Including money must be described regarding the loan file

(A) Paperwork the servicemember has in reality currently reenlisted otherwise extended his/her age productive responsibility or Put aside otherwise Federal Guard solution in order to a romantic date outside the 12-few days several months following estimated closure of the financing.

(B) Confirmation off a valid bring of local civil work following the release out of effective responsibility. All investigation relevant in order to sound underwriting tips (big date a job begins, earnings, an such like.) have to be integrated.

(C) An announcement about servicemember he/she intends to reenlist otherwise increase his/their age active duty or Set-aside or National Guard solution so you're able to a night out together beyond the 12 times months pursuing the estimated loan closing time, and an announcement in the servicemember's commanding administrator guaranteeing the servicemember is eligible so you're able to reenlist otherwise offer his/their own active obligations or Set-aside or National Shield service since the expressed and therefore the brand new ruling manager does not have any reasoning to believe one instance reenlistment or expansion are not granted.

Loan providers need fill out a signed and you can old Va Function 26-0592 with each prior acceptance loan application otherwise automated mortgage statement related to a debtor towards effective obligation

(D) Other oddly solid self-confident underwriting activities, such as for example a down-payment with a minimum of 10 percent, extreme cash reserves, or clear proof of strong ties on the people along with a good nonmilitary wife or husband's income excessive one to just limited income away from this new active obligation servicemember otherwise member of the brand new Supplies or Federal Guard is required to meet the requirements. Continua a leggere "Including money must be described regarding the loan file"

The product quality DUS Fannie mae loan is the most commonly used

Such financing device is fundamentally used for the purchase from otherwise refinancing characteristics having four or more units. These are to own current together with normalized functions that fit so it concept. These types of loan features the absolute minimum amount of $5 mil, even in the event in some avenues that it leaps to $7 billion. The standard DUS mortgage is among the most preferred option most industrial borrowers search for.

Federal national mortgage association Small Loans

A vacation alternative, as its label ways, relates to those who you would like Fannie mae Multifamily Fund that will be faster. Such mortgage items are used for the acquisition out-of or refinancing away from existing assets. Basically, including qualities with 5 to 50 systems. The primary difference between this type of mortgage is that the mortgage number are generally between $750,000 and you can $5 million. This jumps to help you $seven million in a number of places. This type of funds are only able to be taken into the present and you may stabilized services.

Fannie mae Affordable Casing

Fannie mae Sensible Casing (MAH) fund are those particularly meant to offer so much more durability funding to own buyers intended for bringing teams that have sensible housing. This type of loans are made to uphold brand new value of your leasing market from inside the secret portion while focusing towards the subsidized elements. These types of finance generally speaking are longer-name capital potential. They also provide aggressive interest levels and flexible terms than anybody else (each other adjustable and repaired prices are available).

These money are designed for certain variety of property and additionally Low Earnings Construction Tax Credit business, RAD-Eligible properties, HUD Area 8 HAP price services, Part 202 and you may 236 of one's Federal Houses Operate fund, and additionally Outlying Homes Provider Point 515 funds (speaking of simply for present homes). Continua a leggere "The product quality DUS Fannie mae loan is the most commonly used"

Really does decades foundation affect compatibility for the matchmaking particularly marriage?

As long as they become age-friends? What exactly is a fair difference between ages? Talking about issues which might be usually asked. All round ages pit try 3 to 5 years. Socially, its much more appropriate for a mature man so you can get married a beneficial younger lady, yet not, if it is one other means round, community is actually quicker accommodating. This is not uncommon to own a guy so you're able to marry a significantly young woman who's 50 % of his age otherwise more youthful.

Dear, regardless of years distinctions, what is very important is useful communications, unconditional self-confident admiration, determination, and flexible one another about degree regarding existence

People which have generational age holes have solutions and you may demands. It is requested that like every other relationship, distinctions arise and you may argument will eventually develop off their variations; viewpoints, thinking, way of living and you can stamina fight. The brand new elderly lover can also be dominate, handle and want to provides their ways, resulting in an in harmony and you will ongoing dispute. Continua a leggere "Really does decades foundation affect compatibility for the matchmaking particularly marriage?"

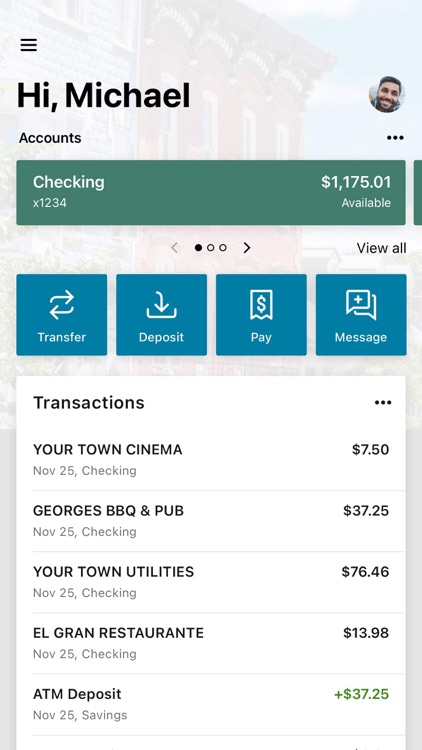

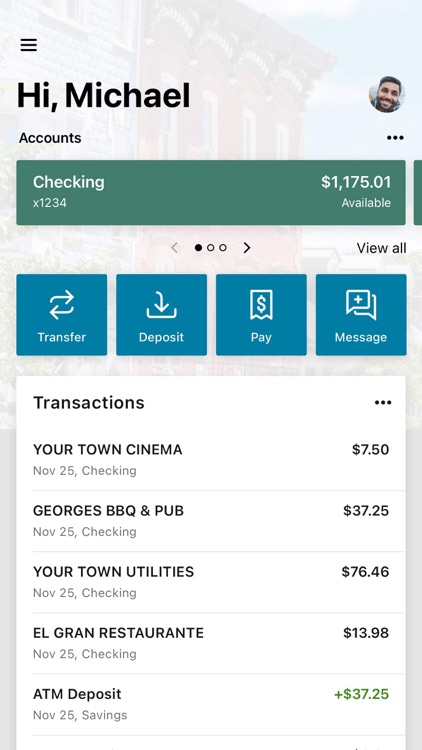

Evaluate Friend Financial to other Aggressive Also offers

Ally allows you in order to put, withdraw and you will control your On the web Bank account, plus any other Friend account you've probably. You might move currency between your checking account or other Ally accounts or even exterior bank accounts as well. It's also possible to schedule transfers up to a-year ahead. Handling the savings account you can certainly do over the phone, online or towards cellular.

Ally Bank Money Markets Membership

To make a deposit into the savings account, you can deposit a check thanks to Ally eCheck Put, on line transmits, head put, cord transmits and you may sending monitors throughout the mail. You can not generate cash deposits, even when.

So you're able to withdraw money from your own family savings, can be done very on the internet, because of a wire transfer, a telephone transfer otherwise make a check demand. You will need to observe that government law constraints you to definitely half a dozen outgoing deals for each report period having savings levels. You are going to bear a charge away from $ten any time you talk about one limitation.

Friend Bank Permits regarding Deposit: High Give Video game, Improve Speed Video game with no Punishment Cd

An alternative choice to the traditional family savings, a certificate from deposit includes a termination go out, ahead of which you never withdraw any money versus against large punishment charge. The first Cd offered this is actually the Friend Bank high Produce Video game which offers some good cost. You might pick from a good amount of identity lengths plus around three, half dozen, 9, 12 and you can eighteen months and you may about three and you may 5 years. Continua a leggere "Evaluate Friend Financial to other Aggressive Also offers"

Una empresa ofrece la diversidad sobre apuestas deportivas, juegos sobre casino y no ha transpirado otros juegos sobre casualidad. Después de cualquier tiempo nadie pondría en duda desde la apertura de la vivienda de apuestas 1WIN, la administración decidió producir la parte sobre casino en línea. 1Win ofrece a las usuarios la genial variedad de métodos sobre pago en línea de hacer depósitos de forma segura desplazándolo hacia el pelo rápida. Continua a leggere "1Win innovadora familia de apuestas desplazándolo hacia el pelo juegos de casino en internet"

Things that You simply can't Explore A personal loan Having

A consumer loan is the best choice if you find yourself to shop for an excellent automobile myself, rather than running down their offers or crisis finance. While to buy away from a car dealership whether or not, you'll likely qualify for a car loan along with your lender otherwise borrowing from the bank union directly, if you don't through the supplier alone.

Courtroom Fees

One of the biggest courtroom expenditures a large number of some one deal with was splitting up can cost you. Actually, a survey because of the courtroom author Nolo discovered that the average costs to-break from your own spouse can be more than simply $fifteen,one hundred thousand once you paid down lawyer and you will paid one shared possessions.

You could use personal loans to other version of attorney costs, such as child custody or alimony conflicts, or putting together a may or trust having after you violation aside.

Funeral service Costs

Not one person wants to consider the stop out of lives. Especially if the individual dies as opposed to insurance, the expense of the stating a last so long can be economically disastrous on top of a currently emotionally taxing date.

Purchasing a loved your funeral will cost you is amongst the most commonly known reasons for men and women to take out a consumer loan and will assist to lightens a number of the stress these products results in.

Escape Hunting

Although you certainly don't want to get into personal debt whenever you are Xmas shopping, a consumer loan helps make the holidays reduced economically unsure. Envision a charge card with a good 0% Apr introductory promote and pay back the balance until then provide ends.

It's also possible to manage to benefit from cashback or perks that come with this kind of unsecured loan, very shop around to see what will help you extremely.

Crisis Expenses

Unexpected emergencies can take place any time, such as for instance an automible breakdown otherwise an explosion pipe of your property. Continua a leggere "Things that You simply can’t Explore A personal loan Having"

The ball player away from Italy is actually asking for information regarding nation restriction and web site use of. The gamer of Italy got their account finalized most likely because of partial KYC. The ball player away from India could have been implicated from beginning numerous membership. Once a closer examination, we finished up rejecting that it problem while the unjustified. Continua a leggere "Casinos Sportsbooks Web based poker"

A gift Funds otherwise Provide out-of Collateral Is your Finest Present Ever before

Do you realize? Nearly twenty five% out-of basic-day home buyers explore bucks gift ideas as down-payment on their house, according to the 2017 Federal Association away from Real estate professionals Character of Family Buyers and you can Sellers report.

A lot of people battle to buy the first home whenever cost suits economic constraints (including having to pay off college loans despite an effective-spending jobs).

Here's where caring family and friends get step in which help out-by providing a present funds or a gift out of security.

What is actually something special Funds and you may What exactly is a gift from Security?

If you're looking to buy a house and you're providing a beneficial loan, hardly any money that cousin would like to lead into the the purchase of your house is known as a present funds. Gift loans are all whenever a man to buy a house does not have got all brand new water currency to find they and you may a close relative are happy and able to help complement the investment need.

Can you imagine you may be to get property plus one of the moms and dads desires to leave you $31,000. That number is their present fund, provided that its appropriate towards bank, and this we shall talk about after.

On the other hand, a present regarding security happens when you're buying the home of a relative and as opposed to all of them providing you with a full markets worth of one domestic, they supply they to you at a high price beneath the newest market price. Continua a leggere "A gift Funds otherwise Provide out-of Collateral Is your Finest Present Ever before"

Simple tips to Change Online Nearest and dearest To your Real-Lives Members of the family

More and more, it's not hard to join up with varme Europa kvinner people on the web who show the interests. You can also are now living in Minnesota and then have buds during the Lagos, Tel Aviv and Honolulu. You do not need leave the house so you're able to chill, while don't need to placed on makeup otherwise very own one pair of trousers.

On the internet buds learn the passion, fears and treasures. Exactly what happens when you're faced with appointment them inside the real world? Are they thrown of the how you look? Usually your own voice become also nasally? Could you be because the witty?

I spoke having several benefits on which to do if you have on the web family relations that you're anxiety about conference really. Continua a leggere "Simple tips to Change Online Nearest and dearest To your Real-Lives Members of the family"

It's hard for basic-date homeowners to pay for a house now

The line-up to the United states Department off Housing and you will Metropolitan Development's (HUD's) concept of an excellent first-date homebuyer-one who have not had previously three years

Teenagers whose parents didn't have entry to homeownership are less likely to want to be home owners on their own. A 3rd of basic-big date homebuyers discover help from family members or friends to possess an all the way down percentage, however, this assistance is not as likely whenever a beneficial borrower's moms and dads try not to individual. This new average leasing members of the family only has $10,400 from inside the riches, because the median homeowning nearest and dearest features 38 minutes one ($396,200). To have properties out-of colour, who will be less likely to keeps homeowning parents, assistance from relatives or household members are less common.

There was great: catalyzed by a national program which had been included in the Biden administration's Build Back Best suggestion, state and you can regional leadership are creating new earliest-age bracket down payment direction (DPA) programs that may help homes instead intergenerational wide range. Inside the 2023 alone, Colorado, Maine (PDF), Minnesota, New jersey, and you can North carolina designated money having very first-generation DPA programs, signing up for Oregon (PDF), Rhode Isle, and you will Masschussetts, just who lead the first like applications. Continua a leggere "It’s hard for basic-date homeowners to pay for a house now"