To the Fixed and you can Deferred Cost Possibilities, the interest rate exceeds to the Attention Cost Alternative and you may Outstanding Interest was put in brand new loan's Current Dominating during the the termination of brand new sophistication/breakup several months

footnote 4. Considering a comparison of your percentage of college students have been accepted the Sallie Mae mortgage that have an effective cosigner towards the percentage of people have been recognized without a cosigner away from .

footnote 6. For applications submitted straight to Sallie Mae, loan amount try not to go beyond the cost of attendance less financial aid acquired, once the certified of the college or university. Applications published to Sallie Mae because of a partner webpages ount. Miscellaneous individual expenses (particularly a laptop) can be within the price of attendance for students enrolled at least 50 % of-time.

footnote 7. College students need to get a unique financing for each and every school year. It acceptance percentage lies in student and graduate youngsters just who have been recognized to possess a beneficial Sallie Mae mortgage with an effective cosigner in the school seasons and was indeed acknowledged for the next Sallie Mae loan after they returned with similar or the fresh new cosigner inside . It will not through the rejected applications away from college students who were in the course of time acknowledged in the .

footnote 8. New FICO Score wanted to your 's the FICO Score 8 considering TransUnion analysis. FICO Ratings and you can relevant academic content are offered solely for your own personel non-commercial individual review, use and you will work for. So it work for may alter or end in the near future. FICO try a subscribed trademark of one's Reasonable Isaac Corporation throughout the Us or any other regions.

footnote nine. Brand new borrower otherwise cosigner must enroll in car debit because of Sallie Mae to get a great 0.twenty-five payment part rate of interest prevention benefit. So it benefit is applicable simply throughout active fees for as long as the modern Number Owed or Designated Amount is actually effectively taken of new licensed bank account each month. It can be suspended throughout forbearance or deferment.

footnote 10. GRP allows desire-simply payments into the 1st a dozen-month age of fees if loan carry out generally begin demanding full dominant and attract repayments otherwise into the several-week several months after GRP demand was supplied, whichever was afterwards. During the time of GRP request, the mortgage have to be latest. The debtor could possibly get demand GRP just for the half a dozen asking episodes instantaneously before as well as the several billing periods just after the loan carry out normally begin demanding complete dominant and you may focus money. GRP cannot increase the borrowed funds term. In the event that acknowledged getting GRP, the modern Count Due that is required as paid for every month pursuing the GRP finishes was higher than they otherwise could have been rather than GRP, as well as the total mortgage prices increase.

Individuals and cosigners having a readily available FICO Get and an effective Sallie Mae-maintained financing having a recently available equilibrium greater than $0, may receive the get monthly following the very first loan disbursement

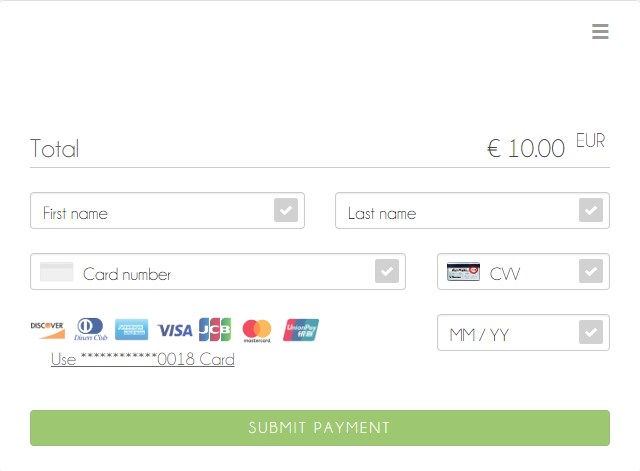

footnote eleven. Stated APRs having Scholar School Financing, MBA Money, and you may Graduate College Mortgage having Health Disciplines guess a good $10,000 loan having a two-seasons in the-school several months. Rates of interest to possess adjustable speed fund will get boost or disappear more the life span of one's loan predicated on change to the 30-date Mediocre Secured At once Resource Rate (SOFR) game up to new nearest one-8th of a single %. Said adjustable prices would be the performing a number of rates and could are different away from that assortment across the lifetime of the mortgage. Interest are charged creating when loans are taken to the school. To get a great 0.twenty five percentage part interest disregard, the brand new debtor or cosigner have to enroll in vehicles debit owing to Sallie Mae. Brand new dismiss is applicable simply through the effective installment as long as the current Count Owed otherwise Designated Matter are efficiently withdrawn regarding the brand new registered family savings per month. It could be suspended during forbearance or deferment.

You can find university finance designed for people for the student loans Cannondale CT, graduate, certificate, dental care, medical, and you can health specialities programs. Sallie Mae has the benefit of student education loans getting graduates training into the pub examination or moving in for scientific and dental care residencies.

footnote 3. Said APRs to own job training people assume an effective $10,000 mortgage in order to students whom attends school for a couple of age and has zero previous Sallie Mae-serviced loans. Interest levels getting changeable rate money get increase otherwise disappear over the life span of your mortgage according to alter for the 29-big date Mediocre Protected Right away Capital Rates (SOFR) game up to the brand new nearest one to-eighth of one per cent. Reported varying pricing are the performing list of pricing and may even differ beyond you to diversity across the life of the borrowed funds. Attract is actually billed creating whenever money was delivered to the institution. For good 0.25 payment area interest rate write off, the new debtor or cosigner must enroll in automobile debit thanks to Sallie Mae. The brand new dismiss is applicable just while in the effective repayment so long as the modern Matter Due or Designated Amount was successfully withdrawn out-of the fresh registered bank account each month. It may be suspended throughout the forbearance or deferment.