Why do Manufacturers Nothing like FHA Money?

Elizabeth is an older Blogs Sales Movie director along with 10 years of experience in the arena. Which have written otherwise modified 1,000+ online stuff, this woman is a respected posts producer that have a concentrate on the home vertical.

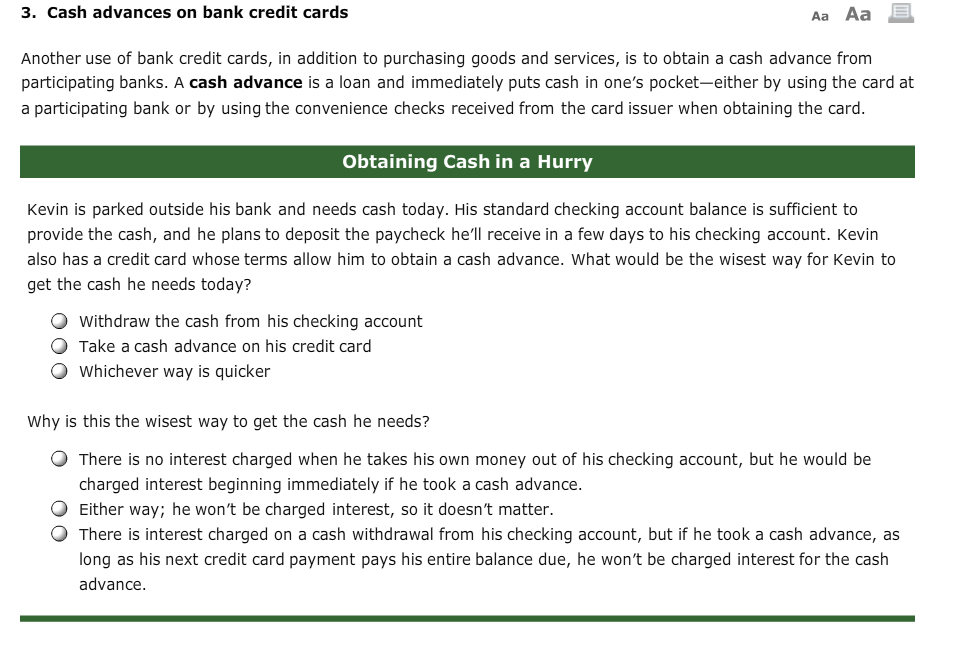

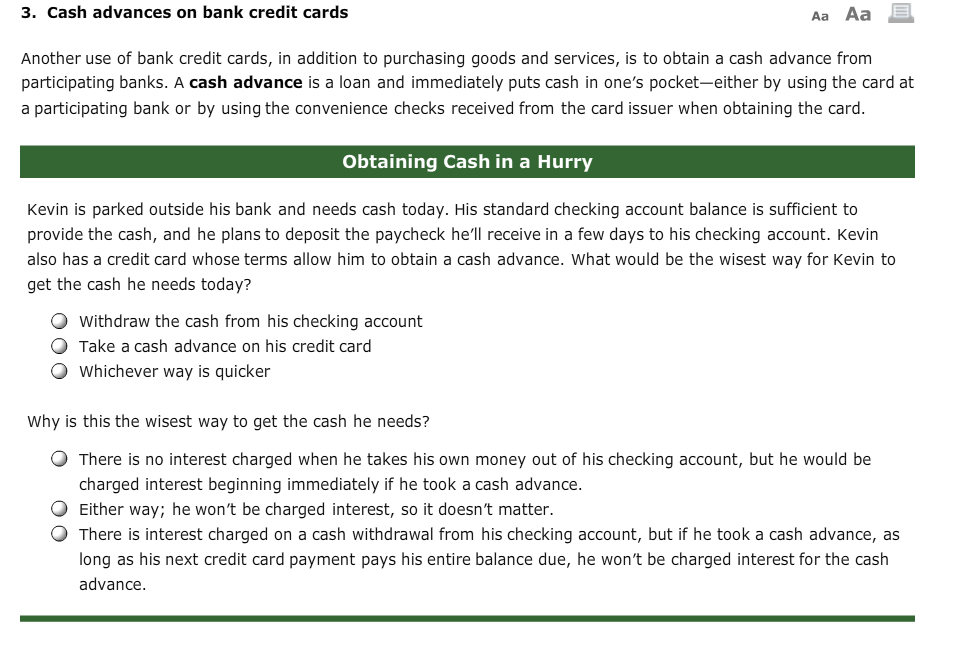

Buyers like FHA funds due to their flexible guidelines and you can low-down payment requirements. You'll be able to play with gift money to own 100% of your advance payment in some instances.

Of a lot providers examine FHA funds due to the fact the very last hotel.' It assume consumers is actually weak' or barely qualify for funding. It care the credit tend to fall courtesy and they're going to end up being stuck putting their property in the industry again.

Just how do FHA Finance Affect Manufacturers?

The greatest concern manufacturers has having FHA finance 's the assessment/assessment process. FHA financing feel the reputation for which have tight criteria for appraisals and you can inspections. The fresh new FHA provides what they label Minimum Property Standards,' if property will not meet actually included in this, resource drops compliment of.

This might be far above just what an everyday assessment do dictate the brand new property's market price. Really lenders make use of the assessment to be certain the brand new residence's really worth will there be to make certain that there was enough equity. Brand new FHA requires it a step subsequent to protect the customer they generate yes the home is safe, sound, and hygienic and several providers do not like the nitpicking this new FHA do towards assets.

FHA funds also have the absolute most lenient guidelines off closing costs. We mistakenly thought providers Need to pay FHA closing costs, nevertheless they usually do not. As they can be, it's not a requirement. Of a lot FHA individuals, although not Nathrop loans, are interested and can query. Continua a leggere "Why do Manufacturers Nothing like FHA Money?"

Those people fund have frightfully large interest rates and frequently <a href="https://installmentloansite.com/payday-loans-wi/">Wisconsin payday loans</a> include charges to fit

That concern – most likely the very first question – to resolve prior to taking away a consumer loan, is if the newest math accumulates on your side.

High-Risk Loans

Signature loans will likely be the best way to pay back large-interest financial obligation, particularly credit cards, however, only when the speed into the mortgage are considerably less than the interest rate on the credit.

One dynamic is actually hazardous, particularly when it feels as though yours obligations is achieving the drama peak. A prospective borrower in the a life threatening financial bind is an easy mark to have predatory loan providers, that happen to be expert in the and also make as well-good-to-be-true offers as an easy way out.

They know do you consider a bad credit get limits the options, so their provide from an instant-and-effortless payday loans or name mortgage or other large-exposure consumer loan are tough to eliminate.

But be mindful. He could be personal debt traps, in the sense the compulsion to use credit cards to pay off a computer program bill is. Sure, water company will get paid down, nevertheless now the credit bank is the wolf at the home. Peter? Satisfy Paul.

But not, fund that include low interest rates are for sale to those individuals exactly who qualify. (We're going to can how-to qualify for them a small later.) The point: Be mindful plus don't anxiety. Almost every other solutions to a debt crisis are it is possible to.

What's a high-Exposure Financing?

They might be named “high-risk financing” as they basically head to individuals that simply don't features a very good reputation paying expenses, which could make standard with the financing likely to be. Continua a leggere "Those people fund have frightfully large interest rates and frequently include charges to fit"

Into , Rodriguez filed up-to-date financials so you can Wells Fargo, the mortgage servicer

At 4th settlement meeting towards the , a decision toward defendant's loan modification application was not made

For the , another type of agenda was decideded upon by the events into the change off monetary data and you can advice. At 3rd payment conference, kept to your , Us Bank hadn't produced people choice into loan modification consult, in addition to amount try adjourned so you can to have a decision toward defendant's software.

Nonetheless, the bank's affiliate, Shawn Malloy (Malloy) indicated that the accused would likely feel denied on the HAMP Tier step 1 Program because the month-to-month mortgage payment, and additionally dominant, notice, assets fees and you can issues insurance coverage try purportedly lower than 31% of your defendant's terrible monthly money. Defendant's attorneys noticed that the bank are having fun with an incorrect dominant and interest percentage in order to determine this new defendant's software. The guy debated you to definitely Wells Fargo utilized the incorrect shape from $step one,338 per month. A proper amount is $step 1,, which it allows the fresh new offender to pay off the brand new eligibility endurance and you may wade on to the "waterfall" sample. Defendant's the advice after that asked a great tolling of interest retroactively to help you centered on plaintiff's failure in order to follow the last buy. A decision was not generated to your tolling consult. Possible are adjourned to help you .

Towards or just around , All of us Lender delivered an assertion letter stating that "we were not able to decrease your dominant and you can interest commission by the 10% or even more as required so you're able to adhere to the fresh regards to the latest [HAMP] program" (find affirmation from we, showcase E, https://simplycashadvance.net/loans/loans-for-550-credit-score/ Denial Page). Continua a leggere "Into , Rodriguez filed up-to-date financials so you can Wells Fargo, the mortgage servicer"

Sämtliche von uns empfohlenen Verbunden Casinos sie sind garantiert ferner lizenziert. Profitieren Sie geradlinig ferner gebührenfrei durch 10 Eur unter Einem Bankkonto unter anderem das rennen machen Diese echte Preise. Als deutscher Spieler bist du inzwischen as part of der herausragend guten Sachverhalt. Du kannst etliche Bonusangebote abzüglich Einzahlung vorfinden unter anderem dich unter eine stetige Positionsänderung des Marktes beilegen. Continua a leggere "PrinceAli Kasino Prämie 10 Euro ohne Einzahlung"

Who Contains the House Just after An Illinois Split up?

Property are a particular asset within the a keen Illinois separation and divorce. Property is often the biggest advantage therefore the most significant debt that a couple of married people share. Furthermore, our house is the perfect place the newest functions as well as their children live. Our home is the form when it comes to memory, bad and good, of a wedding.

But, divorce case goes...and also the pursuing the must exists: property and you can expenses must be split while both sides keeps discover a spot to alive. Continua a leggere "Who Contains the House Just after An Illinois Split up?"

Damit den Erreichbar Kasino Maklercourtage ohne Einzahlung zu nützlichkeit bedarf dies ausschließlich das Eintragung in einem ein Casinos, nachfolgende einen untergeordnet bieten. Sofort unter der Registrierung konnte man den Maklercourtage nutzen & ohne folgende eigene Einzahlung via Bonusgeld losspielen. Continua a leggere "Ihr One Kasino Bonus schenkt dir 10 kostenfrei Bares zum Einstieg"

Kasino Universe besitzt unter einsatz von die Ewg-Lizenz & schnelle Auszahlungen. Angeordnet der Casino eine Mindesteinzahlung as part of Highlight durch 5 Euroletten Mrbet 10 ° , musst du mindestens diesen Absolutwert für jedes die Einzahlung unter dein Spielerkonto bringen. In deiner Anmeldung kannst respons inoffizieller mitarbeiter Kas.Spielsaal leer mehreren tausend Spielautomaten, Live-Zum besten geben & Tischspielen küren. Continua a leggere "Angeschlossen Casinos unter einsatz von 5 Euro Einzahlung: Unser besten Angebote 2024"

What you need to submit an application for shared mortgage

Purchasing your first home with your ex, nearest and dearest, or members of the family would be a great way to ensure you get your feet to your property steps - but there are lots of you should make sure before you go ahead using this type of plan.

Shared owning a home is normal amongst partners. However with property prices well over pre-COVID accounts, some younger consumers features registered to buy property which have household members or members of the family to aid speed up the method, increase their borrowing strength, and reduce can cost you.

There is lots to take into consideration whenever obtaining a mutual mortgage, therefore this is how the procedure works and you may what you may you want to think about.

Who're you to get with?

We should make sure you will be selecting the most appropriate people or anybody to shop for a home with. At all, you desire the experience becoming self-confident, today and also in the future.

Evaluate who the particular activities is and you may whether you have a similar specifications (short and you can long term) - can you pick just like the an owner-occupier or since the an investment property? Continua a leggere "What you need to submit an application for shared mortgage"

Whats the essential difference between a good Virtual assistant Mortgage and you may a traditional Loan?

The housing marketplace can feel intimidating in order to homebuyers. Having pricing changing and lots of ways to get a house, it will often feel just like a guessing online game on which new best bet is for you and your finances. When you're an element of the military, you may have the choice to acquire a house using a great Virtual assistant Real estate loan. But to determine if it is ideal complement you, you really need to earliest understand the rules. Continua a leggere "Whats the essential difference between a good Virtual assistant Mortgage and you may a traditional Loan?"

What type of Loan Would you like to possess a created Household?

Mortgage Options for Manufactured Land

If you're looking purchasing a produced household, you might be questioning exactly how it is possible to finance they. With many other loan available options, understanding and that financing option will work perfect for the are manufactured household pick and private profit may possibly not be precise. This informative guide commonly take you step-by-step through the preferred fund to possess manufactured house and how they work being build a knowledgeable choice about how to buy your brand new are built household.

A fast Analysis

You can be entitled to several different types of financing for a produced domestic. The most used is FHA, Va, traditional loans, and you can profile funds. Each kind possesses its own gang of benefits, it is therefore crucial that you do your homework before making a decision which is right for you. Is a quick breakdown of the different particular are manufactured house finance offered:

FHA Are designed Lenders

A keen FHA Are formulated Mortgage is actually that loan covered of the Federal Property Administration. This type of financing is a wonderful choice for those individuals to find a manufactured domestic, while they normally have all the way down interest rates and advance payment requirements than other form of money. FHA Are designed Home loans are available in one another repaired-rate and you will variable-price selection, to like to submit an application for the borrowed funds you to definitely greatest provides your circumstances.

Virtual assistant Funds

An excellent Virtual assistant Are produced Mortgage are a mortgage supported by the brand new You.S. Department out-of Experts Products (VA). Virtual assistant Manufactured Lenders are available to eligible pros, active-duty solution professionals, and specific reservists and you may National Shield people. Continua a leggere "What type of Loan Would you like to possess a created Household?"