest makes resource mortgage brokers economical across the Wyoming

Homeowners whom may want to list their houses have probably avoided doing so in recent years, since of many with an intention rates of 4% would not like to finance a separate mortgage within eight%

SHERIDAN - Down rates of interest may help customers along side condition qualify for lenders, but sensible mortgages are just an individual cause for easing a homes crisis within the Wyoming triggered generally from the reasonable supply.

Towards Sept. 18 , brand new Government Put aside revealed it might down rates by the 50 % of a share point, mode the target variety so you can 4.75% so you can 5%. Rates toward mortgage loans started initially to fall before the brand new announcement.

All the way down borrowing charges for homebuyers, specific say, can result in an increase when you look at the consumers that happen to be shopping for homes. The latest across the country homes drama has been, inside higher part, passionate by deficiencies in property likewise have, and you can increasing the number of consumers in the business you certainly will head to another demand for a currently-restricted way to obtain homes.

, settee of your Government Set-aside , described the fresh flow because an excellent "calibration" of your main bank's coverage in the place of a sign of issues in regards to the labor market's health. Continua a leggere "Down rates of interest makes resource mortgage brokers economical across the Wyoming"

Indiana is actually positioning alone since a nationwide commander for the clean time, driving economic growth compliment of imaginative projects and you can high expenditures

"We simply cannot be reassured that the text of one's rules commonly end up being precisely enforced," Freese argued. "Which is extremely distressing once the discover gonna be an excellent significant tension to try to deteriorate it law."

She recommended pressure does not avoid with last week's ps" getting resources not able to meet the simple if brush-opportunity technologies are very costly otherwise hamper grid precision. Continua a leggere "Indiana is actually positioning alone since a nationwide commander for the clean time, driving economic growth compliment of imaginative projects and you can high expenditures"

What's the top-piece of recommendations you'll give to basic-time homebuyers when you look at the 2024's next one-fourth?

The modern housing marketplace is not coping united states an effective submit regards to directory. Of a lot local areas are receiving sandwich a couple day catalog membership one to make they very hard to own active homeowners to track down the proper family.' Incase they are doing, the audience is nevertheless experience competitive facts with limited backup options accepted towards the deals.

Boniakowski: We indicates first-go out consumers to target its specific budget and requirements alternatively than external items, including mortgage rates. Carrying out a resources to have an initial house are daunting, therefore i suggest you start with the fresh rule - paying no more than twenty eight% of the monthly earnings into housing, and no more thirty six% to your expenses. Financial calculators are helpful having imagining what those individuals will cost you feel like - even if earliest-big date customers must remember to cause of potential closing costs, costs, representative earnings, and you can any fixes that need to be dealt with blog post-personal.

DiBugnara: Mortgage rates appear to be air conditioning installment loans in Milwaukee which will lead to enhanced competition and you may it is possible to rising home values. It is vital to understand what you really can afford and you will adhere a resources. Including, there's no real cure for give just how long financial rates will stay reduced or if perhaps they'll arrive. Has a payment you are comfortable with and you can heed that regardless of the cost of the house otherwise level of home loan cost. Continua a leggere "What’s the top-piece of recommendations you’ll give to basic-time homebuyers when you look at the 2024’s next one-fourth?"