And since he could be stated they over repeatedly and you can once again, yeah, I might expect to get a hold of a massive push to possess HARP step 3/4/5/6/permanently allow you to definitely refinance his home loan more or less at when, and also for the regulators to help you guarantee such as for example installment loan companies in Columbus NC refinances otherwise subsidize them in some way, otherwise exactly what-have-your. $step 3,000 for every domestic in coupons needs to come from someplace, in addition to finance companies commonly exactly thrilled to capture that struck - particularly the ones that rarely clinging to solvency because the it is.

Several Concluding Concerns and you may Opinion

I could feel dead incorrect, however, and you can government are an uncertain thing in the best of minutes. But I do believe I'm close to this, considering his history, his very own conditions, as well as the determine of one's BPC today.

You to definitely question I do features, not, is the fact that Chairman said over and over you to bodies can be cover and you will keep the new 31-12 months mortgage. People Guarantor will do this, Perhaps, even though it desires make fourth loss position.

Smart funds anybody for example Costs Gross of PIMCO possess flatly said which they cannot financing aside her currency getting thirty decades towards the a fixed speed, because of the rising cost of living chance alone

My question is, How? So we are going to encourage banking institutions and you can people when deciding to take a lot more chance by having the federal government get faster risk into the those people 29-12 months bonds, and you will we are going to do so while keeping rates lower? I'm merely wanting to know exactly how you to magic can come.

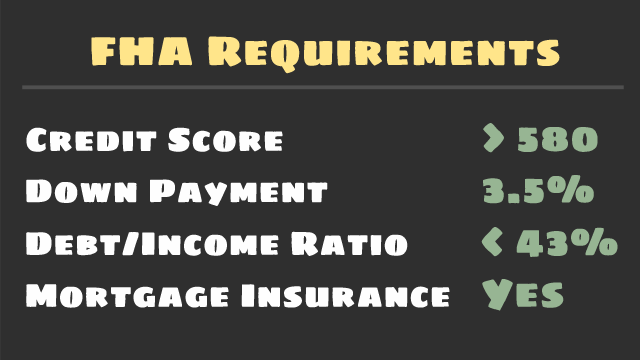

One other question, one other major opening in the speeches and you may conversation, is because of brand new QRM rule currently and come up with their method through the labyrinth from bodies. President Obama don't explore that after all, if the QRM happens how it could have been suggested in the past, we are looking at 20-30% deposit becoming the norm when you look at the that which you but FHA financing (and this, as the we seen, could be minimal).

When the NAR loses toward Middle, loses to the FHA, manages to lose towards the QRM, and you can Fannie/Freddie disappear... really does which means that this new mighty just after-all-strong property lobby is done to own? Or is actually these simple short term setbacks triggered a whole lot more of the macroeconomic image than of the people death of fuel?

All in all, one to whole proposition felt like Kung fu Pander 3 which may or will most likely not citation. It won't alter the business anywhere near this much, not.

I believe this will be perhaps the rough construction of every real package one to becomes introduced with regards to the FHA. I say this simply because the fresh FHA alone desires to come back to their key mission out of providing casing chances to lower-money working parents, not be resource $700,000 house within the Southern California beach places.

A significant second, or variety of minutes, are how often Chairman Obama said taking so much more resources out-of Congress, and in you to particularly, the guy called the reason: to build inexpensive property, especially for young people such Jacob, to own whom leasing is the best option. The guy stated apartments and you can leasing more moments, even yet in reaction to an excellent softball matter regarding an instructor throughout the how she needs to get money much more do have more occupations security.

Nobody knows this mechanisms for how the fresh Government will do that, but playing with HUD's TRA and PETRA apps seems probably. Broadening Point 8 financing and additionally looks more than likely. While Fannie and you will Freddie are indeed changed because of the Societal Guarantor, I would anticipate to pick big authorities role into the to acquire/insuring commercial multifamily mortgage loans and you may strengthening money. Funding for it push with the accommodations will come on the home loan desire deduction, out of limits towards the FHA, and away from scaling right back service with the GSE's over the next long-time on the path to stage-aside.