Navigating new Virtual assistant mortgage pre recognition process is going to be a serious action towards homeownership having pros and you will energetic military users. This step not simply demonstrates your maturity buying a property, however, an excellent Virtual assistant mortgage pre acceptance reveals potential manufacturers the fresh new validity of your provide within the an aggressive field.

Secret Takeaways

- The new Virtual assistant mortgage pre approval techniques is a collaborative energy anywhere between this new You.S. Department out of Experts Things and you can Virtual assistant-accepted personal lenders.

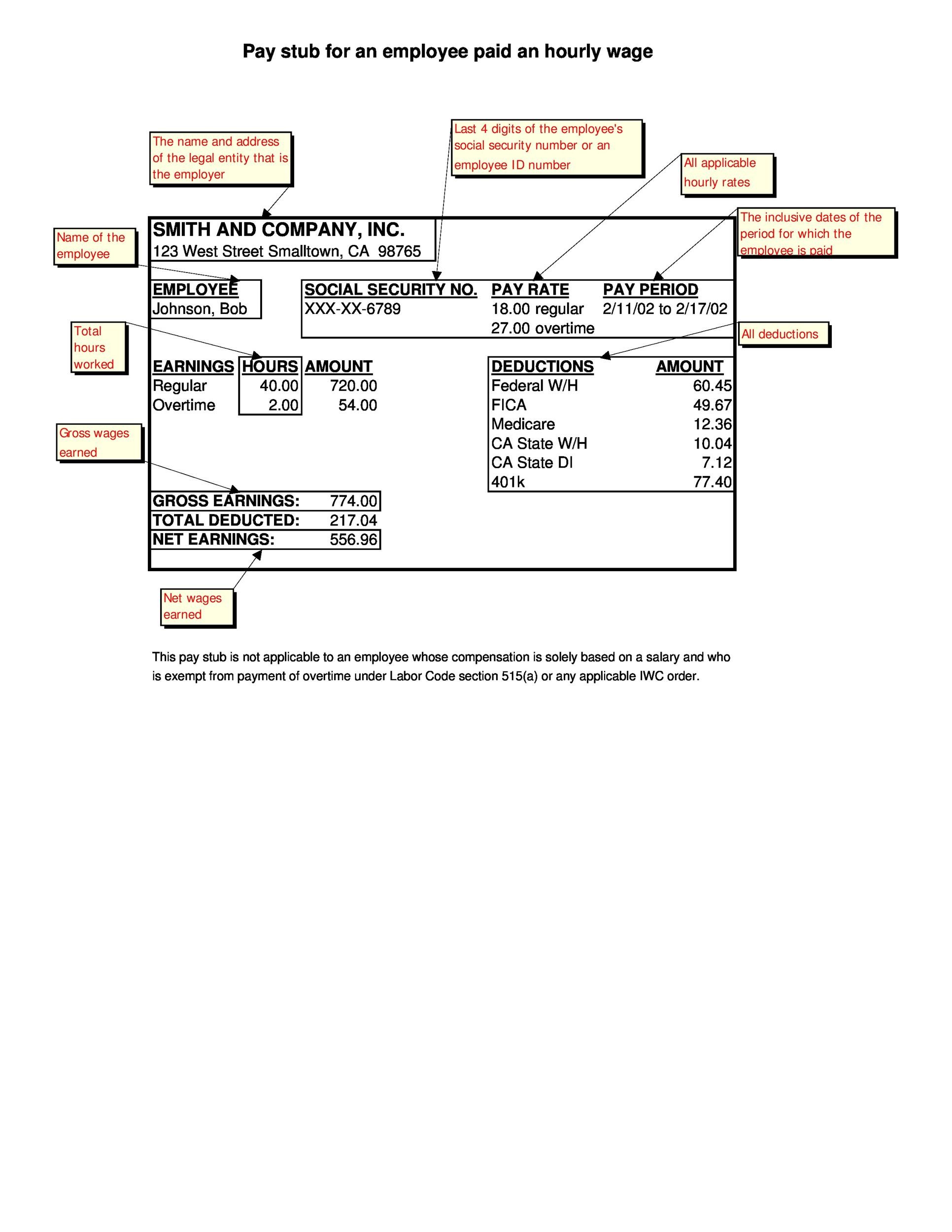

- Essential data files through the Certificate off Qualifications (COE) and you will, getting energetic-obligations service players, an active Responsibility Declaration regarding Service.

- Just the right private bank, experienced in the fresh Virtual assistant mortgage process, is an essential part regarding securing good Va loan. The process concerns entry an intensive number of documents to the financial to have testing of the funds.

- Home to own Heroes facilitate energetic obligations and veterans who are navigating new Virtual assistant financing plus the real estate procedure, and you will saves them an average of $step three,000 immediately after closure. Sign-up and you can a person in the group have a tendency to contact you to choose just how to most readily useful last. There isn't any obligations.

What's the Virtual assistant Mortgage Pre Acceptance Processes, and how Will it Really works?

The fresh Virtual assistant financing pre recognition process is a good preparatory action having veterans and you can military players in order to secure a mortgage. Owing to a mixture of Va service and personal financial reviews, this action comes to acquiring a certificate from Qualifications, selecting the right bank, and you will building expected records getting financing acceptance. Not merely does it pave the way in which for a smoother domestic to get trip, but inaddition it ranks your since a critical client within the aggressive avenues.

While you are attempting to rating a beneficial Va home loan pre recognition, its advisable that you know that you really need to improve into two fronts. The latest Virtual assistant mortgage experience a group energy 500 dollar loan today within You.S. Company off Pros Situations and you can good Virtual assistant-recognized private bank. On one hand there is the Va loan system, who insures and you may guarantees your loan. The fresh new Va will not situation the loan. It stand behind you and tell you the private lender which you are a good chance having home financing. It's sometime including which have an effective cosigner in your loan, but stronger.

The personal bank, lender otherwise mortgage broker does a lot of the heavy lifting inside procedure. They actually provide the loan, pre agree you with the financing, and you can provider the loan for another thirty years (or 15, dependent on your mortgage). Occasionally, your Virtual assistant-accepted financial would be handling the brand new Va discover most of the brand new approvals and you will files lined up.

Finding the optimum personal lender is vital. Homes for Heroes provides attained a system from individual lenders and agents who are committed to coping with pros, effective responsibility service members of the newest armed forces and other society heroes. We are able to assist you in finding and you can apply to mortgage specialists which understand the Virtual assistant financing processes and who wish to help you due to your services into nation.

Upwards side, it is advisable to keep they upright and you may know very well what you need out of each side of your process.

What the Va Do getting Va Mortgage Pre Approval Process

Going through the Va financing pre acceptance process setting getting documents. The one you'll pay attention to extremely regarding the is the COE (Certification away from Qualifications). The good news is, even though you manage you would like this important file to complete the job, that isn't hard. It's simply a-one page means and it's on line.

The new Certificate off Qualification is really what it may sound instance: they verifies towards the Va mortgage processors along with your personal bank of one's Virtual assistant loan qualifications.