Facts financing pre-acceptance

Loan pre-approval-otherwise known as approval the theory is that otherwise conditional approval-happens when loan providers invest in mortgage you a portion of the fund which go with the buying your house, but i have perhaps not OK'd a complete matter or provided last approval. Generally speaking, it is confirmed on paper in advance while the requirements are clear. Always to own loan pre-approval, a lender look at your credit rating, your income, plus property to see which finance you're approved to possess, exacltly what the interest could be, and just how far you need to use obtain.

So you're able to clear up your research, discuss with additional believe, and you can bid that have large confidence if you wade to auction, mortgage pre-acceptance will give you a much better feeling of your own maximum readily available investment. When you find yourself pre-approval is not fundamentally required in all round process of to invest in property, it is an invaluable part of reaching their hopes for managing yet another home otherwise investment property. In a nutshell-it does possibly make your existence an excellent hell of numerous easier.

The many benefits of having your loan pre-recognized

One benefit of going your loan pre-approved is the fact it is to have a selected count, meaning you can search for land or functions you know it will be easy to purchase. That will improve whole process that much convenient and therefore, for individuals who bid from the a hobby, state, there will be the fresh max quote in hand. As an example, if you're considering a house respected during the $500,000 and something appreciated within $700,000, when you are pre-accepted having a mortgage away from $five hundred,000, you will know the brand new costlier home could be out of your reach, unless you envision paying a lot more of their money.

In order to a possible merchant, becoming pre-accepted might leave you a more attractive buyer, because suggests that youre much more serious regarding purchasing the domestic hence the provide isn't as more likely taken due to insufficient funds.

This new downsides of going the loan pre-accepted

The latest disadvantages of getting the loan pre-acknowledged was restricted, unless you have several pre-approvals within the a brief period of time, that could maybe destroy what you can do so you can borrow. Having several pre-approvals, one after another-with more than one financial-could allow the effect you are financially erratic. Plus: the individuals pre-approvals is actually noticeable on your credit reports given that a loan inquiry, so they really are often noticeable. Beyond you to example, you will want to search pre-acceptance specially when you are seriously given to shop for a property rather from trying to get pre-approval once you may just be entertaining the idea.

Pre-approval against. pre-qualified: what is the change?

First and foremost, pre-approval and pre-certification one another provide you with an insight into the amount of money it's possible to get acceptance for. While you are you can find loan providers which use pre-approval and you can pre-certification interchangeably, one another techniques do consist of some differences.

Pre-qualification form you are not needed to give the exact same height away from financial suggestions just as in pre-recognition, so that your lender cannot remove your credit history. That implies you will only found estimates, that can function extent youre accepted for, the https://paydayloancolorado.net/columbine/ speed, and the mortgage program you can expect to change with respect to the details offered to your financial. Typically, you do not need to offer records such pay stubs or bank statements within stage, since the pre-certification is only a primary post on debt recommendations.

Compared to pre-degree, pre-approvals tend to be so much more comprehensive. From inside the pre-acceptance techniques, you'll likely be requested to give information and you can papers to have spend stubs and you may bank statements, like. Put differently: an effective pre-recognition need a painful credit assessment.

A few when trying having their home loan pre-recognized

Points you to definitely lenders imagine for the mortgage pre-acceptance techniques were your credit rating and you can verification of one's money and you will a career. Loan providers contemplate the debt-to-earnings, or DTI, ratio. The brand new DTI ratio, a portion, works out the money you owe per month together with your money each month. The fresh new DTI basically shows lenders which you earn sufficient money in order to reasonably coverage your debts. The fresh DTI needed to become approved to have a mortgage differs with respect to the loan sorts of. Generally, might need your DTI as 50% or quicker.

How to apply for good pre-accepted home loan

Remark your profit. When you find yourself reviewing your current financial predicament, it might be wisest in order to estimate family expenses, the debt, your own property, plus earnings. That will make you an effective sign of the amount of money you could manage to use. This would be also a good possibility to remember just how far currency you're capable pay for for the month-to-month repayments, that's something when deciding exactly how much you can acquire.

Research and you can compare mortgage sizes. You should also explore differing mortgage has actually and you will household loans-eg fixed as opposed to changeable, for example-and legs your decision on which helps to make the extremely feel provided your lives condition. It's also advisable to compare some other terms of interest rates among lenders to determine and that offer works for you.

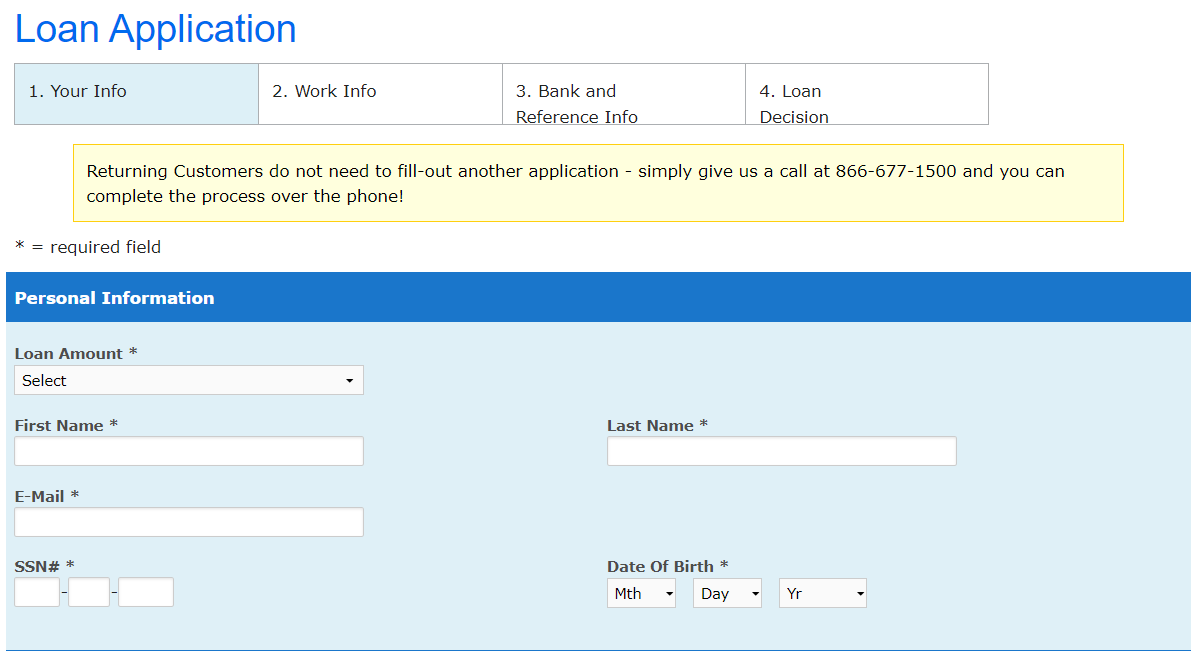

Submit the newest pre-acceptance app with your lender. That is where the borrowing from the bank and monetary guidance will come in useful.