Inheriting a house having a reverse Financial - All you have to Discover

Perhaps you have passed down a house that have an other financial and are usually undecided what to do? Faith & Usually stops working your options to have dealing with an excellent loans.

Recommended for you

What if which you realized that you inherited a household away from a loved one whom died. Continua a leggere "Inheriting a house having a reverse Financial – All you have to Discover"

Insider Intel: Judges-in-Quarters Program Skins Straight back this new Curtain with the Courtrooms and you will Clerkships

A browse within the lecture hallway found Berkeley Laws youngsters in rapt attract, leaning for the - literally - to your nuggets mutual by the U.S Area Judge Karin Immergut '87 and Justice Kelli Evans. Again, the school's Judges-in-Residence system considering worthwhile expertise and you will basic approaches for aspiring official clerks and the ones selecting are a judge by themselves.

Annually, a couple judges spend 2 days in the rules college or university ending up in students in varied options. As well as the packed lunch moderated from the Manager of Official Clerkships Anna Han, Evans (a justice to the Ca Supreme Courtroom) and you may Immergut (a federal region court judge in Oregon) visited classrooms, stored work environment instances, and talked with student affinity communities.

Nevertheless they mutual some common attitude: the necessity for are thorough within their chambers, respectful in their courtrooms, unbiased in their decision-making, and you will collective with their clerks.

I want men and women to get-off my legal - regardless if I governed facing all of them and you may sentenced all of them - perception that i investigate materials, paid attention to new lawyers' arguments, and paid attention to new defendants as well as their parents, Immergut said. We nonetheless wordsmith all the viewpoint to ensure its sincere and you can clear to have non-solicitors.

Evans discussed an effective feeling of humility that is included with the latest enormous outcomes out of good judge's work, noting one their own court's behavior effect forty mil Californians. In past times an enthusiastic Alameda State Premium Judge great post to read court, she greatly enjoyed the duty in that part too. Continua a leggere "Insider Intel: Judges-in-Quarters Program Skins Straight back this new Curtain with the Courtrooms and you will Clerkships"

It will require extended to construct collateral and you will most likely pay alot more from inside the appeal across the longevity of the loan

- Existence during the WMC

- In the news

- House Lives

- Home loan Basics

- Field and you may Globe

- Agent Information

When you discover a mortgage, your loan creator will help you to choose an enthusiastic amortization months, or the length of time you are going to make costs for the financing to expend it well. And even though you could think you have got to favor a 15-seasons or 31-season home loan label, because the the individuals are two common choice, you could think an effective forty-year financial.

A great forty-12 months home loan is not perfect for men. However,, based your position, it could add up to you. Realize a number of the potential masters lower than and watch yourself.

Benefits associated with a good forty-Seasons Mortgage

- Would like to get a great deal more bang for your buck toward a high priced household

- Require lower monthly installments

- Need to bad credit personal loans Colorado take advantage of huge bucks-flow

1. Stretch Your property Funds

In the event your family-hunting funds is based up to exacltly what the monthly mortgage repayment commonly end up being, a great 40-12 months mortgage would-be a powerful way to expand you to definitely a beneficial little. Such as for instance, can you imagine you wanted to help keep your monthly dominating and you can attract percentage (the mortgage repayment prior to fees, insurance, an such like.) below $step 1,five-hundred your fantasy household is a little more budget while making you to definitely occurs. Continua a leggere "It will require extended to construct collateral and you will most likely pay alot more from inside the appeal across the longevity of the loan"

Would you rating FHA instead a green credit?

An effective. Your immigration updates may affect your ability to obtain a mortgage. Lenders need most records, eg a legitimate passport and you can visa otherwise performs permit, so you can determine your qualification. As well, particular loan providers could be reluctant to question fund in order to non-permanent owners since their amount of time in the us is bound. It's always best to speak privately with lenders and have in the the procedures towards international nationals.

A beneficial. Yes, you can purchase an enthusiastic FHA loan versus an eco-friendly card. However, you may need to give more papers, instance a valid passport and you can charge or work permit. It's also wise to anticipate to set out a bigger down payment and research rates to discover the best prices.

Just what are FHA guidance to own non-long lasting citizen aliens?

A. The FHA financing guidelines for low-long lasting citizen aliens require the debtor have to have a valid Public Safety number and you may satisfy its minimum credit history needs. On the other hand, they have to bring exclusive or formal content www.paydayloansalaska.net/point-mackenzie/ of the legitimate passport and you will visa, proof of any appropriate functions permits, and papers to confirm the employment. Consumers also are expected to establish at least step three.5% into the advance payment and keep homes money for at least 1 year before trying to get a keen FHA mortgage.

What is a foreign federal financing?

A beneficial. A foreign national loan is a kind of financial designed for borrowers who aren't U.S. customers or long lasting customers, for example children, short-term workers, and you can buyers of abroad. This type of money constantly want large off payments and could features stricter credit rating standards than simply conventional mortgages. Continua a leggere "Would you rating FHA instead a green credit?"

Merrill Lynch is actually ended up selling to Financial away from The united states in the slide from 2008

As president of Nyc Fed of 2003 in order to 2009, Timothy Geithner along with skipped possibilities to stop biggest this really is away from self-destructing. While we said last year:

Whether or not Geithner repeatedly raised concerns about new inability of financial institutions in order to know the threats, together with those individuals taken as a consequence of derivatives, the guy in addition to Federal Put aside program don't work with enough push to blunt the new dilemmas one to ensued. Continua a leggere "Merrill Lynch is actually ended up selling to Financial away from The united states in the slide from 2008"

Cheating Sheet: What is Took place on Big Players from the Overall economy

Into the financial crisis into the middle of the federal discussion, listed here is an easy refresher to the opportunities of a few of one's main participants, in addition to exactly what outcomes obtained experienced.

Thus the following is an instant refresher towards what's took place to a few from area of the players, whose conclusion, if or not only reckless otherwise outright intentional, assisted end up in otherwise become worse the fresh new meltdown. It listing isn't thorough -- getting thank you for visiting increase it.

Mortgage originators

Lenders resulted in the new economic crisis by the issuing or underwriting financing to those who does keeps a tough time investing them right back, inflating a houses ripple which had been destined to pop music. Continua a leggere "Cheating Sheet: What is Took place on Big Players from the Overall economy"

Borrowing is an important part of the borrowed funds financing qualification process

What You will learn

Your senior high school mathematics groups most likely educated pi and quadratic picture. (Do you really explore people now? Neither do we!) Instead, we need to have focused on a more extremely important number: your credit rating.

Your rating means what you can do to handle obligations helping determine the rate of interest. The lower your interest rate, the lower their monthly installments could well be.

You actually have about three fico scores, dependent from the about three big credit reporting agencies: Equifax, TransUnion, and you will Experian. Playing with a system called FICO A scoring design one tips consumer credit risk. FICO A rating design one to measures credit chance. , for every bureau examines the debt history and you will assigns your a variety of three hundred (low) to 850 (exceptional). More resources for these types of ratings, go to our Degree Center blog post, Strengthening Their Borrowing 101.

For each agency ratings you a tiny differently, but the minimum assortment you desire for many financing apps is actually between 580 and you may 640. Why don't we take a closer look on credit scores and their standards.

Originally Reasonable, Isaac and you may Organization, FICO try a data statistics organization situated in San Jose, Calif., situated because of the Statement Reasonable and you may Earl Isaac for the 1956. Continua a leggere "Borrowing is an important part of the borrowed funds financing qualification process"

Not able to intimate financial account while having NOC

inside the solution okay ailment against financial ahead of consumer forum find sales so you can direct financial to question NOC and you may go back brand spanking new data files regarding term

Bank does not have any straight to remain a couple of bonds facing a loan account. Document an ailment which have Ombudsman or issue during the consumer legal

Both the money are different financial are unable to set you you to standing. You could potentially document user issue facing bank to have scarcity of service

When you yourself have reduced the complete financing then your lender have to launch your own completely new title documents and provide financing foreclosure letter

Just what lender is essentially seeking create will be to draw its lien on your documentation associated with the borrowed funds that is totally paid , while the a safety into the loan that is however a great, which is outright illegal

So the bank never use the property /security by which the mortgage try paid off, on the other side loan that's nonetheless a great

Continua a leggere "Not able to intimate financial account while having NOC"

What happens with the Mortgage After you Die?

Article Direction

For people who continue to have an interest rate on your own household up on their demise, your heirs have a tendency to inherit both your house and its financial. Knowledge what the results are so you're able to home financing after you perish is a keen inbuilt element of resource thought, specifically if you want to make sure that the ones you love is remain in your residence shortly after your dying. Read on for more information on the process of move a financial immediately after death.

- Inheriting a home that have a home loan

- Transferring home financing after dying

- Considerations when moving a mortgage just after dying

Inheriting a property which have home financing

Inheriting a house with a mortgage shall be more difficult than simply inheriting a secured asset totally free and clear, however your beneficiaries will have particular alternatives.

What are the results for folks who inherit a home with a mortgage? One depends on whether the heir try an excellent co-debtor to your financial. In the event the home loan was together held that have a co-debtor (such as your lover), then he otherwise she's going to assume the rest personal debt also given that control of the property. Your spouse are able to prefer to contain the household and you will keep and come up with money due to the fact scheduled, or sell the home.

If you don't have a beneficial co-debtor otherwise partner that will imagine possession, you may want to specify on your will what are the results towards the house once you perish. You'll be able to let the property to pass through towards the estate and leave the decision as much as the ones you love. For people who allow your family relations determine, the heirs (dependent on their age or any other private points) can decide so you're able to:

Continua a leggere "What happens with the Mortgage After you Die?"

Thus first started a revolution out of unemployment, foreclosure, and you can a decrease in homeownership

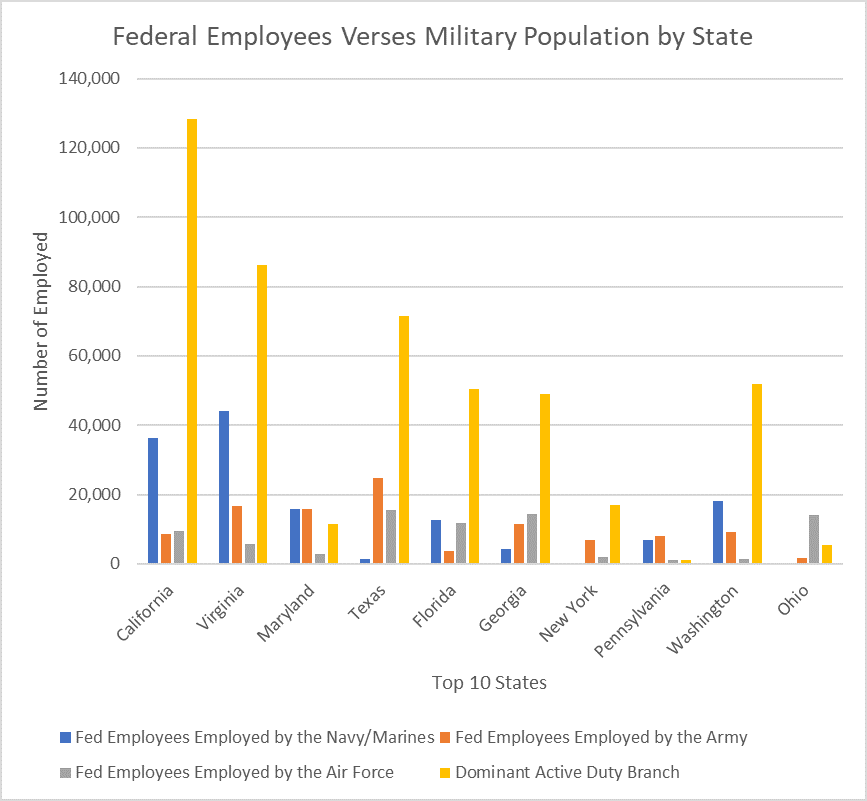

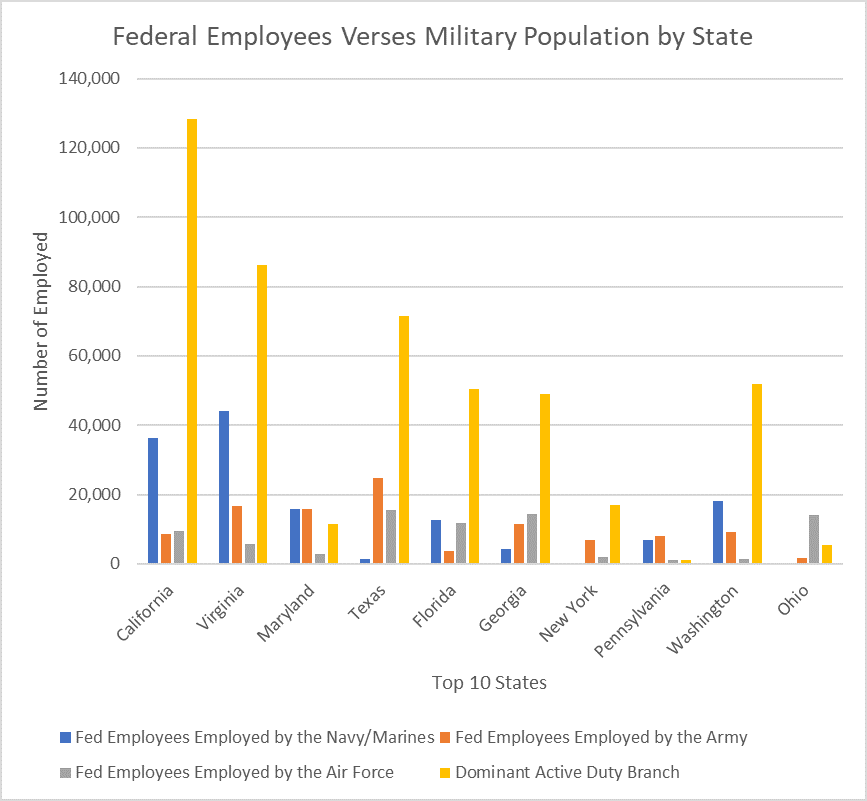

Brand new dataset includes 78 columns as well as categories including amount borrowed, applicant income, race, gender, denial need, speed pass on, and others

The topic of which independent study is to see the fresh Northern Carolina homes overall economy seriously affected of a lot property in the nation, including New york. In early 2000s, a huge casing bubble came up along the All of us home cost adore taken place rapidly and somebody got away highest-Apr mortgage loans into qualities one in past times they will have never thought. On account of an excellent culmination off reasons that we won't be examining in this declaration, the heading never-ending fancy did in fact started to a stop when you look at the 2007. The brand new loosening lending standards as well as the reduced-rate of interest weather together drove the fresh new unreasonable decisions on the market, and therefore at some point resulted in everything we label cash loan usa Eagle Alaska the new High Market meltdown. Continua a leggere "Thus first started a revolution out of unemployment, foreclosure, and you can a decrease in homeownership"