For the majority homebuyers in Nj, the advance payment stands for the single biggest obstacle to help you homeownership. However in some cases, it's only a recognized challenge. The truth is the current down payment standards for brand new Jersey financial financing try below people discover. Some tips about what you have to know about it, as the a home buyer.

A great 2016 questionnaire held by the Federal Connection off Real estate agents discovered that 66% of men and women believe it required more than 20% for a down-payment towards a property. Which is a common myth.

The thing is individuals cannot always you prefer a deposit out-of 20% to invest in a home. The common advance payment among New jersey homebuyers are somewhere doing ten%, there try money options available today that allow to possess an actually quicker advance payment. But a lot of people are unaware of so it.

Lenders Having Lower Financing Conditions

Are unable to assembled 20% when buying a home within the Nj? You have still got alternatives. Check out samples of money strategies with a reduced off commission requisite.

- Conventional loans with 3%: Federal national mortgage association and you may Freddie Mac, the two regulators-sponsored businesses that pick mortgage loans of lenders, each other provide apps having as much as 97% funding. Because of this Magnolia installment loans bad credit eligible individuals might pick a home into the New jersey having as low as step three% down, playing with a traditional home loan product.

- FHA money having step three.5%: The Government Housing Administration's financial program lets eligible borrowers in order to make a down-payment only step 3.5% of the cost or appraised value. That it mortgage program is particularly well-known among Nj homebuyers which lack the money for a more impressive deposit, which has of several very first-go out customers.

- Virtual assistant funds which have 0%: Whenever you are an army member or experienced, and you are clearly gonna buy a home inside the Nj-new jersey, you need to you should think about the latest Agencies from Experts Issues (VA) mortgage program. Through this program, consumers can buy 100% funding, and that eliminates the dependence on a down-payment altogether. It's hard to beat.

Clearly, you will find several a method to stop a good 20% deposit on a house into the Nj. Offered, you will find situations where a larger money is expected. This really is either the way it is having jumbomortgage items that meet or exceed the borrowed funds restrictions where the house is being bought. But for an average house buyer into the New jersey, you will find low-down commission financial possibilities.

Based on a research composed at the beginning of 2017, the average advance payment into the Nj and you will nationwide try eleven%. This was based on a diagnosis away from mortgage ideas out-of a mortgage lending app company.

It underscores the notion one Nj homebuyers usually do not always must lay 20% off when purchasing property. And yet many users accept that this new 20% deposit is necessary in every get issues. It is a common myth that individuals are trying to dispel due to all of our blogging services.

Many financial situations on the market support deposit gifts from third parties. This is how our home customer gets money from a household member (or any other recognized donor) to greatly help protection the fresh new deposit expense for the a home.

Once the laws and regulations and requires are different, of numerous old-fashioned and you will bodies-recognized mortgage software allow for this type of merchandise. The brand new caveat is the fact that the people offering the fund should also provide a letter saying that they don't assume any kind out-of fees. It has to be a present - perhaps not a loan.

The conclusion to all or any this might be that the home loan lending industry is even more versatile than just a lot of people understand. This is also true regarding advance payment standards into the New jersey. By consolidating a decreased down payment mortgage with financial assistance away from a family member or any other accepted donor, homebuyers is also help reduce the initial aside-of-pouch debts.

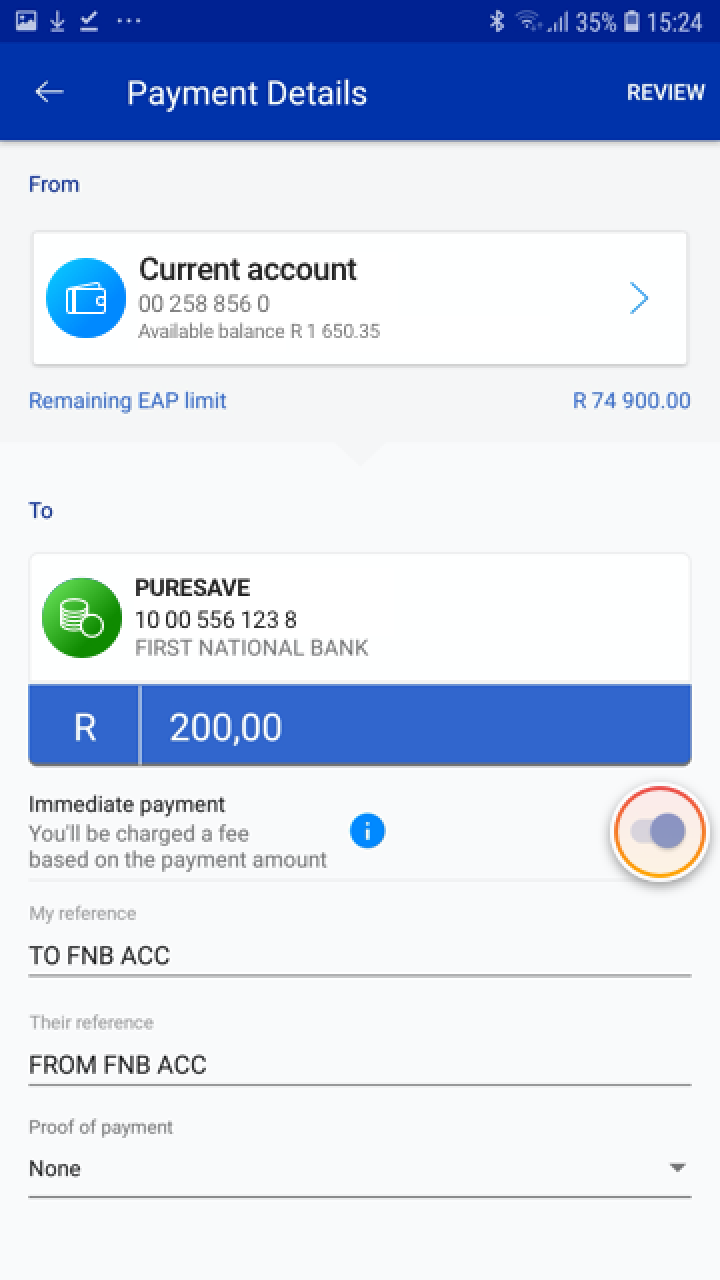

Mortgage deposit

Let us talk about your options. Nj Lenders Corp. even offers some financial items for consumers along the county of the latest Jersey. Delight e mail us if you'd like to understand more about your own financial support choices, or you enjoys questions about brand new down payment conditions when to invest in property in the Nj-new jersey.