Содержимое

Mostbet Bookmaker's Official Website: Bonuses, Registration, App

Mostbet Bookmaker Official Website In Cyprus

MostBet Bookmaker Review - Bonuses, Apps, Registration

Online Bookmaker Mostbet: Players' Reviews, Complaints And Bonuses

MostBet - Bookmaker Company. Sports Betting - APK Download For Android Aptoide

Mostbet Online Games In Bangladesh - Play And Win Big Money!

Unlock Mostbet Casino Features In Morocco - Top Games & Bonuses!

Mostbet BD - Login For Top Sports Betting And Online Casino In Bangladesh | Get Your Bonus

Experience the thrill of Mostbet with our mostbet app – available for mostbet app download now! Join thousands of players in Bangladesh and enjoy exclusive bonuses, fast withdrawals, and a seamless gaming experience. Don’t miss out – mostbet apk is just a click away!

Mostbet Bookmaker's Official Website: Bonuses, Registration, App

Experience the thrill of online gaming with Mostbet Casino. Whether you prefer playing on your desktop or mobile device, Mostbet offers a seamless experience across all platforms. Download the Mostbet APK or use the Mostbet app to access a wide range of casino games, sports betting, and live dealer options.

To get started, simply register and login to Mostbet. The Mostbet login process is quick and secure, ensuring your personal information is protected. Once logged in, explore the vast array of games available, from classic slots to the latest video slots, table games, and more.

The Mostbet app is designed for both Android and iOS devices, providing you with the flexibility to play anytime, anywhere. Whether you're at home or on the go, Mostbet ensures you have access to your favorite games with just a few taps.

Join the millions of players who trust Mostbet for their online gaming needs. Register today and discover why Mostbet is the preferred choice for online casino enthusiasts.

Mostbet Bookmaker Official Website In Cyprus

Accessing the world of entertainment and excitement at Mostbet Casino is effortless with our streamlined registration and login process. Whether you prefer using the Mostbet app or the official website, the steps are straightforward and user-friendly.

To get started, simply download the Mostbet APK on your Android device or visit the official website on your desktop or mobile browser. Once you have the platform ready, click on the "Register" button to create your account. Fill in the required details, including your email and a secure password, and you're all set to dive into the thrilling world of Mostbet.

Logging in is just as easy. After registering, you can use your credentials to Mostbet login anytime you wish to enjoy your favorite games or place bets. The Mostbet app ensures that you can access your account and all its features on the go, making it convenient for players in Bangladesh.

Join the millions of satisfied players who trust Mostbet for their gaming needs. Register today and experience the best in online casino entertainment!

MostBet Bookmaker Review - Bonuses, Apps, Registration

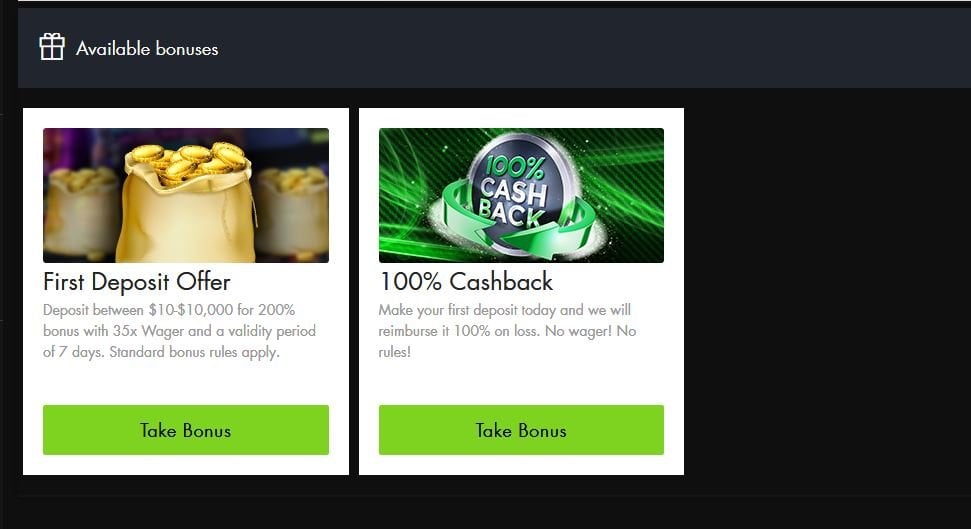

Join Mostbet today and unlock exclusive rewards with our Welcome Bonus! As a new player, you can benefit from a generous bonus package designed to enhance your gaming experience. Whether you prefer playing on our official online website or through the convenient Mostbet app, the Welcome Bonus is available to all new users.

To get started, simply complete the registration process and make your first deposit. The Welcome Bonus will be automatically credited to your account, giving you extra funds to explore our extensive range of casino games. Don't forget to download the Mostbet app for an even more immersive experience on the go. The Mostbet app download is quick and easy, ensuring you can access your bonus and start playing in no time.

For those who prefer mobile gaming, the Mostbet APK is available for download, providing a seamless transition from desktop to mobile. Enjoy the same great features and bonuses, whether you're betting on Most Bet or diving into the world of casino games. Start your journey with Mostbet today and make the most of your Welcome Bonus!

Online Bookmaker Mostbet: Players' Reviews, Complaints And Bonuses

At Mostbet, we pride ourselves on offering an extensive selection of casino games that cater to every type of player. Whether you're a fan of classic slots, immersive live dealer games, or thrilling table games, our platform has something for everyone.

With the Mostbet app or Mostbet APK, you can access our vast library of games from anywhere, at any time. Simply Mostbet login and dive into a world of endless entertainment. Our user-friendly interface ensures that navigating through our diverse game categories is a breeze, allowing you to focus on what truly matters–having fun and winning big!

Join the millions of players who trust Mostbet for their gaming needs and experience the thrill of our wide range of casino games today!

MostBet - Bookmaker Company. Sports Betting - APK Download For Android Aptoide

At Mostbet, we prioritize your security and convenience. Our platform ensures that all transactions are processed swiftly and securely, allowing you to focus on your gaming experience without any worries.

- Mostbet App Download: Enjoy seamless transactions directly from your mobile device with the Mostbet app. Available for both Android and iOS, the app offers a quick and secure way to manage your funds.

- Mostbet Login: Your login credentials are protected by advanced encryption technology, ensuring that your personal and financial information remains safe at all times.

- Mostbet APK: For Android users, the Mostbet APK provides a direct and secure download option, allowing you to access the platform with ease and confidence.

- Most Bet: Whether you're betting on sports or playing casino games, our secure transaction system ensures that your deposits and withdrawals are processed quickly and without any hassle.

Experience the peace of mind that comes with knowing your transactions are handled with the highest level of security and efficiency at Mostbet.

Mostbet Online Games In Bangladesh - Play And Win Big Money!

At Mostbet Casino, we understand the importance of reliable and timely support. That's why our 24/7 Customer Support team is always ready to assist you, no matter the time or day.

| Live Chat | 24/7 | Email Support | 24/7 | Phone Support | 24/7 |

Whether you're facing issues with your Mostbet login, need help with Mostbet app download, or have questions about Mostbet APK, our dedicated support team is just a click or call away. Experience seamless assistance and enjoy your gaming journey with Mostbet!

Unlock Mostbet Casino Features In Morocco - Top Games & Bonuses!

Experience the mostbet লগইন ultimate convenience with Mostbet's mobile compatibility. Whether you're on the go or prefer the comfort of your smartphone, Mostbet ensures a seamless gaming experience.

- Mostbet App: Download the Mostbet App from the official website or app stores to enjoy a fully optimized mobile experience. The app is designed to provide quick access to all your favorite casino games and sports betting options.

- Mostbet APK: For those who prefer direct downloads, the Mostbet APK is available for Android users. This allows you to install the app directly on your device, ensuring you always have the latest version at your fingertips.

- Mostbet Login: Logging in via mobile is as easy as on a desktop. Use your existing Mostbet Login credentials to access your account, view your balance, and place bets instantly.

- Mostbet: The mobile version of Mostbet is fully responsive, ensuring that all features and functionalities are accessible on any screen size. Enjoy the same high-quality graphics and smooth gameplay, no matter where you are.

Stay connected and never miss a bet with Mostbet's mobile compatibility. Whether you choose the app or the mobile website, you're guaranteed a top-tier gaming experience on the go.