Express so it:

- Simply click in order to current email address a relationship to a pal (Reveals when you look at the the new window)

- Simply click to generally share for the LinkedIn (Opens up in the brand new screen)

Frost Lender had been from the domestic financial team having 2 decades when Chairman and Chief executive officer Phil Eco-friendly informed his management people the time is directly to come back when you look at the.

But the guy wished it complete brand new Frost ways, said Bobby Berman, class executive vp away from search and you may method, who was assigned with building a home loan agencies on the soil upwards.

Now, almost couple of years once announcing your lender would offer home funds once again, you to definitely the latest company are 90 individuals strong possesses merely began rolling away about three mortgage items in San Antonio.

Somewhat, complete with what the lender phone calls the Progress mortgage, which offers qualified lower-income users the ability to money 100% of the cost of their residence, doesn't require personal financial insurance coverage and hides to help you $4,000 to summarize costs.

One of the primary reasons we arrive at provide mortgages once more are since the we know there clearly was a space in the circumstances having lower-money anyone, told you Berman, exactly who registered Freeze inside 1985. The bank eventually usually expand their mortgage products to seven Texas countries in which it will providers.

New Progress financing is aimed at Bexar State consumers exactly who make as much as $67,2 hundred, said a financial spokesman, considering area median money as calculated of the Government Monetary Organizations Examination Council, an agency from bank authorities. Inside the Sep, one money limit, that is modified a year, increases to $71,280.

That financial was appealing to a lot of owners. Average household earnings into the Bexar State is more than $62,000, considering study off Personnel Options Alamo; over three-quarters regarding regional house possess yearly revenue lower than $100,000.

The fresh new Improvements mortgage in manners encapsulates the brand new Freeze ways you to definitely Environmentally friendly desired, and you may eschews new commodification of mortgage products which helped force the latest lender out of the market to start with.

Relational banking'

Frost is definitely focused on doing tough consumer relationship that possess added the financial institution to the consistently large customers maintenance results. Such as for example, the financial institution works a 24/7 hotline responded because of the a frost banker, who will address customers' questions regarding its account, plus assist them to discover account thereby applying to own loans.

Mortgage holders should be able to make use of one to brighten, as Freeze are not bundling and offering their mortgages, as it is normal, and you will alternatively will solution all of them on lifetime of the loan, Frost officials said. On the other hand, the lending company said they chose not to shell out mortgage advisors income on the financing it originate to eliminate creating a reward to own them to force high loan numbers.

Freeze re-comes into the loan financing company in the trouble for many borrowers. Rates of interest recently flower on their large profile because the 2002, and supply of current homes stays strict just like the customers that have reasonable home loan prices sit lay. The fresh refinancing team also has all but disappeared because the interest levels features grown.

Consequently, of numerous larger finance companies provides laid off personnel inside their financial divisions, also USAA, Wells Fargo and Citi, completing a share out-of talent to possess Frost to choose from given that occupied their home loan service ranks.

There had been lots of a great someone on the market told you Berman, who wish to be on the ground floor at the job for an amazing team one cares regarding their some one.

Loan volume provides proceeded to refuse, predicated on an August questionnaire from the Government Reserve Financial out-of Dallas, which noted you to definitely bankers mentality remained pessimistic.

The fresh new San Antonio Panel regarding Real estate agents said good 6% within the July statement, and you may a median speed one dipped dos% 12 months more year. Residential property spent on average 57 months in the business, a beneficial 104% improve about prior 12 months.

Substantial extension

Berman recognized the latest interesting place home financing happens to be during the, and you may told you Frost commonly focus very first to the its entire big most recent customer base. It rolled away www.paydayloancolorado.net/copper-mountain its mortgage situations earliest in order to team, next so you're able to its Dallas metropolitan areas when you look at the Summer. San Antonio twigs was indeed stored that have educational material merely a week ago.

The bank is also in the middle of a hefty expansion. This has exposed 30 the fresh metropolises about Houston region and you will is on song to provide four much more, are midway owing to adding twenty eight the fresh new branches regarding Dallas region and you will unwrapped the first off 17 planned this new twigs inside the Austin earlier this season. They currently comes with the prominent Atm system from the condition.

A part away from San Antonio-situated Cullen/Frost Lenders Inc., Freeze Financial 's the largest regional standard bank based in San Antonio, that have 27 twigs right here and you can plans to open an alternative location for the Port San Antonio to the city's South side. As of June, it got $forty-eight.6 mil when you look at the assets and kept $17.6 billion in the money.

Frost Lender got from the home lending team when you look at the 2000; during the time, Green asserted that many things played to your decision, together with that most consumers shopped having mortgage loans considering cost alternatively than towards the present banking matchmaking, a lot of time important toward bank.

Are from the home loan providers intended Freeze Bank skirted this new poor of one's subprime financial meltdown during the 2007 and you may 2008. It actually was the first lender, and another off not absolutely all, you to definitely refused federal bailout finance.

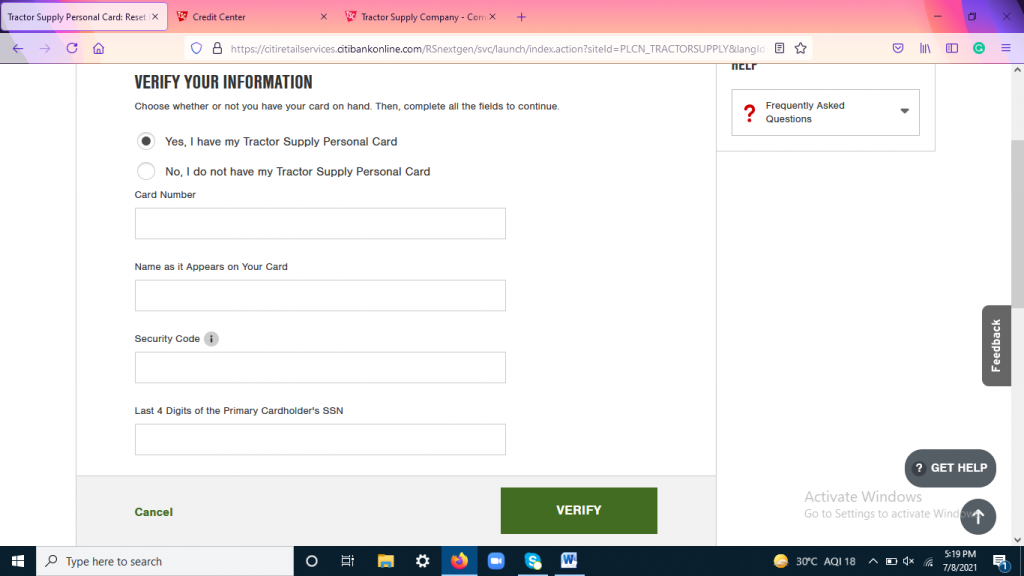

Users had been asking for mortgage loans for some time, Berman told you, and Environmentally friendly decided electronic tech has also been from inside the an area that would allow it to be Freeze to make home loan products that aimed which have the company's work at relationship banking. Users is securely over programs, upload photo away from data files and indication electronically to the dotted line, plus can get an employee simply to walk candidates as a result of every step of your own procedure.

Not in the consumer-centric perks, I together with anticipate which have really aggressive, if not a knowledgeable, rates. Therefore the reasonable fees, told you Berman.

Which facts might have been updated to correct you to Freeze Lender obtains their town average money investigation because of its Advances home loan regarding the Federal Financial institutions Test Council.

Frost Financial is an economic suggest of your own San Antonio Report. To have the full range of business participants, click the link.