To your envisioned regular rise in demand for both social and you can individual residential properties into the Singapore, the need for house home improvements is likely to increase and you may selecting the perfect lenders, renovation fund, otherwise signature loans to have household instructions becomes crucial for cost-energetic and effective do it yourself.

Regardless if you are browsing and get good BTO/selling HDB flat, condo, otherwise private property, evaluating competitive interest levels, versatile payment terms, and swift recognition procedure is very important. Check out expertise to select the differences between lenders, repair financing, and personal money for do-it-yourself agreements, and methods for making the right options.

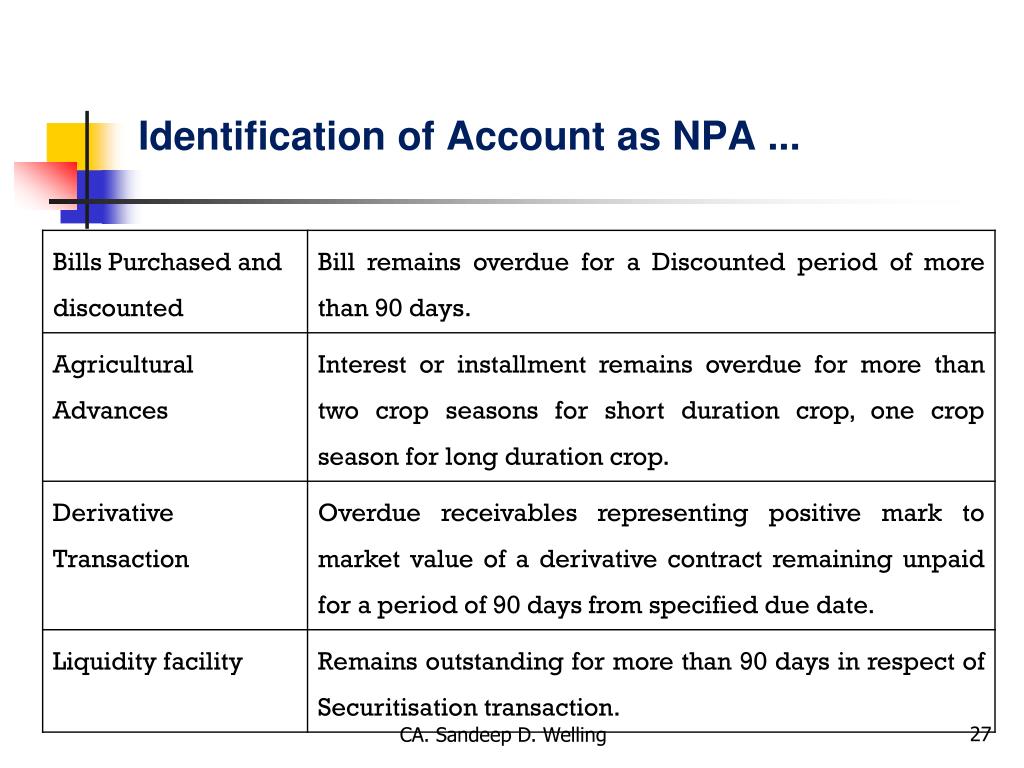

Range beneficial

Given that label suggests, house restoration funds try strictly used in recovery-relevant expenditures. This consists of architectural work such as for instance flooring, electrical really works, decorate, and you will built-within the cabinets however, will not continue so you're able to low-architectural or attractive issue. It is as opposed to mortgage brokers which can be primarily for purchasing possessions, within the cost of purchasing a house but does not stretch to any recovery otherwise decoration costs that would be obtain immediately following buy.

As well, signature loans try extremely versatile with regards to usage and can be studied for everything from debt consolidating, medical expenditures, travel, or even home home improvements. not, as opposed to a specific ree beneficial words (such lower interest levels) getting recovery motives.

Possessions and you will collaterals

Home renovations funds are often unsecured, definition it generally does not want a secured asset since the collateral, when you're home loans are often covered contrary to the property getting purchased, meaning that the property itself is made use of just like the security to help you secure the loan. As for personal loans, they are generally unsecured, however, protected choices are readily available. Secured personal loans might need equity particularly a vehicle, discounts account, or any other property.

Loan amount, tenure and you can rate of interest

/southwest-rapid-rewards-premier-credit-card_background-b2bec4a888c24cb68fc8b8d1537a1208.jpg)

Family reount (age.g. 6 moments monthly money or a cover off S$29,000) and you can smaller period, however, mortgages definitely ensure it is high loan numbers to pay for possessions can cost you and you can encompass offered payment symptoms. Signature loans bring so much more freedom within aspect and are also variable when it comes to each other matter and you may tenure, according to the financial while the borrower's creditworthiness.

When it comes to interest rates, you can find signature loans such as UOB, Practical Chartered CashOne, GXS FlexiLoan that offer reduced rates (less than step 3% since new prices authored towards ) than most restoration loans and you will home loans.

Omitted costs

As temporarily common regarding the above desk, most home restoration loans cannot be used for to find moveable home furniture or appliances such as for instance sofas, bedrooms, fridges, otherwise ornamental items eg curtains and lighting fixtures. Also, home loans do have conditions and don't safeguards one article-purchase will cost you instance home improvements, solutions, otherwise design. Having unsecured loans, there are always zero particular exceptions regarding incorporate, however the wider characteristics does not include the advantages of a great specialised mortgage instance lower interest rates to have particular aim.

Disbursement processes

Having domestic recovery money, finance are typically repaid right to the fresh designers, however for home loans, the mortgage amount is disbursed towards property supplier or developer. New disbursement process to possess a personal loan differs from each other house restoration financing and you may mortgage brokers because the borrower gets the funds really possesses the latest discernment to use all of them as needed.

Which Financing Is the best for My personal Renovations?

Choosing the most suitable style of financing for your residence's recovery most hinges on several factors like rates, intent behind borrowing from the bank, monetary capability to pay the mortgage from inside the some go out, and many other things installment loans Oregon considerations. Just like the all the borrower's financial requires disagree, for this reason there is absolutely no special answer (that fits folks) to this.

To decide which is better for you, you may also make reference to all of our blog post here, and that highlights some of the techniques to note. Let me reveal our quick round-right up of the best 5 finance that you may imagine getting your residence renovations.

*Estimated data collated over is dependent on this new respective mortgage package providers' (DBS, OCBC, HSBC, CIMB) other sites and 's the reason 3M Compounded SORA cost, last upgraded right here to your .

Looking for personal bank loan cost as little as 2.88%?

See MoneySmart's personal bank loan calculator and you can analysis tool to find everything aside. All you need to would is actually enter in your data and you may wished loan amount and you will period, and we will instantly find the best alternatives for your.