- coverage and you will stability

- cashflow

- tax professionals

- long-identity investment

step one. Defense and you can balances

Properties are in consult, just like the men need a spot to real time. While the housing industry was notorious for its activity, its smaller impacted by sector changes which will be gonna render repaired returnspared some other brand of expenditures, a home is more safe and you may stable.

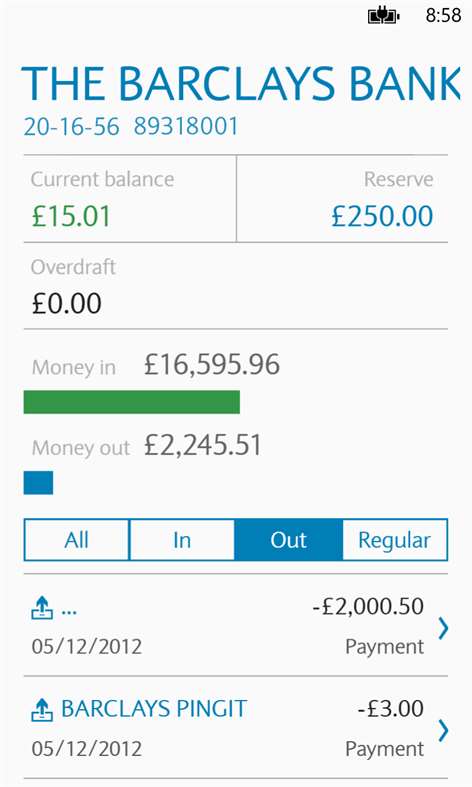

dos. Cashflow

Discover a leading demand for houses, which means an investment property provides you with good steady stream away from couch potato earnings. This really is guaranteed in the event your local rental earnings exceeds their monthly payments and restoration will cost you. It's also possible to utilize this income to settle the loan pricing to suit your investment property.

3. Taxation experts

You are able to appreciate taxation deductions that enable you to optimize your income tax get back on assets. Any expenses which you bear every day-to-big date operation of your own leasing possessions is going to be claimed against your own earnings. This can then decrease your taxation over time.

4. Long-title capital

In the long run, the value of their investment is raise. An equivalent holds true for the rental earnings in case your possessions is actually a leading-yield urban area. Your hard earned money circulate should also raise. Subsequently, you should use this type of most fund to enhance disregard the profile.

Downsides away from financial support qualities

When you find yourself discover apparent advantages to money services, there are also particular drawbacks. We have found an easy glance at the cons regarding resource characteristics:

- liquidity affairs

- entry can cost you

- constant will set you back

- hard tenants

1. Liquidity affairs

Anyway, americash loans Central City it requires longer to market property. When you have an immediate requirement for cash, such an urgent situation, you will have a difficult day cashing for the on your invested interest.

2. Entry costs

New big financing expected is among the greatest pressures to own anybody who would like to go into the latest investment property game. This new deposit alone could cost a fortune. After paying new entryway can cost you, additionally, you will need to plan the fresh new costly money spent mortgage pricing.

step 3. Constant can cost you

By higher costs with it, committing to a residential property means a number of planning. Besides the money spent home loan rates, getting a house can cost you these costs throughout the years:

- council costs

Therefore, forget the means is always to create extra money from your possessions than simply any constant costs combined.

cuatro. Hard tenants

For those who have difficult renters, it can be a nightmare. Capable result in mental be concerned, as well as their measures may even produce monetary loss. This is especially valid should your occupant will not pay-rent or reasons injury to the home.

An average down-payment towards an investment property are ranging from 20% so you can 25%. But not, it can also be prominent having loan providers to require a 30% down payment. To the a confident mention, there are many financing software that offer investment property resource which have a down payment only fifteen%.

The possibility quantity of risk toward bank develops when your borrower can make an inferior down-payment, and therefore escalates the loan-to-worthy of (LTV) proportion. A smaller downpayment reduces the chance for this new borrower and you can boosts the lender's chance. This basically means, the debtor can be more prepared to walk away regarding the money if it underperforms.

To pay the financial institution when planning on taking more chance, investment property funds with a high LTV proportion always incorporate high interest levels and you may huge mortgage fees. Understand how much cash off a down-payment you need to acquire an investment property by seeing that it clip: