The Federal national mortgage association, often called "Fannie mae," and the Government Financial Home loan Enterprise, "Freddie Mac," are the several authorities-paid enterprises (GSEs) chartered by the U.S. Congress during the 1938. None develop otherwise characteristics its own mortgage loans. Rather, they purchase and you may be certain that mortgage loans awarded through lenders from the second financial markets.

Its determine along the U.S. a house es Fannie mae and Freddie Mac scarcely epidermis to the purchasing websites or economic reports headlines. Yet, this type of people was basically the brand new pillars on what the newest American housing sector of your own last 80 age has mainly been centered. The sway lies in securitizing finance, efficiently transforming private mortgages on the tradable securities. So it constant move away from investment allows loan providers to extend so much more borrowing, at some point framing rates and you can while making homeownership open to countless Americans.

Listed here is a review of the way they works, the roles in the 2008 financial crisis, the things they're doing to possess tenants and homeowners inside COVID-19 pandemic, as well as their candidates in the years ahead.

Key Takeaways

- Federal national mortgage association was initially chartered because of the You.S. bodies into the 1938 to greatly help improve the financial market if you find yourself Congress chartered Freddie Mac computer for the 1970 to give credit past commercial banking companies.

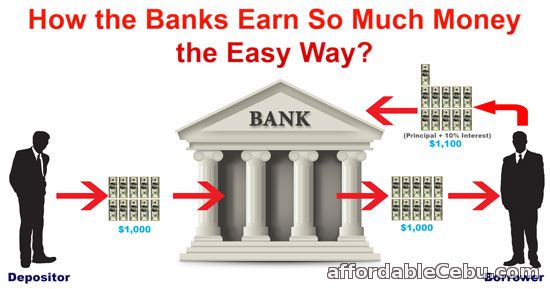

- Neither organization starts or functions funds however, expenditures mortgage loans out of lenders to hang or repackage as home loan-supported securities.

- Loan providers utilize the money from attempting to sell mortgage loans so you can Federal national mortgage association and you can Freddie Mac computer so you're able to originate so much more loans, broadening the newest pond of cash readily available for some body and you can family members to buy homes.

- Fannie mae and you can Freddie Mac computer issued a temporary moratorium with the property foreclosure and you can evictions by the COVID-19 pandemic.

What is Fannie mae?

In early twentieth century, homeownership was unrealistic for many individuals from the U.S.. If you don't you are going to shell out dollars having an entire domestic (and this few people you will definitely), you used to be thinking about a beneficial prohibitively higher downpayment and you will a great short-identity loan, culminating inside a massive balloon percentage.

Even although you could pick a property for the Higher Despair, top personal loans Alaska you might have been one of several almost one in five residents which shed their homes to property foreclosure. Financial institutions plus had no currency so you're able to give, while the nation experienced a houses crisis. The fresh new You.S. Congress replied for the 1938 with the Federal Houses Act, starting the newest Federal national mortgage association, better-known just like the Fannie mae from its phrase, FNMA, to provide reliable, regular investment for casing. It delivered a different version of home loan on business: brand new long-name, fixed-speed loan having a solution to re-finance when. It's got get to be the priericans purchase its earliest land.

Fannie mae initially ordered mortgage loans covered by Federal Housing Government (FHA) and later extra funds guaranteed of the Experts Government (VA), afterwards entitled Veterans Circumstances. The latest Johnson government privatized Federal national mortgage association into the 1968, therefore it is a shareholder-possessed providers funded completely that have private financing. This will has actually high effects afterwards, however it resulted regarding a resources gimmick: Beginning in 1965, Federal national mortgage association try expanding quicker. This might was indeed good for homeowners in a position to purchase homes at the time but harmful to the fresh Johnson presidential management: an accounting quirk meant you to definitely Fannie Mae's mortgages had been put into the yearly finances costs, therefore increasing the budget deficit.

Couple of years later, Federal national mortgage association are signed up to find antique mortgage loans plus FHA and Virtual assistant funds. The latest department began issuing mortgage-supported bonds (MBS) from the eighties to offer way more liquidity on the home loan capital elizabeth away from issuing loans ties offered in the brand new You.S. and you may around the world financial support segments.

What is actually Freddie Mac?

Freddie Mac 's the unofficial term of one's Federal Home loan Mortgage Agency. It actually was created in 1970 underneath the Disaster Home Financing Act to grow this new second mortgage sector and reduce interest chance for financial institutions. During the 1989, it had been reorganized once the a stockholder-possessed business included in the Loan providers Reform, Data recovery, and Enforcement Operate.