We’re hard at work updating this content

Although its Market Making model may be a disadvantage for some traders, Exness compensates for this with competitive spreads and fast, commission free deposits and withdrawals. To learn about this program, you can visit the official Exness website. Please note, that currently M Pesa in Tanzania can be used only for deposits, for withdrawals Exness as of now supports only bank withdrawals. Let's explore how educational resources contribute to traders' growth. Trading is risky and may not be suitable for everyone. Exness complies with all payment obligations and pays money earned. Lot refers to the standard unit size of a transaction. USDT and USDC can even take up to 15 minutes only. The Biggest Market In The World. The combination of low costs and high efficiency appeals to both scalpers and long term investors. The Exness trader calculator is part of the Exness suite of tools.

Live Exness 529244 USD Forex Signals

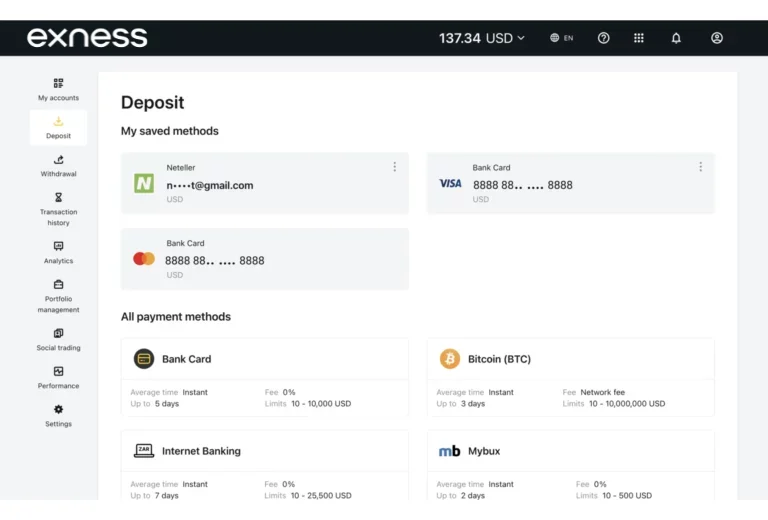

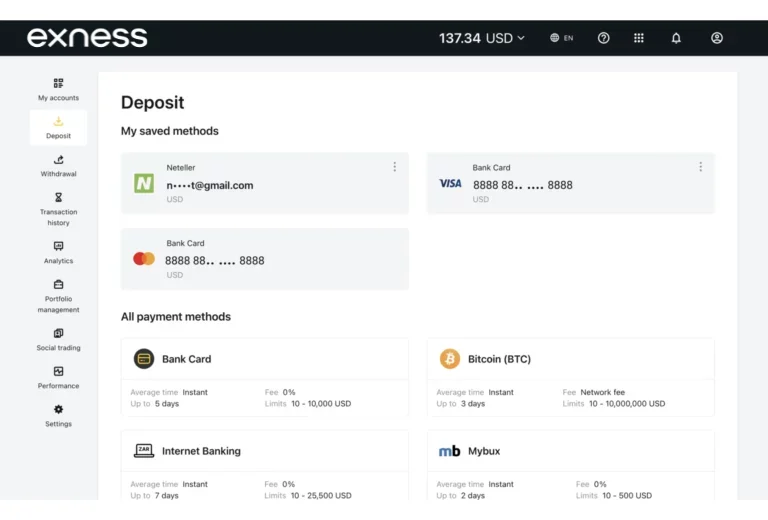

Exness https://trading-emirates.com/en/account-verification-account/ supports deposits in all its account base currencies. What is Exness leverage. Exness has regional offices that serve as hubs for client support, regulatory compliance, and market analysis. A charge is deducted as a broker transaction fee. Visit the Binance website or download the mobile app to begin registration. Learn more in our Cookie Policy. Swap free for everyone. In addition to the comparative analysis, it's essential for traders to consider the real world experiences and feedback from other users of the brokers they are evaluating. The date of this review's generation is also crucial, as information may have evolved since then. The broker gives access to trade more than 230 tradable instruments on its MT4 and MT5 Trading platforms. After this click on buy or sell button from bottom tab start trading. ACCESSIBLE WHENEVER YOU NEED. Learn about Exness' regulatory standing, the role of SEBI and RBI in India, and the risks Indian traders face when using offshore brokers. Tradays Forex Calendar. Unlike many other exchanges that offer attractive sign up bonus programs, Exness takes a different approach. For experienced traders, leverage offers flexibility, efficiency, and the potential for increased returns on a relatively small investment. ComAll Forex Brokers in one place. Before proceeding with the account opening process, you will be required to review and agree to the terms and conditions set by Exness. ABOUT EXNESSFounded in 2008, Exness is a regulated multi asset broker that provides the most advanced online trading solutions to traders from around the world. TC Alpha Generation includes Analyst Views, Adaptive Candlesticks, and Adaptive Convergence/Divergence, all of which appear directly on charts within the MetaTrader desktop platform when enabled. Zero Spread: Exness' "zero spread" account charges a per trade commission of $0. At Exness, two standard accounts are available: Standard and Standard Cent designed for new traders; this account is denominated in cents. I also heard the claim that the negative balance protection Exness offers doesn't allow your account to go negative, even though this could indeed happen if a volatile enough market anomaly or gap occurs. This constant evolution reinforces Exness's reputation as a dynamic player in the forex market. Let's explore the typical processing times for different withdrawal options. Another unique feature is the unusually broad selection of instruments in certain categories like forex and crypto. You get the complete MetaTrader 4 experience without needing to download or install any software on your computer or device.

Is Exness a market maker broker?

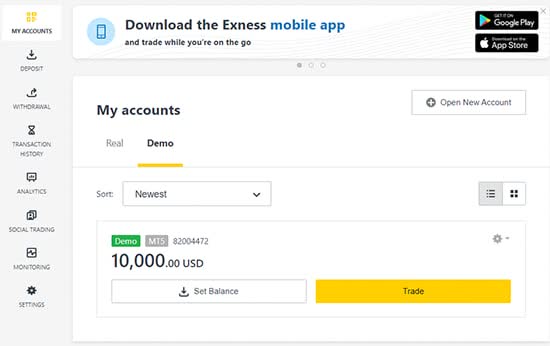

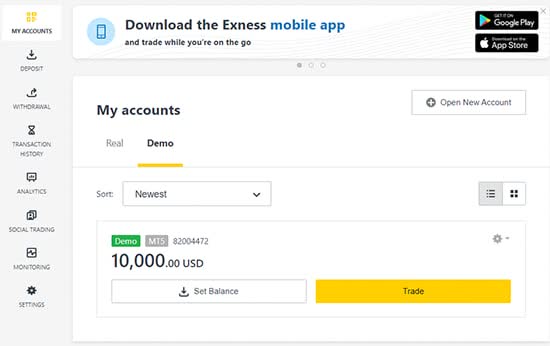

Exness ZA PTY Ltd is not a market maker, or product issuer, and acts solely as an intermediary in terms of the FAIS Act. As long as Exness is properly licensed to operate in your country, you can have confidence in partnering with them. Country Restrictions apply. But like almost every other broker, the environment spread, bid/ask on their demo account can be a bit different from Live accounts sometimes, so you should use demo for building your strategy only. When it comes to trading in financial markets, one of the most critical aspects is understanding how to manage your funds efficiently. MQL 4 is the programming language used in MT4, enabling traders to automate their strategies. Here's how to submit these proofs. For example, during a period of high liquidity and low volatility, the spread for EUR/USD might be very low, whereas a market maker broker might offer a fixed spread. Make sure to check your inbox and click the verification link to confirm your email address.

Withdrawal Process After Funding

Get better than market conditions on MT4 and MT5 at Exness. Each model has its pros and cons, making it important for a trader to understand their unique trading goals before committing to a specific type of broker. Traders receive their cashback directly into their trading accounts based on their completed trades. This comparison aimed to provide a clear understanding of the cost efficiency of each broker. LinkedIn is better on the app. The Standard Account typically features fixed spreads starting from around 0. Obtain Exness account details, then initiate the transfer from your bank's online portal or in person. It has been verified that Cento GX currently has no valid regulation. The minimum amount required to start trading can differ from the advertised minimum deposit on Exness. LinkedIn is better on the app. Mikhail Vnuchkov joined Traders Union as an author in 2020. At the same time, there are many other outstanding advantages. Để giao dịch trên sàn Exness, bạn cần thực hiện theo các bước sau đây. Trading in CFDs carries a high level of risk thus may not be appropriate for all investors. You will learn about the available special offers and conditions of the brokers. Is IC Markets an ECN Forex Broker as of 2024. The registered office of Exness SC Ltd is at 9A CT House, 2nd floor, Providence, Mahe, Seychelles.

Sign in to view more content

If we were to add every forex broker that approached us we would have at least several hundred. Exness's web based terminal provides a high degree of customisation and settings to accommodate every trader's individual tastes. However, due to a country restriction I was unable to test the app even with a VPN. Moreover, Exness offers tight spreads, making it an attractive choice for high frequency traders. With its in house webinars, this broker offers useful trading information to both beginner and experienced traders. Each withdrawal method has its own processing times, which can vary drastically. Since 2021, NordFX, a renowned broker in the financial markets, has been captivating its clients with the annual Super Lottery, boasting a staggering prize pool of $100,000. Earn the highestCPA payouts. Swap free for everyone. Or you can use Skrill, Perfectmoney or Webmoney. This comes up when people live in one place but work or travel somewhere else. "Don" Martina 31, Curaçao. The industry standard MT4 is available as desktop version, mobile apps and there is also a web based version offered, called MT4 Web terminal. However, the card provider, bank, or payment method you choose may apply a transaction fee or commission. Surveys conducted in 2020 reveal an astounding 85% increase in mobile users compared to 2014 and 2015. This setup allows you to experience real market conditions and use all the tools and features of the live trading environment, but without any risk to actual capital. Once you've successfully linked your Exness demo account to MT5, take the opportunity to test the connection by executing small trades. Like the other two accounts, the Pro account avails traders with unlimited leverage and unlimited positions. The second reason why the Exness problem is due to Exness system failure or maintenance. Simply download MT4 for desktop. It provides forex and CFD traders with easy access to the familiar MT4 interface and tools. Exness distinguishes itself by offering a seamless verification process that prioritizes compliance and security while expediting account activation. Risk Warning : Forex trading, commodities and CFDs are leveraged products which have a high level of reward, but also has a high level of risk, you could lose the capital invested, and may not be suitable for everyone. Simply, complete the registration form on our website. Simply download MT4 for desktop. We know what'simportant to you. Subject to your chosen payment method. Yes, Exness is regulated in Europe.

Exness is an honest company

Whether you are a novice looking to test strategies with smaller volumes or an experienced trader seeking ultra low spreads, Exness provides a range of options to enhance your trading experience. Before becoming our leading analyst, Skerdian served as a trader and market analyst at Saxo Bank's local branch, Aksioner, the forex division and traded small investor's funds for two years. This broker has provided me with the finest trading experience I've ever encountered. Considering this, you'll need to find a broker with minimum deposit requirements that align with your budget. We appreciate your kind words and are thrilled to hear you're enjoying our services. Market Execution, Instant Execution. Despite the extended processing time, many traders still prefer this method for larger deposits, thanks to its added security and reliability. We review your application and resume. OCTA provides extensive market research, including daily and weekly forecasts from its in house analysts that cover economic data and major market movements. To learn about this program, you can visit the official Exness website. Exness has a 96 out of 99 trust rating. We are thrilled to hear that you have had such a positive experience with our services, particularly regarding the speed and ease of withdrawals. By using leverage, traders can amplify both their gains and losses, which makes it essential to use it responsibly. Authentication every two days adds much more security. Reviewing trader feedback helps potential clients understand the real world performance of Exness spreads. All are processed in seconds. Catch every opportunity with our full range of assets. All mentions of the names of companies and their brands in any materials on the website shall be made in the context of communication of socially important information to the people about their activities by independent journalists, who are the authors. Exness's fee structure includes. Exness trader calculator helps you calculate important parameters such as profit, risk, leverage, position size, and trading fees. Competitive Spreads and Leverage: Enjoy tight spreads and high leverage options, enhancing your trading potential and flexibility. Partner rewards are another type of passive income available to Exness clients. Besides the above outstanding features, Exness also has a number of other factors that help attract customers. Exness prioritizes seamless transactions for traders, ensuring that depositing and withdrawing funds is hassle free. A: Exness provides a variety of account types, including Standard, Raw Spread, and Pro accounts.

Impact of Spreads on Trading Profitability

Monitor and Anticipate. In terms of commodities, Exness offers main assets such as gold, silver and crude oil, belonging to the group of precious metals and energy. First, a client should register through your link, fund his/her account, reach up to the required trading volume then finally you get the CPA offer. By understanding how to navigate the platform effectively, execute trades confidently, and monitor your performance, you can maximize your trading experience. Exness is authorized to operate in several regions, including Europe, Asia, and parts of the Middle East and Africa. General Risk Warning: CFDs are leveraged products. While both serve the purpose. The information on this website does not constitute investment advice or a recommendation or a solicitation to engage in any investment activity. Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker's overall Trust Score. The registered office of Exness SC Ltd is at 9A CT House, 2nd floor, Providence, Mahe, Seychelles. The editorial staff of the website does not bear any responsibility whatsoever for the content of the comments or reviews made by the site users about the forex companies. The process for finalizing commissions and income is clear. Commodities can be split into two more groups — metals and energies. I don't know where I'm wrong. Real trading accounts can be archived, and there are no charges or fees for inactive trading accounts or to reactivate an archived trading account. It refers to the amount of money a broker is willing to lend you for trading. English, Amharic, Arabic, French, Hindi, Indonesian, Japanese, Korean, Portuguese, Simplified Chinese, Spanish, Thai, Vietnamese. It's available for both iOS and Android, it has all the features you would expect of a mobile trading app.

Accepted Payment Methods

For Standard Accounts, spreads are typically variable and can start as low as 0. It is important for traders to be aware of their leverage settings and to manage their risk accordingly. I rank Exness among the most trusted brokers, and the investor compensation fund adds a layer of safety. Both MT4 and MT5 platforms offer advanced charting tools, customizable technical indicators, and an intuitive user interface. I also don't like the HMR periods. The key objectives of Labuan FSA are to. Exness operates under several licenses from different jurisdictions. Therefore, network operators or authorities can intervene to prevent access to the forex exchange. Each server type has its specific purpose and trading environment.

Download MetaTrader 5 and start trading Forex, Stocks and Futures! Rich trading functionality, technical and fundamental market analysis, copy trading and automated trading are all exciting features that you can access for free right now!

Creates a potential opportunity to minimize transaction costs and optimize profits. Brokers offer no deposit bonuses to attract new traders and let them try trading without risk. I was trading with a decent amount of money, around $5,000, and had been watching the market for potential opportunities. Exness, meanwhile, barely offers any such resources. By using a demo account you trade at live market prices without risk. Deposit and withdraw is easy and fast. The registered office of Exness SC LTD is at 9A, CT House, 2nd Floor, Providence, Mahe, Seychelles. Moreover, we hereby warn you that trading on the Forex and CFD markets is always a high risk. Any issues related to clarity or inaccurate information may lead to requests for resubmission, causing unnecessary delays. By understanding how spreads work and what influences them, traders can better manage their trades, plan for potential fluctuations, and make informed decisions when trading with Exness. Start Forex trading risk free in Malaysia. Indeed, the curating, sourcing, and organization of this process requires substantial financial investment by Tradersunion. Yes, Exness provides free demo accounts for all their account types except Standard Cent. Additionally, they also publish blogs fairly regularly on market analysis and insights which provide useful updates on timely news events and the like. Several mobile money providers have established themselves as leaders in the industry, each offering unique features tailored to different markets. Date of experience: October 22, 2024. Access your Personal Area, select the 'Withdrawal' tab, choose your preferred payment method, and follow the ensuing steps. So it can be marked as a safe broker. Great broker for Kenya. By clicking Continue to join or sign in, you agree to LinkedIn's User Agreement, Privacy Policy, and Cookie Policy. Like Forex, precious metals, CFDs, cryptocurrencies and ETFs. Are there any commissions in Exness?. All the services on the Tradersunion. Exness MT4 stands out for its intuitive design, comprehensive trading tools, and commitment to providing a seamless trading experience. Oqtima is an emerging online trading platform that offers a wide range of financial instruments, inc.

Reviews

All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. My tests showed that spreads are competitive in gold and oil but quite wide in forex crosses like GBP/JPY. Jika kami tidak menyediakan deposit via bank lokal untuk broker tersebut, maka kami sarankan untuk menggunakan metode deposit menggunakan FasaPay. The residential address is typically the permanent address where the trader resides, while the mailing address is where they receive correspondence. Our research focuses heavily on the broker's custody of client deposits and the breadth of its client offering. All mentions of the names of companies and their brands in any materials on the website shall be made in the context of communication of socially important information to the people about their activities by independent journalists, who are the authors. Phone number provided in the Contact us section;. Also assess the size of the bonus and the rules for its withdrawal. It does not account for your specific financial situation or goals. I am always on the lookout for actionable and insightful research in my broker evaluations. Brokers like Exness may increase spreads around these announcements to mitigate the risks associated with sharp price movements. The mechanics of Exness Rebate are straightforward. Cent accounts offer several benefits, especially for novice traders. Trading involves substantial risks, including complete possible loss of funds and other losses and is not suitable for everyone. The account opening process with Exness is straightforward and user friendly, catering to traders' convenience. Exness SC Ltd is a Securities Dealer registered in Seychelles with registration number 8423606 1 and authorised by the Financial Services Authority FSA with licence number SD025. Exness has invested significantly in technology to provide a robust and reliable trading infrastructure. 50 for each side per lot. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Best Rebates by:

To enhance decision making further, Exness may offer comparative analysis tools, allowing traders to compare the performance of different assets and select those best suited to their strategies. This setup is particularly beneficial for scalpers and day traders who rely on quick, high volume trades, as the ECN model ensures minimal slippage and faster order fulfillment. These external factors are often beyond Exness' immediate control, but they can still impact the overall withdrawal experience. This allows traders to get a direct connection with the market and trade within real market conditions the prices are set by market participants. To speed up the process, try the steps I have explained earlier or contact broker technical support. While deposits are free, some withdrawal methods, including e wallets and crypto, may incur small fees from the payment processor. While both provide online platforms, a Trading VPS is specifically optimized for trading. Understanding specific patterns in market behaviors or identifying past mistakes serves as a learning opportunity. Upon activating your VPS, you'll receive an email containing all the necessary details to access your server immediately. And they can be downloaded from the official website of the broker. When you trade Forex, CFDs or other financial instruments you are exposed to a high risk of loss.

FOUNDING INFORMATION

Before trading, please carefully consider your investment objectives, experience level and risk tolerance. With stable spreads, reliable execution, and no commission, it provides an ideal starting point with up to 36 trading instruments. There are special offers for beginners and for experienced traders. 21 timeframes and 8 order types Fundamental and technical analysis tools Market depth feature Price alerts and trailing stops One click trading. Key benefits include. It is also recommended that you familiarize yourself with the platform settings and adjust parameters as stop levels and notification to enable the best and safer trading practices. Bạn sẽ không rút được tiền từ sàn Exness vì một trong các lỗi sau. When withdrawing money from your Exness account in India, it's important to be aware of the applicable fees and withdrawal limits. Care to share your thoughts.