Navigating household closing costs from inside the Colorado? Which full guide reduces per component of these can cost you so you will be aware how to plan your next Texas home buy otherwise purchases without the unexpected situations.

Short Summation

- In Tx, vendor settlement costs generally range from 6-10% of your property's developed price, and you may customer settlement costs basically include dos-6%, according to the measurements of the borrowed funds.

- Closing costs into the Colorado become mortgage origination fees, appraisal charges, title insurance coverage, assets fees paid in arrears, and you may probably most expenditures such as for example homeowner's insurance rates and you can annual tools.

- Texas also provides closure prices guidance applications like SETH and you may Family Superstar getting eligible buyers and you will settling charges, and utilizing on the internet hand calculators will help estimate and you may possibly clean out closing can cost you.

Extracting Texas Closing costs

Due to the fact label closing costs' may sound challenging, that it is way more easy than you might trust. These are fees for features must transfer owning a home out-of the seller to your consumer. So yes, both customer and you will seller have the effect of using these will set you back. For the Texas, seller settlement costs basically consist of 6-10% of the cost, when you are consumer closing costs typically are normally taken for dos-6% of one's residence's contracted purchase price.

The amount of closing costs are going to be affected by the sized the loan loan; a bigger financing can end in a smaller sized payment repaid. The past closing prices rates is actually disclosed in order to both buyer and you can provider at the very least around three business days prior to closure.

Buyer's Express from Closing costs

- Mortgage origination charge: defense the expense associated with operating paperwork and you can installing a loan

- Appraisal charges: money for an expert to assess the newest house's well worth

- Name insurance coverage: coverage against identity flaws

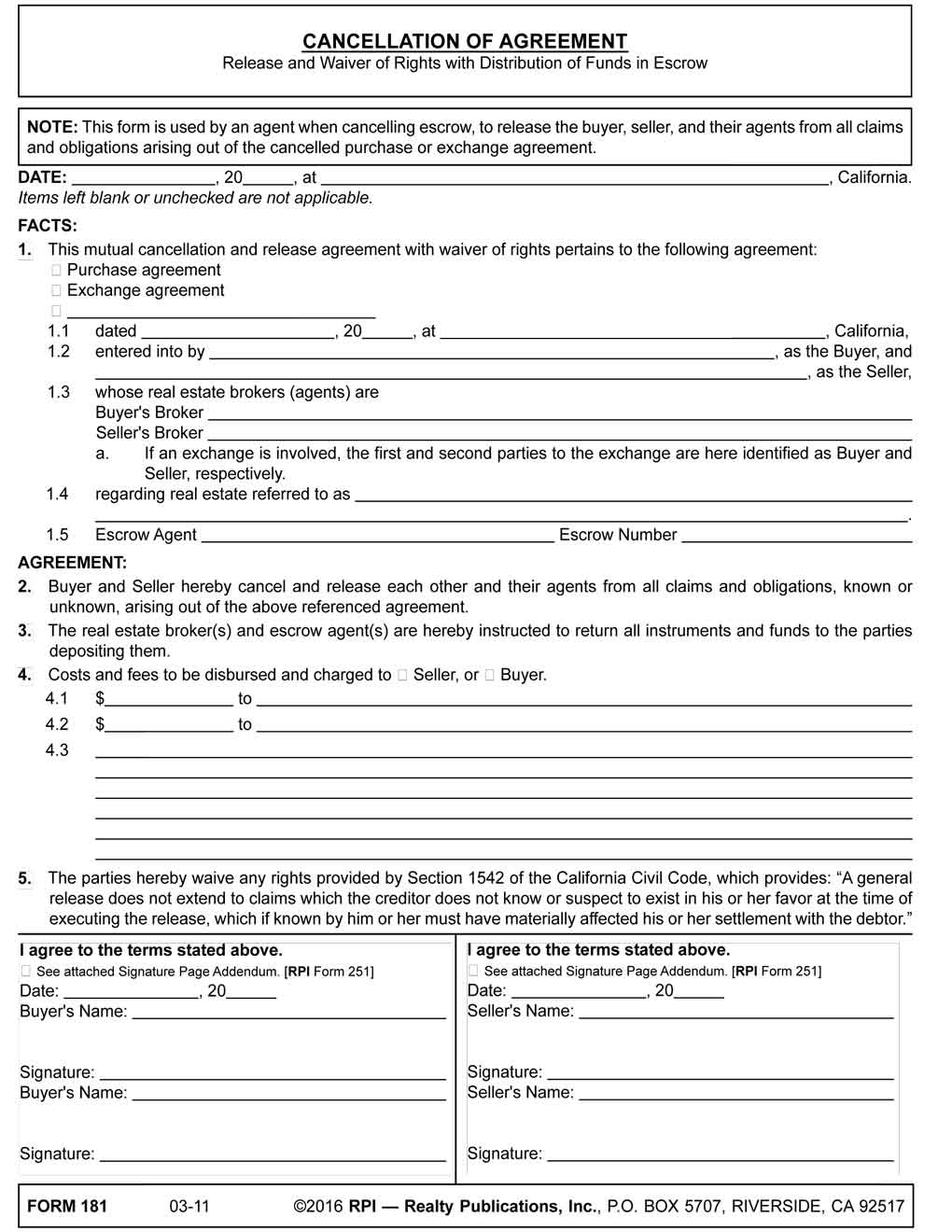

- Escrow Charge (Applied by Name Providers): Costs for dealing with escrow account, making certain safer deal and you will document approaching.

- Prepaid Interest: Appeal paid in progress, within the months anywhere between closure together with first-mortgage payment.

- Homeowner's Insurance: Insurance policy protecting against damages with the family and property.

Specific customers and you may manufacturers also can work with a genuine estate attorneys to aid navigate new closing procedure, that may enhance their complete closing costs.

Seller's Express off Closing costs

Due to the seller's express, vendors within the Tx generally bear closing costs you to definitely vary from six-10% of your house's purchase price, the greatest of which try broker or agent income. Just remember that , most of the real estate agent functions and you may charges is actually flexible.

And additionally real estate professional commissions, manufacturers are generally accountable for coating title costs, transfer fees, customer's identity insurance expenditures, tape costs, and attorney costs.

List of Popular Closing costs inside Tx

Lower than try a table that shows widely known settlement costs within the top North Carolina installment loan Texas, indicating whether they're typically repaid from the client, owner, otherwise mutual anywhere between both. You should remember that these is negotiated amongst the buyer and you will provider for the income techniques.

New Character regarding Assets Taxation from inside the Tx Settlement costs

Inside Tx, possessions taxation are paid-in arrears, meaning he could be paid down after the house loan process through the closure. So it commission supporting individuals societal services in people, including:

Assets taxation decided by multiplying the house's analyzed taxable worthy of by regional taxation rates and can even become university area fees, medical areas, and you will Civil Electricity Region fees (MUDs). The typical property tax rates in the Texas is just about 2.0%, but is commonly highest when served by a sand or perhaps is located within a public Upgrade Section (PID). As they are paid in arrears, these types of taxes must be thought whenever figuring the brand new bills during the newest closing away from a home loan, along with prorated possessions taxation.