We nterest-simply mortgages is going to be a good financial option in a number of items. An attraction-only mortgage comes with keep costs down for a preliminary duration (constantly around 5 years). This may accommodate deeper autonomy and also make most other expenditures with your bank account, or even ease pressure out of payments regarding several months. But not, from the delaying money of one's equilibrium owing into financial, an attraction-just mortgage boasts specific dangers.

- What exactly is a destination-just mortgage? and you may

- How does an attraction-merely home loan works?

We'll including go through the head positives and you may risks of an appeal-only mortgage, contrasting they so you're able to a fundamental mortgage.

What's an attraction-Just Financial?

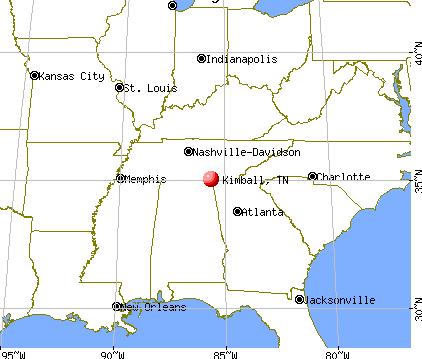

A standard mortgage can often https://paydayloanalabama.com/hokes-bluff/ be titled good prominent and you may interest household loan'. Thus your obtain a certain amount of funds from a lender - the principal - along with to invest this straight back more than an agreed-up on go out, and additionally attract.

An attraction-only financial was a home loan the place you only pay right back the eye toward financing. This means that the bill of financing continues to be the exact same. The bill owing then must be reduced following desire-merely financing has ended.

How does an attraction-Only Mortgage Really works?

An attraction-only financing will have a predetermined stage, typically of up to 5 years. Additionally include a separate (will high) interest so you're able to an interest rate applied when financing money try also becoming made.

Lenders will promote focus-just financing within a much bigger mortgage framework. Like, Higher Bank lets people to incorporate notice-simply fund as high as 5 years into the much of the mortgage products which has actually a whole loan label off upto 3 decades. The best, Higher Rate, Money Best, and you may Capital High Price mortgage brokers every feature the possibility off an attraction-only age between step one and 5 years.

During the an interest-only label, you will simply be required to make repayments for the focus getting accumulated contrary to the financing. Since you will not be making costs against the principal in itself, the loan repayments is smaller than during the a simple prominent and you can notice financing.

At the conclusion of the interest-merely term, the mortgage will need to be transformed in order to a simple dominant and you may appeal mortgage. Now, you may be expected to start making money up against the dominating alone. Another type of financing label and you will interest may also apply.

Advantages of a destination-Only Home loan

The original and most apparent advantage of an attraction-simply financial would be the fact money would be dramatically reduced throughout the short term. This might be a useful feature when you find yourself in a position to generate successful assets during the attention-merely title.

For people who might not be able to build costs for a primary months, an attraction-merely financing may also be helpful to relieve new short-identity pressure of one's mortgage. This is certainly such helpful in symptoms regarding low income (elizabeth.g. bringing time away from try to improve pupils) or more expenditure (age.grams. support a centered relative).

An attraction-simply mortgage can be useful whenever highest gains is anticipated on the market. An interest-just financing enables people to invest in functions which have relatively lower lingering costs, ahead of attempting to sell once a preliminary turnaround to own a large cash. | Greater Financial

In case the property facing that your mortgage is drawn try an money spent, the eye payments is entirely otherwise partly tax-deductible. Because of it are the way it is, you need to be renting the house out, otherwise have it accessible to book.

Risks and you can Disadvantages off an appeal-Only Home loan

The original and more than visible disadvantage from an interest-just mortgage is the fact that the loan will surely cost a lot more on the lasting. Since you are not while making money up against the mortgage alone, what kind of cash you borrowed the bank does not disappear at all in attract 100 % free several months. It indicates you'll spend a heightened level of full focus over the life of the mortgage. Furthermore, the latest costs for Intrest Only financing are normally quite highest.

An associated chance of the borrowed funds amount leftover an identical is actually that you are required to build high costs than just you are acclimatized to using once the notice-only several months is finished. Of a lot borrowers find it difficult to to evolve out of desire-merely costs so you can mortgage costs plus attract. This can be particularly the case if the borrowers haven't used their offered loans and also make a beneficial investment within the desire-simply period.

A lot more threats could happen if your property sector does not act while the borrower anticipates. If the property value the home doesn't boost affirmed - or if perhaps it depreciates - then it's likely that the latest debtor could be leftover which have a loan they aren't capable pay back. And, if your value of the loan is higher than the significance of the property at the conclusion of the attention-just period, it can be difficult to refinance. When the offering the house, it could should be done at a loss.

It is also high-risk for taking a destination-merely financing if your finances do perhaps not develop since you assume. Often consumers usually choose a destination-simply loan, believing that they are going to safer functions, otherwise you to definitely the money have a tendency to increase significantly. In the event the high unanticipated will cost you arise in your life, or costs that you consider was basically short-term dont disappear completely, it can be very hard to handle the mortgage after the attention-only several months has ended.

Try a destination-Just Home loan Suitable for Me personally?

Interest-only money could be extremely useful in particular points, however they are not befitting someone. So you can remove an appeal-simply mortgage, just be sure if you will be capable begin making big money in the event that focus-simply months stops. Just be yes regarding the monetary mind-set with the years to come, and the mind-set towards the property value your home. Be sure so that it is possible to make the fresh every attract-simply period, which means saving and you may expenses your money rightly, and preparing oneself financially to possess when mortgage repayments begin.