Inclusion

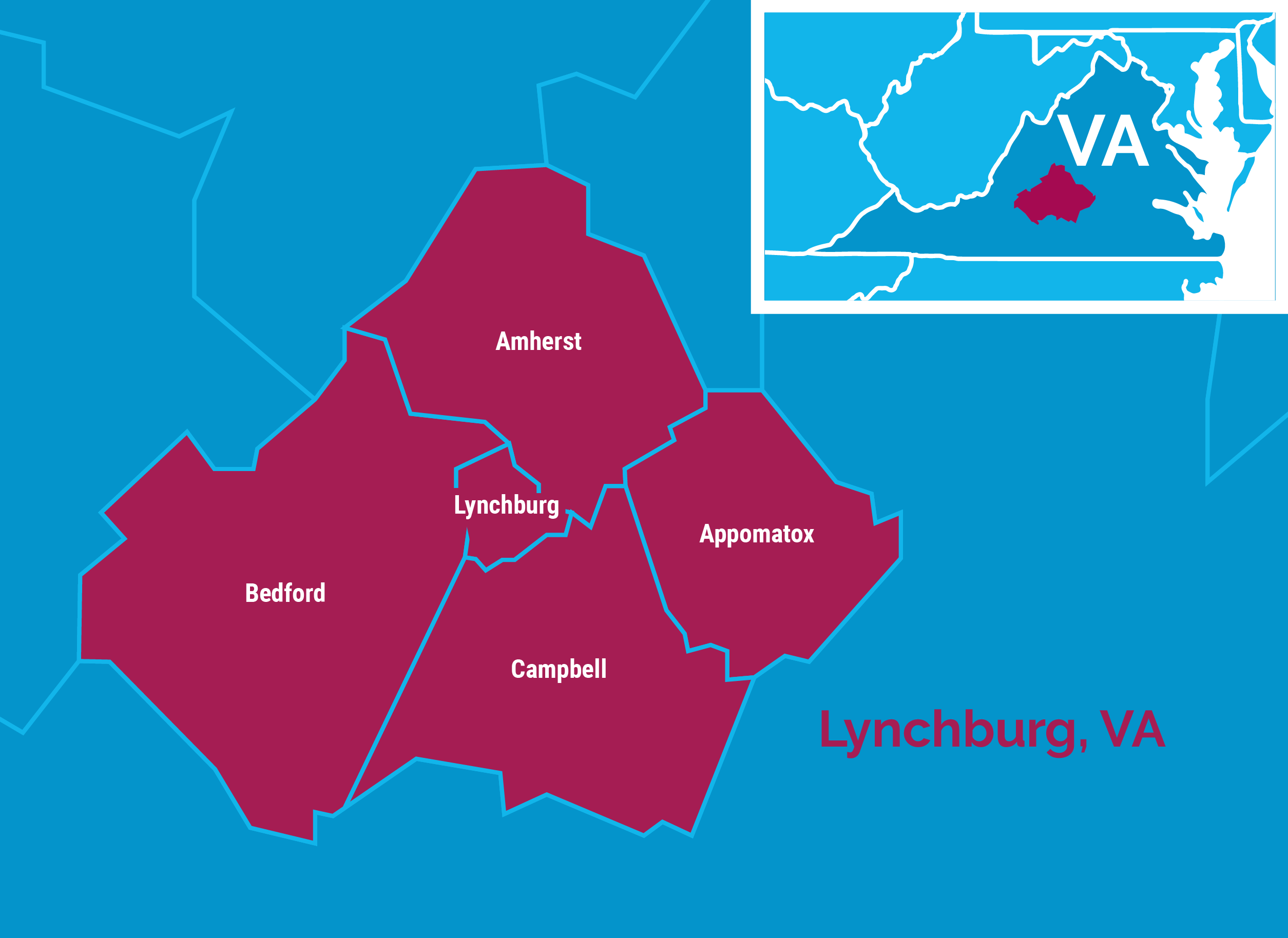

Do you really believe home ownership part of the Western fantasy? You aren't alone! Sadly, while you are an ambitious very first time homebuyer about Arizona, DC, Maryland, Baltimore, and you may Northern Virginia elements with a low otherwise modest money, monetary barriers can make it dream be unrealistic. NACA's mission should be to assist you in your hunt having a house.

Although not, to be honest, even though you are not a first time home buyer, but have property you will promote before buying another type of household, the new prefer out of real estate beliefs about DC town and North Virginia, Prince George's County, Montgomery County, and all sorts of section in-between - have observed rapid progress due to the fact 2019. Therefore, of these homeowners who wish to move to a special domestic many different factors, the selection can be extremely restricted.

Such as, if you were able to promote your house for the less consult part of say Northern Virtual assistant, the cost for another possessions when you look at the your local large request urban area would-be really out-of-reach as a result of the fast price appreciate having increased rates in certain organizations more than other people, considerable down payment, closing costs and all sorts of others areas of antique financial programs.

NACA could help those in the above mentioned circumstances comprehend its dream of moving to a specific city. For this reason, even if NACA favors those who fall into reasonable-to-mid earnings groups, and are very first-big date homeowners, its just formal demands is that zero person in the household applying have any control of another possessions in the course of closing.

Thank goodness, the newest NACA (Area Advice Company regarding America) get system is actually working hard to eradicate this type of traps by simply making affordable mortgages offered to people with restricted monetary means. The original concern regarding NACA should be to suffice reduced so you can moderate money population to find the very first house, but other people will get use such as the over the state explained having North Va.

Contained in this comprehensive publication, we're going to speak about what NACA mortgage loans was, how they work, and why they might be the online game-changer you've been awaiting when you find yourself willing to purchase a beneficial house.

What/Who is NACA?

Created into the 1988, the local Guidelines Company from The usa (NACA) was a low-cash team whose goal is to promote homeownership and you may monetary fairness as availableloan.net installment loans a consequence of reasonable financial choice.

NACA was established with the objective off combating discriminatory financing means which had led to a high rate off property foreclosure inside operating-group neighborhoods across the You such as the DMV. It actually was established by the Bruce Scratches, a good partnership activist exactly who acknowledged the necessity for a course you to would offer equal access to funds for everyone audience out of a house, no matter what the financial history.

Does NACA Enjoys Regulators Affiliations?

Sure, Service of Houses and you may Urban Advancement has proclaimed NACA a medication non-finances company. Yet not, NACA isnt an authorities entity. To note, NACA features a non-old-fashioned character as a home loan new member. It's not commercially a lender or simply a broker. NACA retains a license since a large financial company nevertheless underwrites it's own financing internally in the place of almost every other brokers. The brand new finance try satisfied because of the companion banking institutions. Confused? Don't be concerned we'll describe a great deal more, you'll be able to here are some our comprehensive guide to all things mortgage loans on the DC Town.

Was NACA a lending company?

The easy answer is once again, zero. NACA partners having finance companies to fund the fresh new mortgages it underwrite that have the greatest bank getting Bank of America, at around 65% otherwise $15 Billion the time. Ergo, regardless if NACA underwrites and processes a unique loan in this its individual design, the fresh funds close in the lenders identity & the money is inspired by the lender..