Thus You will find found that while you are an effective retiree with little in order to zero reported money, but a lot of property, you might certainly get a home loan to get a property. And you can probably select a competitive interest. But you'll have to research rates.

Within circumstances, it's a cure to understand that, whenever we get the top home in regards to our fantastic decades, we are able to have the financial support to buy they, without the need to promote possessions and sustain highest money progress within the an individual 12 months.

Can we genuinely wish to complicate the effortless renters' lifestyle which have brand new obligations, limitations, and you can dangers of owning a home? Is i ready to commit to residing in an area getting recent years it may decide to try recover the transaction can cost you?

Worthwhile Resources

- A knowledgeable Later years Calculators can help you would detail by detail advancing years simulations and additionally modeling withdrawal methods, federal and state taxes, medical care costs, and a lot more. Must i Retire Yet ,? lovers having a couple of most readily useful.

- Boldin (previously This new Senior years): Internet based High fidelity Modeling Device

- Pralana Gold: Microsoft Do just fine Established High fidelity Modeling Device

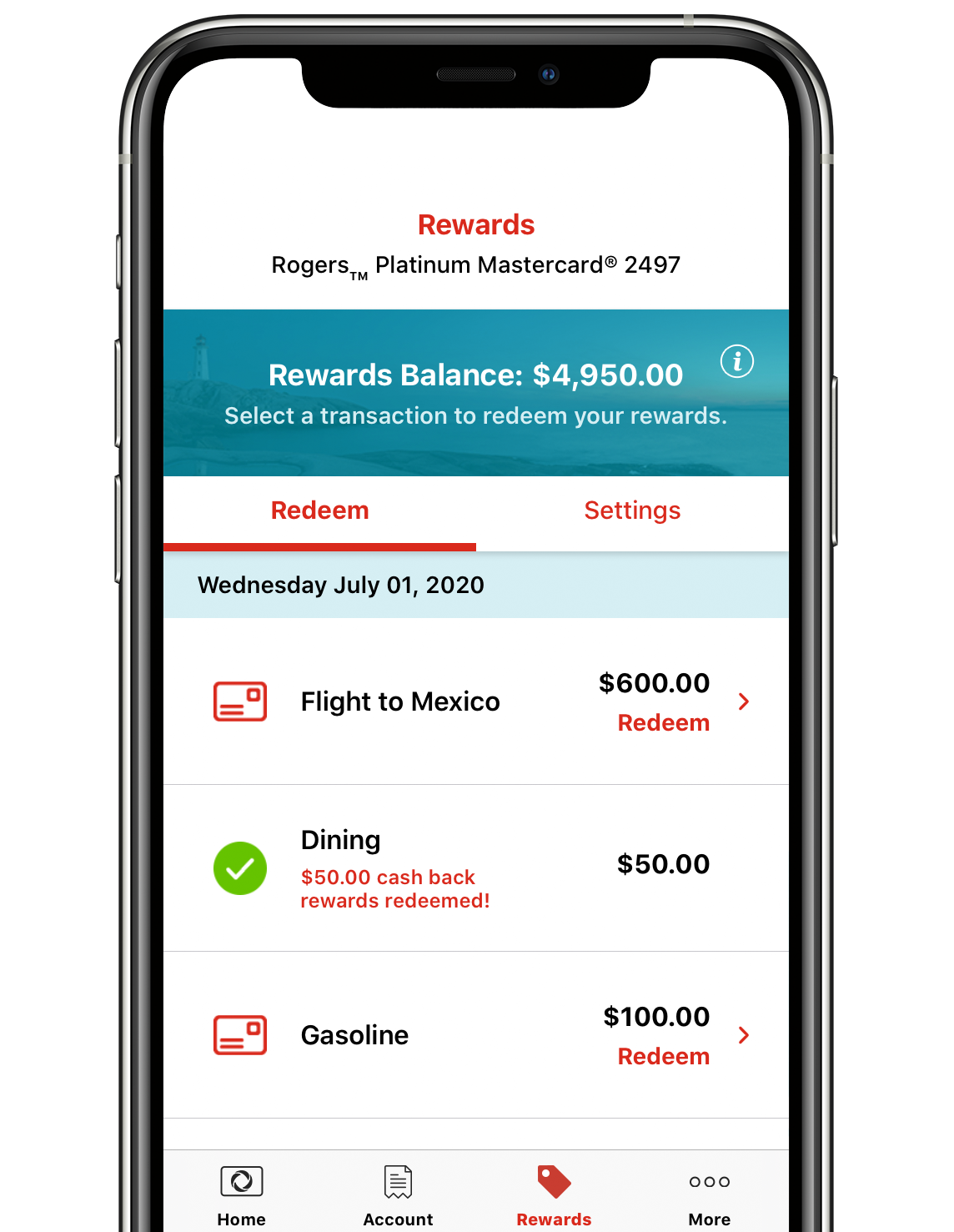

- Free Travelling otherwise Money back that have charge card rewards and you may indication up incentives.

- Find the best latest travel perks also offers here.

- Get the best cash back benefits has the benefit of here.

- Display Your investment Portfolio

- Sign up for a free of charge Enable membership to get into tune the advantage allowance, capital results, private account stability, net worth, income, and you will money expenditures.

- All of our Guides

[The brand new creator out-of CanIRetireYet, Darrow Kirkpatrick used a small life, large discounts speed loan places Sylacauga, and easy couch potato list using so you're able to retire within years fifty off employment due to the fact a civil and you may application engineer. He's got already been cited or composed on Wall Road Diary, MarketWatch, Kiplinger, The fresh Huffington Article, Consumer Reports, and money Journal yet others. Their instructions is Retiring Ultimately: How exactly to Accelerate Debt Independence and will I Retire Yet? Learning to make the biggest Financial Choice of your own Remainder of Your daily life.]

Disclosure: Ought i Retire But really? provides hitched having CardRatings for the publicity out-of credit card issues. Can i Retire But really? and you may CardRatings may discovered a payment regarding credit card providers. Some or every credit now offers that seem for the site are from advertiserspensation can get impact on just how and you will in which card things appear on your website. The website does not include most of the card people otherwise the readily available credit has the benefit of. Other backlinks on this site, like the Amazon, NewRetirement, Pralana, and personal Capital links are also user backlinks. Given that an affiliate we earn from being qualified requests. For people who click on one of them backlinks and get out of the latest affiliated providers, up coming i discover specific settlement. The funds keeps this website supposed. User website links dont improve your prices, therefore only use them getting products or services you to we're used to and therefore we think get submit value for your requirements. In comparison, i have limited command over all the display screen ads toward the website. Whether or not we do try to cut-off objectionable articles. Client be mindful.

Looking around is completely important if you are in the market for a secured item-dependent financial. You need research discover an acceptable mortgage within an effective competitive rate of interest.

Purchasing a property, or perhaps not

Second We talked that have a friend from a friend about home loan providers during the Tennessee. Their business got given a fannie mae advantage-situated mortgage prior to a recently available control changes. Today they may give an advantage depletion program having reasonable mortgage numbers, however-so-aggressive interest levels.