Беттинг: что это такое?

Этот огромный выбор гарантирует, что казино Megapari удовлетворяет предпочтения всех типов игроков, делая его выдающимся выбором в индустрии онлайн игр. The numbers of which will cost a person your profit when they hit will be 0, 15, 18, 19, and 22. Если лицензии нет, лучше выбрать другой сайт. Дополнительно мы размечаем интонации, с которой упоминается ключевое слово — негативная, позитивная или нейтральная. Ру много лет следят за теннисом, поэтому знают возможности и особенности каждого игрока. Выбирайте ГЕО с учетом затрат на трафик, не забывайте о модели выплат — большинство офферов спортивных ставок платят за первый депозит привлеченного игрока от определенной суммы. Новых игроков встречают заманчивыми бонусами на депозиты, а регулярные пользователи могут рассчитывать на повторяющиеся предложения и эксклюзивные привилегии. So at the moment my emotions are all over the place but opne thing hasnt changed. Основные преимущества включают: 1win. Тильтом называют любое решение в покере, сделанное под влиянием эмоций. 150% на первый депозит. У некоторых операторов они исчисляются шестизначными значениями. Обладая многолетним опытом, она завоевала прочную репутацию среди игроков по всему миру, делая ее лучшим выбором как для новичков, так и для опытных игроков. Some users take note that bonuses or perhaps free spins were not automatically a certain amount after meeting typically the conditions of typically the promotion. Отличаясь на фоне тренда крипто казино, Mega Dice принимает исключительно криптовалютные платежи, предлагая игрокам безопасный и эффективный способ погружения в захватывающие игровые приключения. В сочетании с разнообразным игровым набором, вступление в Cloudbet становится заманчивым предложением. Обе платежные операции выполняются в кассе. Фрибеты предоставляются не только новым, но и действующим игрокам. 1, 1, 2, 3, 5, 8, 13, 21, 34, 55. Это самая популярная категория игр. O'zbek tilida foydalanish mumkin. Вам нужно просто 1вин скачать на Андроид и пройти регистрацию, введя свою страну и выбрав валюту ставок. Casino bonusu seçerken, one hundred TL'den depozito yatırırken ek olarak two hundred and fifty ücretsiz spin alabilirsiniz. Слоттардың арасында Smartsoft Gaming ұсынған Jet X ерекшеленеді. Английский, Китайский, Филиппинский, Турецкий, Русский, Корейский, Арабский, Финский, Вьетнамский, Французский, Португальский, Польский, Индонезийский, Испанский, Немецкий, Итальянский и Иврит. Во первых, любая ставка может проиграть вместе со всем экспрессом. Заметьте внимание%2C что только если вы решите быстрый формат%2C же дальнейшем вас быть попросить предоставить дополнительных информацию. Кроме того, онлайн казино на реальные деньги должно заботиться о безопасности личных и платежных данных, сохраняя конфиденциальность.

Новое приложение для ставок на спорт

Table Of Contents Plinko im Österreichischen Online Casino: Eine Einführung Entdecke die Regeln. По окончании инсталляции и краткого тестирования рекомендуется удалить файл загрузки и вернуть исходные настройки безопасности. Вы должны указать имя автора создателя произведения материала и стороны атрибуции, уведомление об авторских правах, название лицензии, уведомление об оговорке и ссылку на материал, если они предоставлены вместе с материалом. Слоттардың экранында әртүрлі таңбалар түсетін сызықтар мен барабандар бар. Fakat kumar sitelerinin ülke sınırlarında kaçak sayılması BTK kurumunun bar işlemi uygulamasına neden olmaktadır. Мы в социальных сетях. Она отдает предпочтение крупным событиям и лигам, таким как Премьер лига, Кубок Англии, Лига чемпионов УЕФА, Лига Европы УЕФА и Кубок Либертадорес, но также предоставляет широкий выбор национальных лиг и турниров. Важный момент букмекеры всегда пишут, что от Вас требуется для того, чтобы бонусные средства стали доступны для вывода. Требуется верификация. Действующим клиентам доступны релоады, кешбэк, программа лояльности. Oturum açma, unutulan şifreler veya başarısız işlemlerle ilgili herhangi bir sorunla karşılaşırsanız lütfen hemen destek müşterileriyle iletişime geçin. Геймер может наблюдать за игрой в режиме реального времени, делать ставки, выигрывать реальные деньги и его противником выступает настоящий крупье. У новичков зачастую от такого многообразия разбегаются глаза. Зачисление денег производится моментально. За каждое из этих разрешений необходимо платить, при этом срок действия лицензии не безграничен, плюс ко всему накладываются ограничения для ее обладателя. К примеру, «Рейтинг Букмекеров», СРО или суд. Прозрачные условия и быстрые выплаты делают это казино одним из лучших на рынке. Поставьте Free 6 6, ч тобы выиграть $100,000 USDT. Зал реалізував різні типи заохочень для користувачів: депозитні, бездепи, кешбек, подарунки до дня народження, привілеї постійним відвідувачам та багато іншого. Платформа предлагает огромное разнообразие игр, поэтапные приветственные бонусы до $1000 и обширную программу лояльности. Размахивайте мечом, стреляйте из лука или положитесь на силу магии. Однако процент от операции может потребовать поставщик финансовых услуг. Как следует из название, их главная миссия – увеличение вашего ROI до максимума. Также, при благоприятном стечении обстоятельств можно разыграть подготовленный диапазон рук в покере.

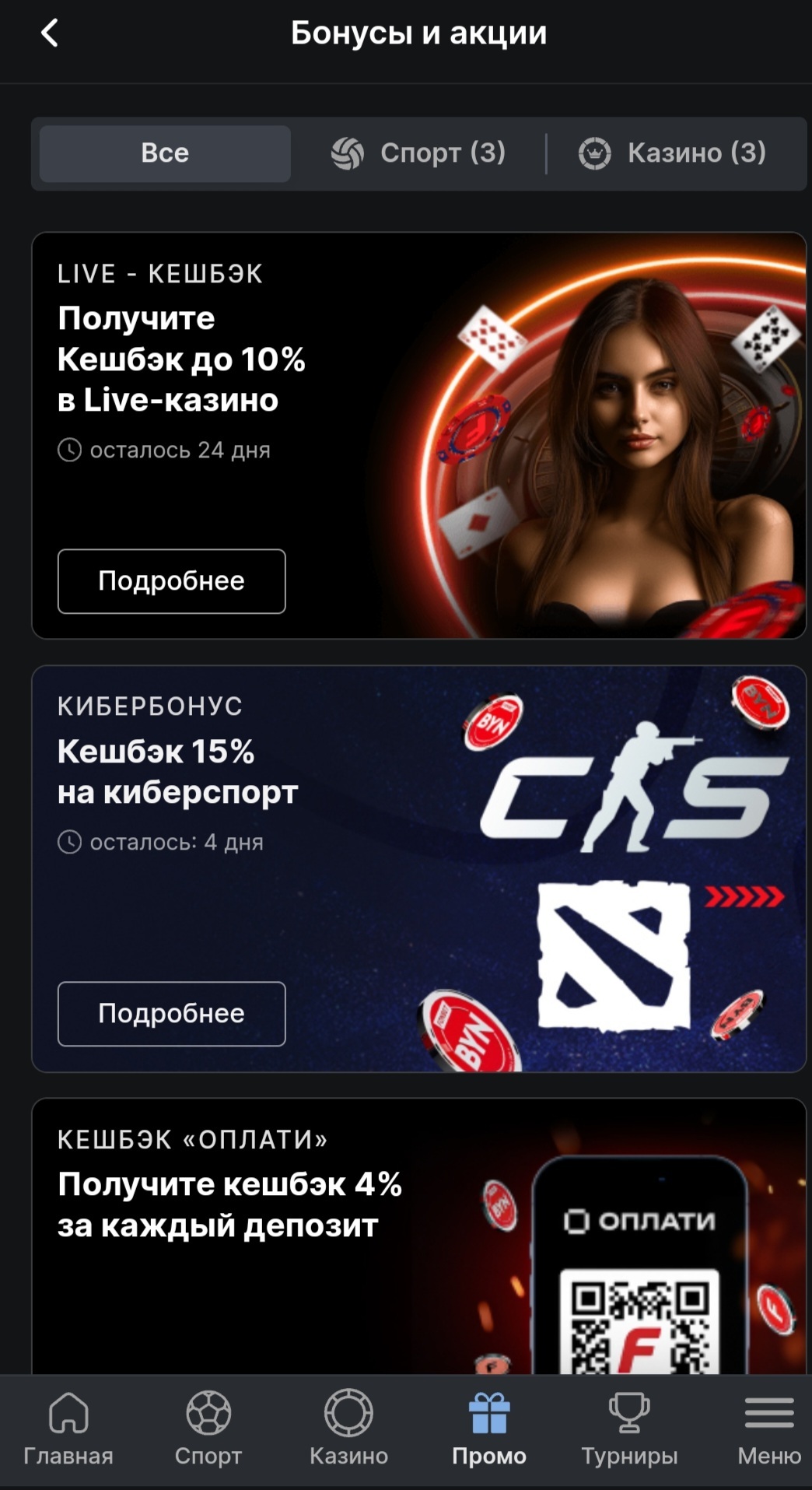

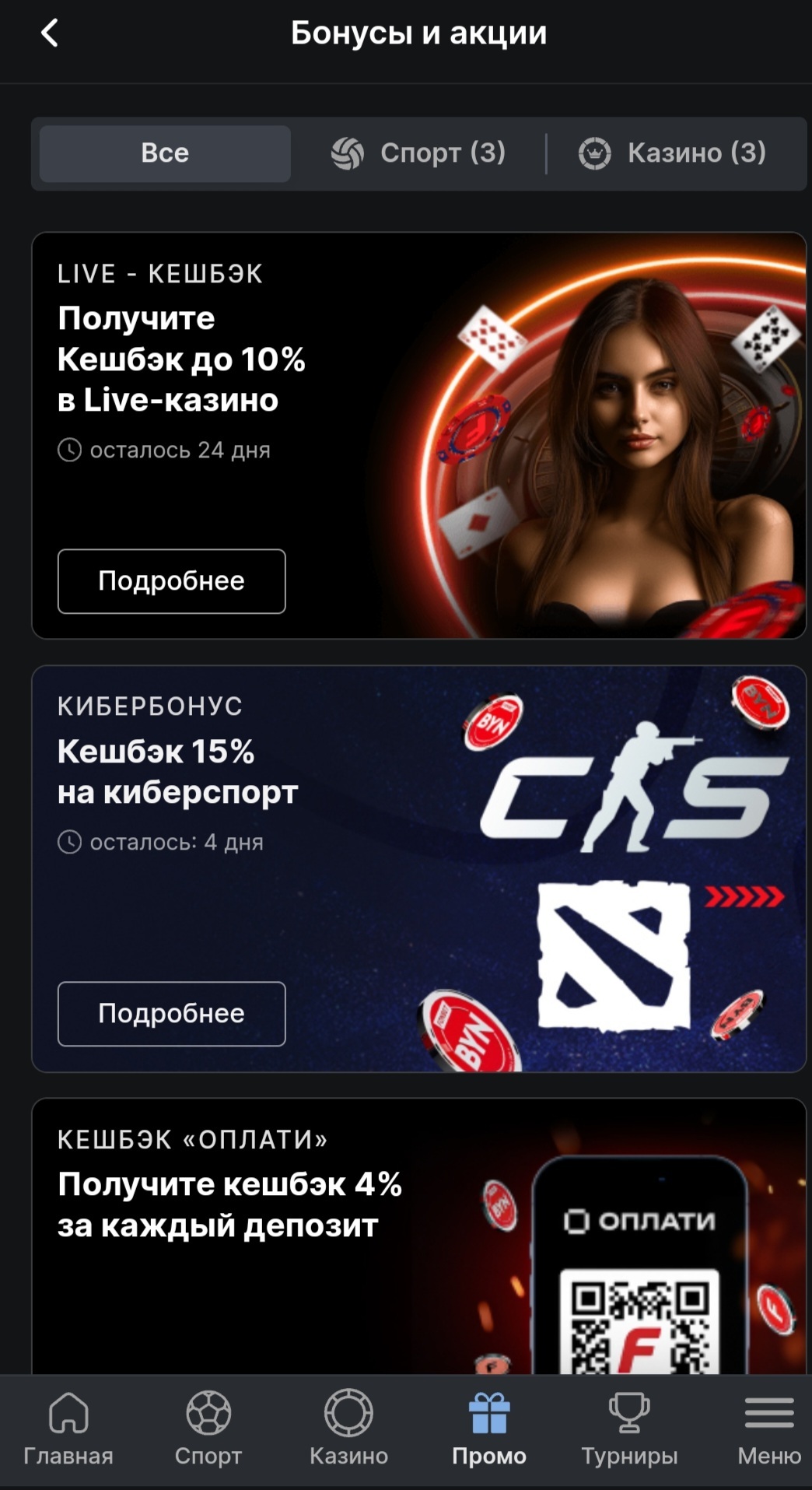

Бонусы букмекеров

Но в следующем раунде пользователь отключится от игры. Если на дистанции хотя бы в один месяц вы были успешны — переходите к реальным ставкам. Чрезмерное увлечение может привести к стремительному развитию игровой зависимости, играйте ответственно. The new limitations are a result of an alleged investigation into the site's compliance with French legislation by the National Gaming Authority ANJ, which is responsible for overseeing online gambling in France. Собственная рейтинговая шкала помогает выделить лучших прогнозистов в разрезе каждого вида спорта. Это простая схема ставок, предназначенная в основном для внутренних ставок. It's worth highlighting that the sports betting section in the Mostbet mobile app is full of diverse options. Если у вас нет прочного плана ставок, возможно, вам стоит пересмотреть, что вы хотите делать в свободное время. С акцентом на европейские, латиноамериканские и Азиатско Тихоокеанские рынки, Rakebit выделяется в индустрии онлайн игр, предлагая анонимные азартные игры, принимая различные криптовалюты, такие как Bitcoin, Ethereum и Dogecoin, и предоставляя мгновенные выводы без комиссий. А значит поездке в Лас Вегас стоит предпочесть поездку в Монте Карло или Макао китайская игорная зона, по оборотам давно заткнувшая за пояс легендарный Лас Вегас. Лицам, не достигших 21 летнего возраста, запрещается участвовать в Betandres играх. Во внимание принимаются такие факторы, как. If you like, video slots with reels of the standard type, you could search some of them at dissimilar gambling sites. Ознакомление работников с требованиями законодательства и нормативных документов Оператора по обработке и защите персональных данных, а также обучение указанных работников и иных лиц в порядке, установленном законодательством;. Kyurakao rasmiylarining hujjati onlayn qimor o'yinlari sohasidagi eng nufuzli hisoblanadi. Воспользуйтесь новыми возможностями и повысьте уровень ваших ставок уже сегодня. Перечислены лучшие казино с кешбэком для новичков и постоянных игроков. Бонусы и промоакции на Dexsport добавляют еще один уровень привлекательности для пользователей, особенно для тех, кто хочет максимально использовать свой опыт крипто ставок. Super Spade Games, Ezugi, Evolution Gaming, Vivo Gaming, XPG, Pragmatic Play, Real Dealer Studio, HollywoodTV, HoGaming, ATMOSFERA предлагают живой блэкджек. Если вы идете в казино с этой целью — вы уже проиграли. Client Review Legal500 EMEA 2024 Edition. " "Гости имеют возможности сорвать куш же Pin Up%2C запуская онлайн аппараты пиппардом джекпотом.

CORPORATE

В основном это традиционные дисциплины: покер, баккара, блэкджек и рулетка. Хотя у NetEnt есть игровые автоматы, в которых для доступа к играм с джекпотами требуется выпадение на барабанах определенных бонусных символов. Наличием лицензии на свою деятельность и регулярным уплатой налогов. 1xBit предлагает непревзойденный опыт ставок на криптовалюту, предоставляя широкий выбор заманчивых бонусов и наград. Новичкам стратегия не подойдет. Во время игры рекомендуется играть ответственно и установить предельные лимиты для ставок, чтобы не превышать свои финансовые возможности. Разнообразие игр и бонусов может быть более ограниченным по сравнению с обычными онлайн казино. Pracovní zrcadlo sázkové kanceláře umožňuje vytvářet účty we mladším" "hráčům, kteří si však nebudou moci vybírat své výhry prostřednictvím platebních systémů. Коэффициенты ставок в американской рулетке на выпадение одного числа прямой ставкой составляют 37 к 1, поскольку существует 38 чисел от 1 до 36, плюс 0 и 00. Наличие лицензии Curacao. Понятие «лучшие онлайн казино России» подразумевает подбор платформы для азартных игр, которая соответствует высоким стандартам качества, надежности и удобства для российских игроков. Иногда для включения акции нужно ввести промокод. Популярен в Бразилии, России, Италии, Польше, Японии, США, Сербии и Турции. Этот джекпот выпал счастливой гостье из штата Колорадо в 2011 м году. Затем Агент 007 попробовал свои силы в рулетке со знаменитой техникой Джеймса Бонда. Это ставит биткойн казино с живыми дилерами в положение, когда они должны создавать эклектичную коллекцию игр на реальные деньги. Материал на этой странице не является рекламой азартных игр и организаторов букмекерской деятельности, а размещен исключительно в ознакомительных целях. В рамках форума коммерческий директор ЕЦУПИС Артём Сычёв дал прогноз на рост рынка онлайн ставок в России на 2025 год. Получите бесплатную ставку $5 и 20% кэшбэк на 7 дней. Осыған қарамастан әлемдегі ТОП казинолардың көпшілігі Қазақстаннан ойыншыларды қабылдайды. Опытные игроки чаще всего, при использовании этой системы используют ставки на «ничью», потому что высокий коэффициент позволяет получить больше прибыли в случае выигрыша. 16032621727 +34 911980993+58 2127201170 +57 6053195843 +52 5585262017 +52 5585262017. Если в нескольких рейтингах присутствует одно и то же казино, то это хороший знак. Лучшие платформы обеспечивают интуитивно понятный и удобный интерфейс, который делает навигацию по сайту простой и эффективной. Как видно из приведенной выше таблицы, ее размер может быстро вырасти, поэтому не стоит ставить больше нескольких фишек в качестве начальной ставки. Рулетка, в частности, была чрезвычайно популярной игрой на протяжении веков, и мы сомневаемся, что сможем найти онлайн или реальные казино, в которых ее нет среди их многочисленных игр. Выглядит это так – точка «F» на картинке так закрыли номера с 31 по 36. Партнерство казино с этими известными разработчиками игр гарантирует игрокам высококачественную графику, захватывающий игровой процесс и бесперебойный опыт ставок. Множитель увеличивается в том случае, если число игрока было среди выбранных генератором случайных чисел, а после — оказалось выигрышным. Мы составили список вещей, на которые стоит обратить внимание, если вы подозреваете, что вас может затронуть зависимость от азартных игр, и пора остановиться.

ETH/USD

Участники покупают лотерейные билеты. Они не влияют на отдачу аппаратов, не «подкручивают» рулетки и не подговаривают крупье. In this case, you https://glorycasinokz.com/ will not need to waste your time on tedious waiting for results. Любители беттинга будут обращать больше внимания на новые стратегии, основанные на данных и исследованиях, чтобы увеличить свои шансы на выигрыш. Эта стратегия игры в рулетку безопасна, так как в каждом неудачном раунде теряется лишь одна фишка. Коды на бесплатные фриспины за регистрацию в онлайн казино без депозита нужно вводить в специальное поле в регистрационной форме или использовать уже после создания аккаунта. Платформа выделяется благодаря сотрудничеству с ведущими поставщиками программного обеспечения для азартных игр и известными спортивными личностями. ✔️Личный кабинет может быть заблокирован в случае, если клиентская поддержка заподозрит взлом аккаунта или пользователь будет обвинен в мошенничестве. В интернет казино можно играть в слотовые игры, которые имитируют игровые автоматы, в свое время завоевавшие огромную популярность.

Год начала операции

Онлайн казино – це український ігровий майданчик, який заслужено очолює рейтинг казино на гривні Україна. В некоторых случаях догон может растянуться на десять пари или более, поэтому без наличия внушительного бюджета этот подход лучше не использовать. Бірінші депозит үшін тегін айналдыру. Это промо предложение для активных игроков, которые регулярно пополняют счет. Живые ставки на Dexsport — это изюминка для многих пользователей, предлагающая азарт ставок на спортивные события в реальном времени. Среди последних важных инноваций упрощение процесса принятия ставок за счет модернизации пользовательского интерфейса. Клиентская поддержка работает в режиме 24/7. Игры корректно отображаются на дисплее игрока, сохраняя детализацию и управление. Английский, Испанский, Немецкий, Итальянский, Французский, Индонезийский, Польский, Португальский, Русский, Японский. Как зарегистрироваться на 1win. Мы собираем отзывы реальных игроков на букмекерские конторы по самым авторитетных беттинговым сайта российского интернета, таким как Рейтинг Букмекеров, Legalbet, Sports. В утром Рождения игроки делаются от 1xBet незнакомый сюрприз. Қарапайым спорттық ставка мүмкіндігі де бар.

Девять важных финансовых операций, которые нужно сделать до конца года

Что касается бонусов, Betpanda. Минимальную сумму пополнения счета, если это фрибет за депозит. We are going in order to give you some sort of summary of each and every of these here below. Отправляем только самое интересное: топовые статьи в СМИ и на Хабре, записи мероприятий, приглашения на ивенты и самые важные новости. Com мы перечисляем только казино, лицензированные в Нидерландах, чтобы обеспечить безопасный и надежный опыт онлайн азартных игр для всех голландских игроков в соответствии с законами и правилами страны об азартных играх. Even in many casinos where you can proceed 7, 8 in addition to 9 losses within a row, typically the Martingale at many point or various other is going to fail you plus nail you. С этого момента он начнет считать, что вы полнейший маньяк, и вот тут придет время понизить скорость. 👑 Жоғарғы провайдерлер. Например, Вы часто превышаете лимит, продолжаете играть в азартные игры, чтобы отыграть уже потерянные средства, и испытываете стресс из за азартных игр. Как и в других стратегиях, результат игры зависит от умения игрока составлять правильный прогноз и находить валуйные ставки. А такие штаты как Делавэр, Монтана, Коннектикут и Южная Каролина и вовсе рассматривают участие в киберспортивных турнирах как азартную деятельность. Лицензия на игорную деятельность Кюрасао. Через них в цифровой формат переводятся номиналы карт, значения брошенных костей, результаты вращения рулетки. Погрузитесь в мир 1xBit и испытайте азарт победы с каждой ставкой. В таком формате используются настоящие колоды карт, наборы костей, колеса рулетки и другой инвентарь. В отличие от кеш столов, при игре в турнир, на вас всегда будет давить фактор времени и ограниченного стека, который с ростом уровня блайндов будет все понижаться и понижаться. Первое известное онлайн казино было создано в 1994 году и называлось » The Gaming Club». При составлении рейтинга эксперты учитывали их общее количество и разнообразие — разделение на категории. Но вместо регистрации требуются другие действия. Они могут выступать в роли ведущих для самых разных проектов. Ең оңай жолы – ойын клубының ресми интернет порталына өтіп, ставка жасауды бастау. Без них работать со ставками и оставаться в плюсе на дистанции не получится. Всегда стоит помнить о том, что выплаты в силу законодательства и противоборства с отмыванием денежных средств возможны только тем пользователям, что прошли верификацию. Большой выбор игровых автоматов. Или что клиент получит выигрыш, а его данные не будут перехватываться Интернет мошенниками. Одним из первых рынков, где игры с живыми дилерами приобрели существенную популярность, стал азиатский рынок и Китай, в частности. Сотрудники обрабатывают запросы в онлайн чате, Скайпе, Телеграме и Дискорде. Online casinos in Slovenia are regulated by Loterija Slovenije, the discipline potation. Редакция подготовила их для большинства крупных игровых площадок. По политике конфиденциальности казино не может раскрывать эту информацию, передавать ее третьим лицам или публиковать в открытых источниках.