You may still be capable of geting home financing without occupations, but it's harder. Whenever you convince a lender you have a good sizable bank account, a great amount of property otherwise a choice revenue stream, it can be possible.

Manage Mortgage brokers View Coupons?

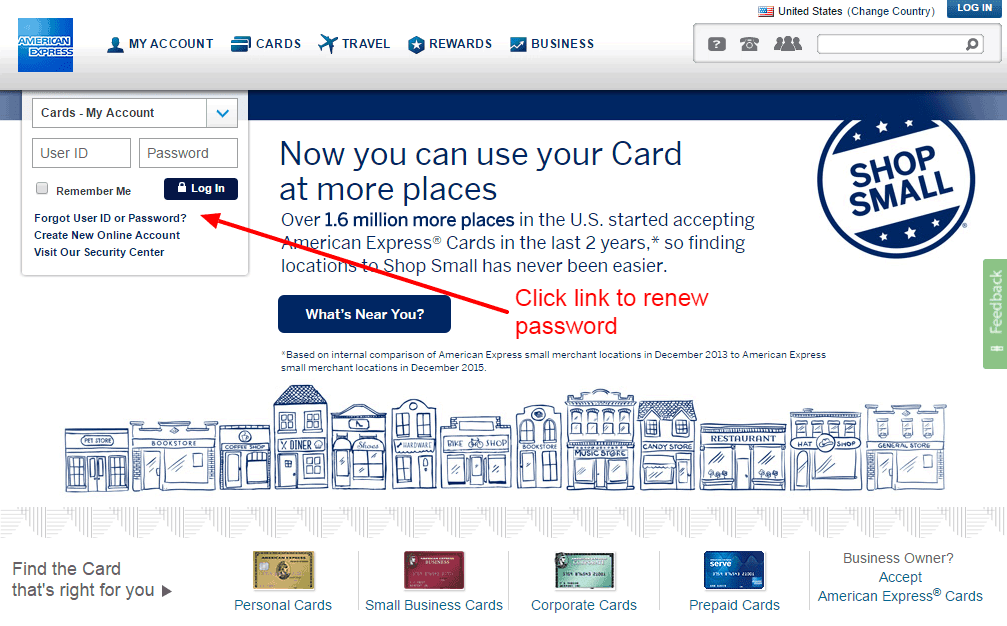

pop over to this site

Mortgage brokers can look any kind of time depository accounts in your lender statements; this can include people checking and you can coupons levels and any unlock lines of credit. Therefore, if you don't keeps a frequent money away from employment, loan providers commonly still account for your discounts to evaluate home loan affordability.

If you'd like to high light your own deals to mortgage brokers, it is recommended demonstrating loan providers you have sufficient currency spared; the same as half a year or maybe more of shell out stubs.

Do you really Rating a home loan for those who have No Work?

If you are currently underemployed, whether or not because of the solutions or just after shedding your task, it may be more challenging to safe a mortgage. Loan providers generally view a good borrower's paycheck to help you assess what kind of cash he is happy to mortgage. Within, of several lenders will also establish a minimum money.

But not, some mortgage providers be much more flexible than others in the way it establish income. If this is the situation, these businesses could possibly get accept coupons account if you is establish that month-to-month income is enough to fulfill money.

If you're out of work, you are going to always need to have a beneficial credit rating due to the fact well as the manage to establish a great ount out of down commission to secure a home loan. Will, no-money loans, as well as mortgage loans, can come having higher interest levels and not capable use as often money.

How do you Qualify for a home loan When you are Underemployed?

While you are obtaining a home loan and cannot establish a job, attempt to be able to show particular way to obtain regular earnings that could become offers. Loan providers will also need a good credit score. Whether or not you are underemployed by choices, like delivering retirement, otherwise have forfeit your task, try to persuade one bank that you could generate regular repayments timely.

A good way that you may be able to qualify for a great home loan even though the unemployed is through which have a beneficial co-signer; this can be a family member, partner otherwise pal. Which co-signer must be working otherwise keeps a premier web really worth. Co-signers make the mortgage a reduced amount of a risk into the bank since they're securing the borrowed funds with the income and you can credit records.

Different ways So you're able to Be eligible for home financing for those who have No Occupations

There are numerous means you happen to be able to qualify good mortgage even if you commonly completely-big date a career:

Part-time a position, self-employed functions or gig discount feel while you are capable illustrate that you take an employer's payroll towards a beneficial partime or self-employed base, it will help your case with loan providers as long as the brand new income is enough to be eligible for the loan youre trying to to safe. This will show the financial institution you have had the opportunity to create a fairly steady income while having were able to help oneself financially.

Varied sourced elements of money unless you get one full-time jobs but can demonstrate that you have more than simply you to definitely way to obtain normal really works, it helps present yourself given that financially steady to any prospective lenders.

Income tax commission showing loan providers their taxation statements might help make certain your earnings, especially in its lack of regular paychecks.