Just like the an old financial banker and dominant of Castle Laws Category, Ben recommends clients to their probability of receiving financing modification helping expose requirement regarding your most likely regards to that loan amendment contract. Ben in addition to advises members about the it is possible to choices for escaping out of around their upside-off mortgage totally and assists customers write thereby applying approach in regards to the an identical.

Discover Your chances

Many individuals that trying a loan modification do not at this time qualify for loan mod often on account of jobless otherwise however, because their earnings is significantly greater today than simply after they gotten the borrowed funds in the first place. Once more, courtroom power is beneficial here. Individuals just who tournament a property foreclosure match have a much large possibilities of protecting that loan amendment compared to those whom ignore the lawsuit. Disregarding this new suit is a choice that have long-lasting negative effects.

Understand Your options

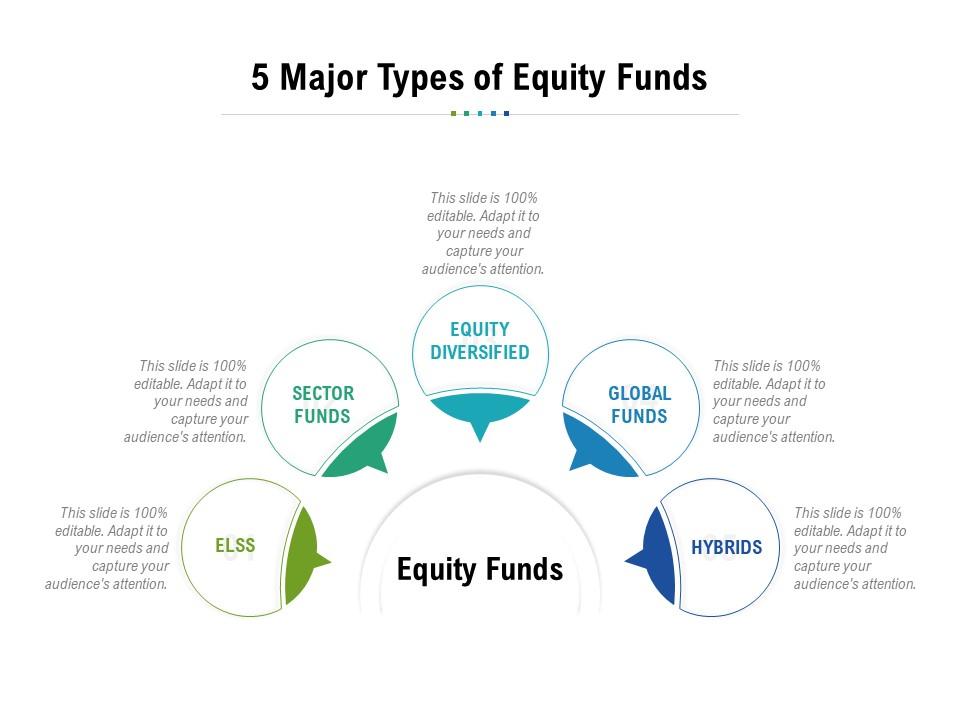

Mortgage loan modification is not the only choice. Ben educates website subscribers on the additional options to get out from not as much as an enthusiastic upside-off home loan and avoiding lack wisdom. Because Loan mod, Deed-in-Lieu, Small Profit, and you can Property foreclosure through Proper Default are not collectively exclusive methods, it was beneficial to keeps a multi-faceted proper approach.

Frequently asked questions

What is actually financing modification or loan mod?A loan modification are an official written arrangement to change the newest terms of a loan. That loan amendment can occasionally is a decrease in the eye speed, an ever growing the term otherwise amount of the loan. That loan amendment can also tend to be a main balance prevention.

Do i need to be unpaid towards bank be effective with me?The new short answer is yes. Although not, specific lenders create run individuals who aren't delinquent. As well, specific authorities-paid applications want borrowers to be newest on the money. It is also vital that you comprehend the implications of neglecting to generate money lower than an effective promissory notice. Failure and work out repayments are infraction out of contract and can probably have significant negative effects to help you good borrower's credit rating. Consult payday advance loans Pea Ridge AL an attorney who can take you step-by-step through the risks of becoming outstanding.

The length of time do financing amendment just take?Loan modification might be an extended techniques, taking from around two to 8 weeks or years when you are denied and you can re-apply many times.

What is actually an excellent HAMP loan mod?HAMP, or perhaps the Domestic Sensible Amendment System is perfect for individuals who are used but still unable to make monthly home loan repayments. It might decrease your month-to-month mortgage payments. Many highest loan providers participate inside the HAMP, but not, of numerous high lenders have her mortgage loan modification apps.Reference:

Defending a property foreclosure fit also provide not simply legal leverage but and additionally time for you to get financing amendment, to help you make a short income or even stop an insufficiency.

A lack wisdom lasts up to 20-age except if reduced if not resolved. A lack view is going to be a good lien on the non-homestead a property or other assets.

Even if you really well qualify the lender does not have to modify your specific loan. Lenders try not to customize everybody's mortgage; it is simply perhaps not financially possible.

Palace Legislation Group helps subscribers decide if a primary selling try suitable for all of them because of the detailing the dangers and you may prospective benefits cousin to our clients' novel financial situation.

- Get aloan modification. To try to get financing modification, inquire about or download the lender's loan modification software and fill it and gather the desired copies of monetary advice. If you find yourself worry about-employed, discuss with a talented attorneys. The target is to get a loan amendment one to gurus your maybe not the lending company. Likewise, financing mod software program is not an alternative to responding to a foreclosures problem.