Single-mission reverse mortgages will be least expensive solution. They are offered by specific county and you may local governing bodies and non-earnings groups, but they're not available everywhere. Such loans can be utilized simply for the point specified by the lending company, including, home repairs, improvements, or property taxes.

Such loans are not widely available and then make up a installment loans Riverside no credit check tiny part of the reverse home loan age, such as possessions income tax deferral applications. These can be discovered online having California, Texas, Connecticut, Idaho, Illinois (get in touch with County Treasurer's office), Massachusetts, Michigan, Minnesota, Oregon, Tennessee, Texas, Washington, Wisconsin, and you may Wyoming. About 50 % the newest says involve some types of assets taxation deferral program. Look at the county.

Exclusive reverse financial

Exclusive opposite mortgages was individual financing supported by the businesses you to offer them. Higher-appraised homes you will qualify for more substantial loan which have an exclusive contrary home loan. He could be more pricey than simply old-fashioned home loans or solitary-mission contrary mortgages as well as the resource costs are highest, crucial if you plan in which to stay your property getting good short time otherwise use lower amounts.

The loan size relies on a comparable facts given that an enthusiastic HECM, it is minimal merely because of the risk the financial institution is actually willing for taking. These mortgage loans gone away pursuing the housing bubble burst for the 2008-2010, after that came back whenever home values rebounded. They aren't since the common as HECMs as they use up all your a secondary marketplace for lenders, and cannot be easily protected by product sales so you can Fannie mae and you may Freddie Mac.

Opposite mortgage criticism

The most common ailment is that opposite mortgage loans be more high priced than traditional home loans therefore the financing costs are high. However, other problems have been listed:

- Because there are no necessary mortgage payments, the eye is placed into the mortgage balance monthly. The newest rising financing balance is eventually grow so you can meet or exceed the significance of the house, particularly in days of decreasing home prices or if the new debtor continues to inhabit your house for decades. That being said, that have an FHA-insured HECM the new debtor will never owe more than the benefits of the property.

- Reverse mortgage loans is confusing, and some obtain them in the place of completely knowing the fine print. In , this new Federal Reverse Mortgage brokers Association (NRMLA) interviewed 600 owners that have reverse mortgage loans along the You.S., and just 46% out of respondents felt they knew the fresh new monetary conditions "perfectly" once they safeguarded the opposite mortgage. A consumer Monetary Shelter Bureau are accountable to Congress in the 2012 stated you to "bodies assessment and individual advocacy organizations increased extreme user cover concerns about the business means off contrary mortgage lenders or other enterprises from the opposite financial industry."

However, a beneficial 2006 survey off individuals from the AARP shown 93 percent told you their opposite financial had good "mostly positive" affect the existence. While the 2010 NMRLA survey claimed 56% off elderly people which have a reverse financial would not be able to security month-to-month expenditures without it.

- Guidance available to help customers learn prices and you will threats, plus federally required disclosures and you will counseling, commonly enough to make sure that he or she is and come up with an effective choices.

- Property owners is actually taking out opposite mortgages at the even more younger ages which have additional money upfront, stressful the tips eventually.

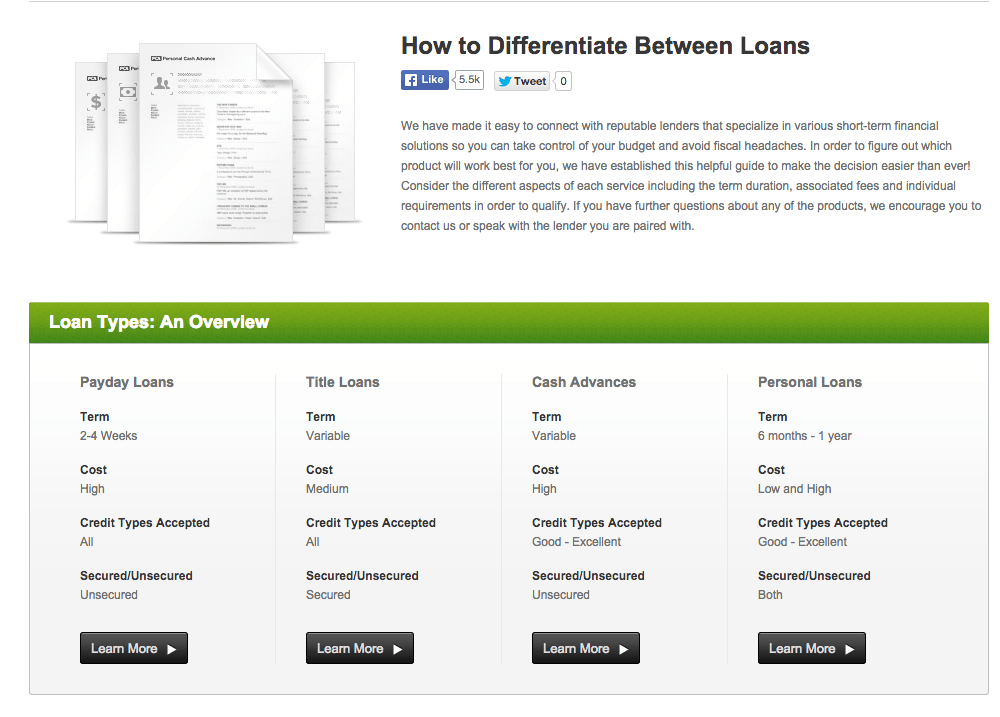

Other available choices

Unlike a reverse mortgage, the first a couple alternatives wanted month-to-month payments with the lender. An opposite home loan could be more straightforward to qualify for than simply good domestic collateral loan otherwise domestic security personal line of credit (HELOC), and therefore require enough income and you may credit ratings. The newest HELOC is more flexible compared to home security mortgage, and you may a cheaper solution to use small amounts when your principal is paid back quickly. As a whole, a face-to-face home loan is best for very long-title income regardless of a reduced home. Property security financing otherwise HELOC is the best to own short-term cash, when you can build month-to-month costs and would like to stop selling.