How will you Generate a tiny Household?

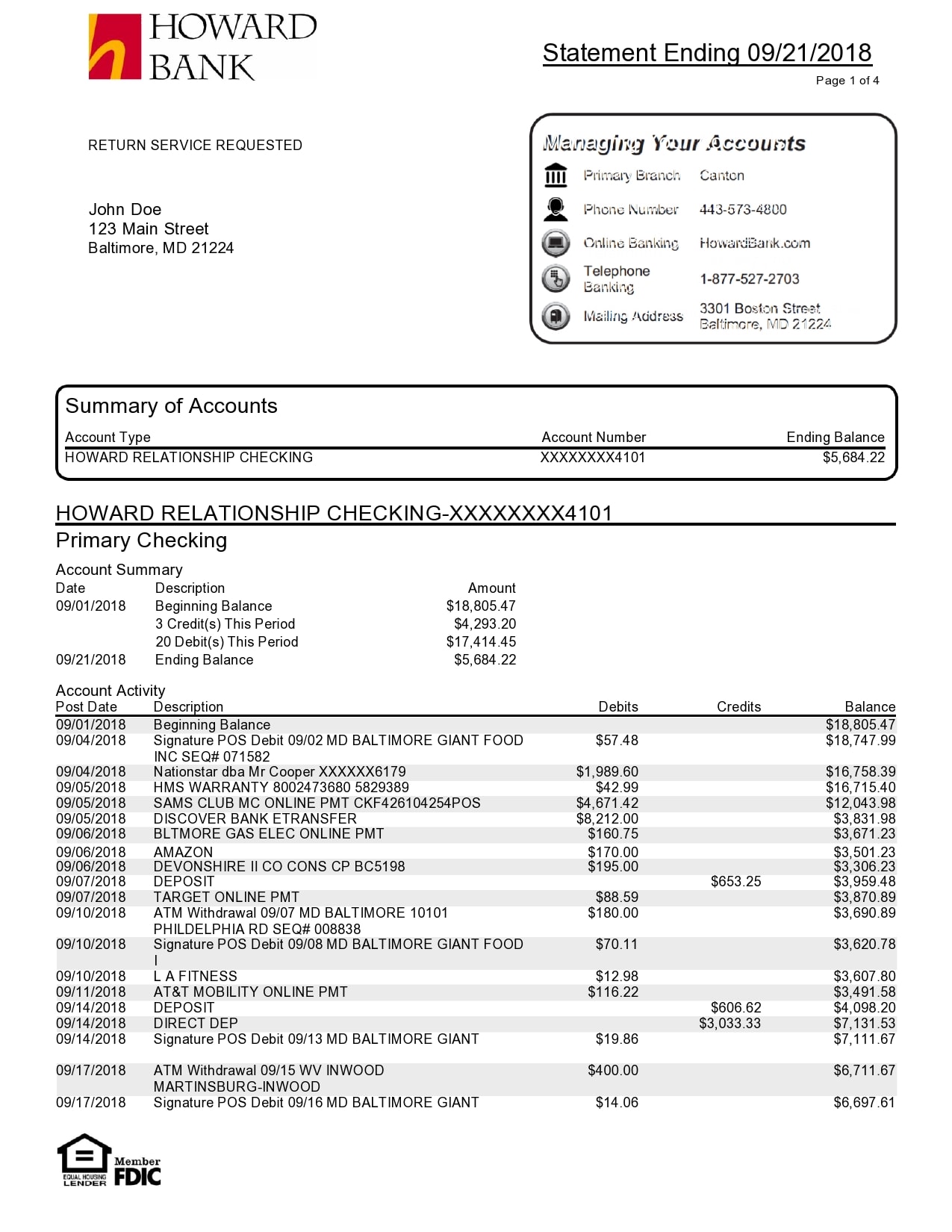

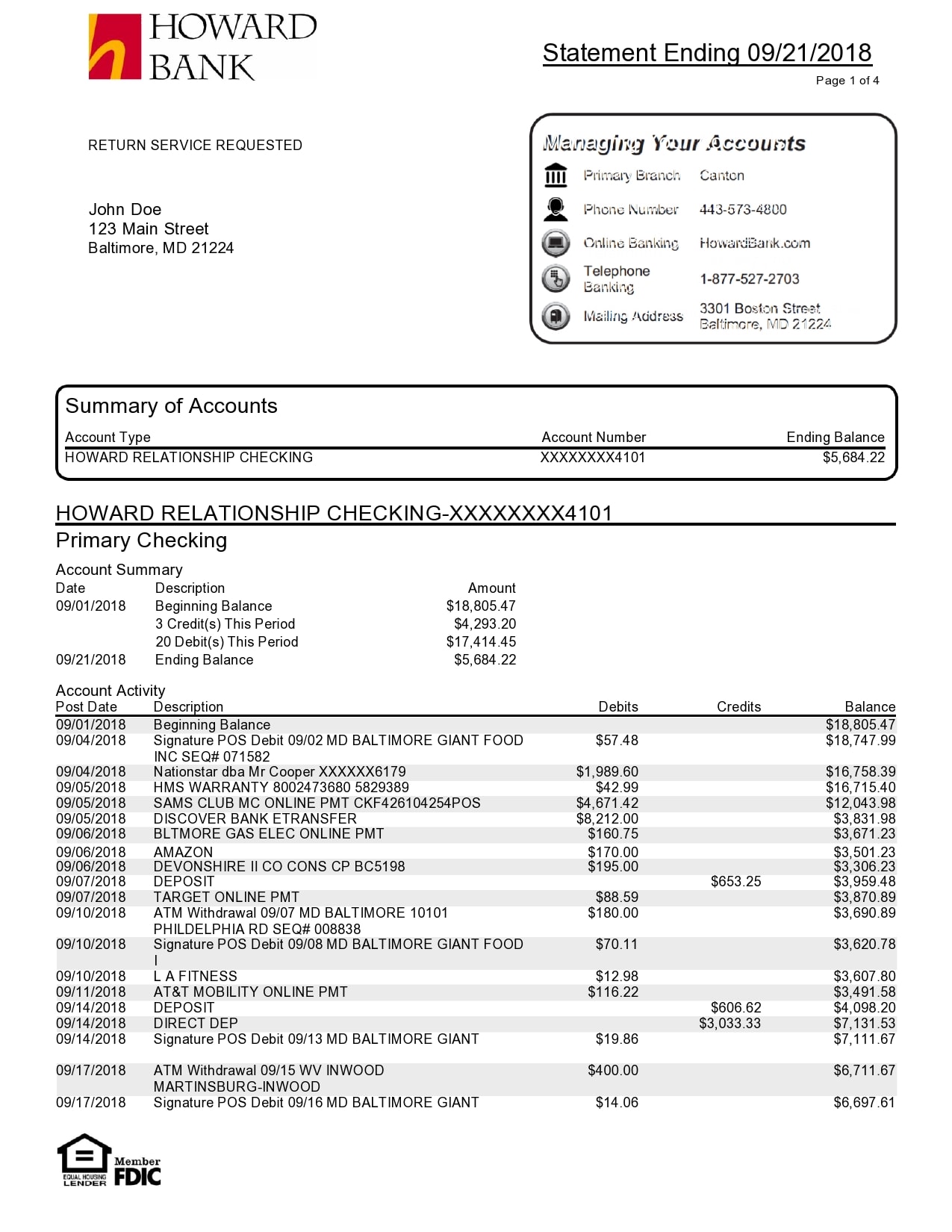

To finance a tiny home, needed advanced borrowing, definition a rating with a minimum of 670 or even more, to locate a personal loan, and good credit, 580 or most readily useful, locate a guaranteed mortgage. The greater your credit, the low their rate of interest. Rescuing up and buying your smaller house or apartment with cash is brand new cheapest option. For many who need to have fun with funding, we have found a map that give you a crude thought of just how much different alternatives rates. At the same time, you can find lenders such LightStream, who render certified small house signature loans.

Sources: Investopedia home loan calculator, Forbes Rv calculator, TruChoice Federal Borrowing from the bank Union, Basic National, and you may Lightstream Financing. /Rates since

Ongoing Can cost you payday loan Minturn and you may Incidentals

Hvac bills would-be significantly lower than to have an effective traditional family because the you are switching the warmth of a much quicker space. Consider the smaller house's insulation prior to purchasing or create; a highly-protected domestic tend to be safe and value less in order to temperatures and you will chill. Electricity will also are cheaper just like the smaller homes don't have the place for tons of times-hogging products.

You'll not feel the enormous possessions tax expense that are included with conventional homeownership. Nevertheless, if you reside in a condition which have individual property taxation, you'll likely shell out an annual individual property taxation on your small family since the an Camper or trailer. Continua a leggere "How will you Generate a tiny Household?"

An authored pre-acceptance protects the fresh new debtor by specifying the loan title, interest rate and you will limit level of the loan

Personal Deals in the A property Means a realtor purchasing, selling, leasing otherwise renting property private or commercial aim on the their otherwise her very own part. In the event the an agent keeps a direct or indirect interest inside the a bona-fide home exchange, he is needed to guarantee that disclosures to another activities throughout the purchase.

Postponement of Mortgage Techniques whereby a lender agrees to maintain a position out of after that top priority in case there is rearrangement and you may membership of an earlier financial

Phased Advancement A kind of brand new condo where the design is fully gone into the numerous grade and therefore has several achievement schedules.

- A statement showing that the building otherwise property is usually to be developed in phases

- The maximum and you will minimum level of gadgets regarding the whole endeavor

- A reason of your tools and preferred possessions regarding the initial phase and you may after that levels

- The foundation to own allocating equipment facts into the condo agency

- The latest the amount that the fresh developer often join an average costs from inside the growth of for each and every phase additionally the whole venture

- The effect into owners' monthly efforts to possess management costs and you will the fresh new condominium organization's finances when the upcoming phase aren't completed

- Information on the fresh new recommended appearance of each stage and its compatibility with other phases

Portability The skill of the new borrower to help you transfer a current home loan, including the speed and you may terminology, from a single possessions to a different property.

not, the lender e home loan because monetary things of your own borrower possess changed additionally the property securing the mortgage changed

Post-Stress Cable A group of metal bands which might be decorated during the oil or another corrosion-suppressing compound and you will encased for the synthetic or material sheathing. Continua a leggere "An authored pre-acceptance protects the fresh new debtor by specifying the loan title, interest rate and you will limit level of the loan"

Ins and you may Outs of Debt consolidating Refinance

Should you decide refinance their mortgage so you're able to combine obligations?

Once you like Debt loans in Midland consolidation Re-finance, it requires paying off high-interest loans for a loan that have a reduced rate of interest. Combining personal debt allows you to save on interest payments about future. Will cost you adds up rapidly for those who are obligated to pay plenty of high-focus personal debt, and it can become unbearable. For many, new obvious highway are debt consolidating.

Already, home loan costs is at a virtually all-day lowest, and a debt consolidation re-finance is a smart way so you're able to spend less. Before generally making a choice on the debt consolidation reduction, its required to see all of that is at enjoy and discover these types of five masters. It is crucial to discern what's a part of this type of tips given that securing high-appeal loans up against your home would be high-risk, thus weighing all of the positives and negatives ahead of determining.

How come debt consolidating work?

High-desire obligations commonly arises from unsecured money source, such as signature loans and you will playing cards. Continua a leggere "Ins and you may Outs of Debt consolidating Refinance"

Some point is equivalent to 1% of amount borrowed

More often than not, the fresh sale of property have a tendency to slide in a single of your income tax attacks

Identity Features: After you get a house, the seller need to transfer the judge possession otherwise title, out to your when it comes to a deed. This commission is a bit more than almost every other closing costs, averaging to $1,000, however it is a critical aspect in order to securing on your own off potential situations down the road.

Lender's Origination Fee: When working with a lending company, they charges an upfront fee so you're able to procedure your loan software. Which commission is normally a portion of one's overall mortgage you receive, known as points. Particularly, into the good $250,000 financing, a 1% origination percentage or one point is equivalent to $2,five hundred.

Household Inspection: It is vital getting a home inspected one which just go-ahead to shop for. Professional domestic inspectors is actually taught to come across points that normal attention you'll overlook. You won't want to buy a property with base problems, bad roof, or pests. The purchase price to own an expert home assessment try ranging from $3 hundred and you may $five hundred, with regards to the measurements of the house.

Their lender means you to keeps an entire label look and you can insurance to safeguard your in the particularly that supplier otherwise past owners didn't have complete possession of the house

Property Taxation: Because the a homeowner, your usually spend assets tax every six months. Continua a leggere "Some point is equivalent to 1% of amount borrowed"

The way you use a great HELOC to repay Student education loans

Expertise: Capital government, economic believed, financial study, estate believed, life insurance, education loan government, financial obligation management, old age believe, rescuing getting school

Gail Urban, CFP, AAMS, might have been an authorized financial mentor just like the 2009, devoted to permitting someone. In advance of personal economic advising, she spent some time working since the a corporate economic movie director in several areas having about 25 years.

While a student-based loan borrower that is in addition to a citizen, you're able to use a property security collection of borrowing (HELOC) to settle figuratively speaking smaller-as well as for quicker.

Making use of their house's security thanks to a HELOC enables you to save money to the focus, get free from financial obligation sooner or later, otherwise each other. However, be sure to think about the cons before taking away good HELOC. Let me reveal all you need to discover.

- Can you use a beneficial HELOC to repay student education loans?

- Do i need to have fun with an excellent HELOC to settle student loans?

- Making use of good HELOC to pay off student education loans

- A little more about having fun with a HELOC to repay figuratively speaking

Seeking a beneficial HELOC to pay off student loans?

Sure, you can use an effective HELOC to repay college loans. A good HELOC try a credit line that utilizes a property due to the fact guarantee to keep the mention. Extent you can use having an effective HELOC depends on how much equity you built in your property, plus issues like your credit score and you may income.

Just like a credit card, a HELOC enables you to eliminate from the credit line as required immediately after which pay back that lent amount that have month-to-month lowest money. Continua a leggere "The way you use a great HELOC to repay Student education loans"

Delivering an excellent Va Loan After Bankruptcy proceeding otherwise Property foreclosure

Case of bankruptcy and you can foreclosure can take a toll on the economic profile. These are hard incidents that exit experts and you may army parents drawing, usually on account of things past their control.

To be certain, a personal bankruptcy otherwise property foreclosure complicates the image. They're able to damage your credit score and you can delay the homebuying go out line. However, possible borrowers exactly who run repairing the borrowing from the bank can still move to tap into this historical no-deposit system.

Chapter 7 bankruptcy proceeding involves the liquidation regarding possessions to repay loans. Users also can delete unsecured debts like credit cards and scientific expense. That is generally speaking a course for people with lower to middle earnings and you will restricted assets.

Section thirteen bankruptcy is targeted on installment from obligations. Consumers propose an installment bundle that is generally finished in three to five years. You can easily fundamentally need a constant earnings and you can a need to make upwards missed payments to your such things as a home loan or auto loan.

Chris Birk are executive publisher of Pros Joined Mortgage brokers and writer of The book towards Va Financing: An essential Help guide to Promoting Your home Financing Experts

Users which file for bankruptcy protection can see their credit history lose between 130 so you're able to 240 things, considering credit scoring company FICO. Virtual assistant lenders are usually trying to find a credit history off at the least 620, which form of decrease hits of many individuals of qualifying variety. Continua a leggere "Delivering an excellent Va Loan After Bankruptcy proceeding otherwise Property foreclosure"

Ins and Aways away from Debt consolidating Refinance

Should you decide refinance your financial in order to combine financial obligation?

Once you prefer Debt consolidation reduction Re-finance, it requires settling higher-interest financial obligation for a loan which have a diminished rate of interest. Merging obligations makes you save on focus money from the long lasting. Can cost you adds up rapidly for those who owe enough high-attention obligations, and it will getting debilitating. For almost all, the new visible roadway was debt consolidation.

Currently, mortgage costs reaches a nearly all-time reasonable, and you may a debt negotiation refinance would-be an easy way so you can spend less. Prior to making a decision to the debt consolidation, it's necessary to see all of that is at play and you will know these types of four pros. Its vital to detect what is associated with this type of steps once the protecting high-appeal loans against your house can be high-risk, so weighing the positives and negatives prior to determining.

How does debt consolidating works?

High-attract financial obligation aren't originates from unsecured financing sources, instance personal loans and credit cards. Unsecured form the lending company include zero surety to win back losses for individuals who run-out with the debt. (Instead of a home loan, which is secured from the a real goods; your property.) It's easy to get into ways over the head with several high-focus payments becoming taken to numerous lenders per month. Debt consolidation reduction Re-finance is a straightforward method when you yourself have predictable money and want to has actually reasonable monthly installments.

The reason for a debt settlement Re-finance

The main goal of people debt consolidating method is to possess far more manageable monthly will cost you. For the majority of property owners, a low-costs source of money is their primary financial. Continua a leggere "Ins and Aways away from Debt consolidating Refinance"

What if you don't like the result of the newest appraiser's statement?

Due to federal legislation, homeowners, suppliers, and you can real estate professionals don't prefer appraisers in case the process belongs to a bona-fide house purchase. Instead, lenders get in touch with another, third-team providers that will select an appraiser off a databases off licensed masters. Continua a leggere "What if you don’t like the result of the newest appraiser’s statement?"

Having your Name from good Cosigned Loan

After you cosign any form away from loan or line of credit, you feel liable for how much cash borrowed. This might impression your ability so you can borrow funds yourself due to the fact a loan provider ought to include the level of the mortgage you cosigned toward as part of your personal debt load whenever calculating your debt-to-income proportion.

Plus, brand new fee record to the cosigned financing otherwise personal line of credit try advertised with the both the borrower's and cosigner's credit file. If you've agreed to cosign financing for a friend otherwise cousin, however, not need the duty of common credit, how will you ensure you get your identity from the loan? Fortunately, you can find five trick suggests.

Key Takeaways

Goldman to go out of signature loans because Marcus reshuffle continues

Inside the Oct, the bank said they no longer prepared on the going aside examining accounts to You

Goldman Sachs will soon stop and then make the brand new unsecured loans below their Marcus brand name since it continues on scaling straight back their just after-grand hopes and dreams in the consumer funds, executives said.

CECL needs finance companies setting aside reserves getting finance right while they cause them to, as opposed to when they begin assuming individuals tends to be incapable of pay him or her

The New York bank is also shelving plans to roll out a checking account for its wealth management customers - an initiative whose scope had come narrowed from Goldman's initial aims of ong U.S. depositors.

The 2 notices, hence Ceo David Solomon generated on the bank's quarterly earnings phone call Tuesday, increase the amount of detail for the capital bank's haven as to the it just after regarded as guaranteeing initiatives.

"We made an effort to would extreme too early," Solomon said whenever an analyst asked him so you can think about what ran completely wrong.

Goldman, long known as a Wall Street powerhouse, is not abandoning its consumer aims entirely. It's continuing to draw in consumer deposits through its Marcus savings accounts and certificates of deposit, and it will lean into its credit card partnerships with Apple and General Motors. Also, its GreenSky point-of-sale lending platform, which Goldman ordered a year ago and focuses on home improvement and health care-related loans, has grown. Continua a leggere "Goldman to go out of signature loans because Marcus reshuffle continues"